In the labyrinth of financial markets, understanding options can be akin to navigating a dense jungle, filled with intertwined paths and hidden pitfalls. But fret not! Our mission is to unravel the complexities of options trading, illuminating this enigmatic realm for all who seek to venture into it. Join us on this enlightening journey as we delve into the anatomy, mechanics, and practical applications of this powerful financial instrument.

Image: napkinfinance.com

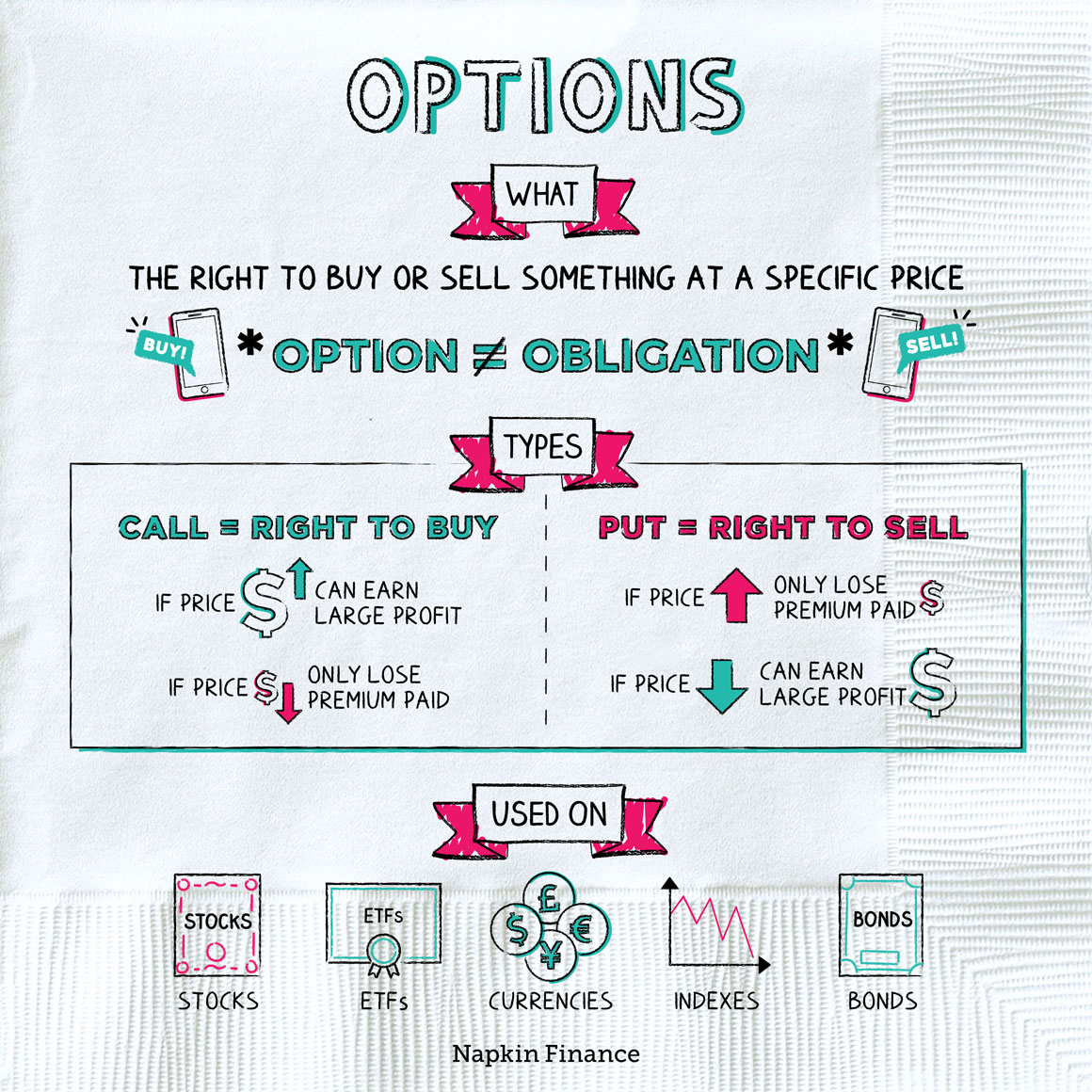

Options: A Tale of Two Sides

At the heart of options trading lies a fundamental concept: the right, not the obligation, to buy or sell an underlying asset at a predetermined price known as the strike price. This right extends over a specified period, empowering traders with flexibility and strategic maneuverability. Options represent a spectrum of financial possibilities, offering investors the chance to amplify profits or hedge their risks.

Call Options: The Right to Buy

Picture a scenario where you’re convinced that XYZ stock, currently trading at $50, is set to soar. To capitalize on this conviction, you could purchase a call option with a strike price of $55. This option grants you the right, but not the obligation, to buy 100 XYZ shares at $55 any time before the option’s expiration date. Should your prediction hold true and the stock rises above $55, you can exercise your right to buy the shares, potentially realizing substantial profits.

Put Options: The Right to Sell

Now, let’s imagine the opposite: you anticipate that XYZ stock will plunge in value. By acquiring a put option with the same strike price of $55, you secure the right to sell 100 XYZ shares at $55 before the expiration date. If your bearish outlook materializes and the stock value drops below $55, you can exercise your option to sell at the higher strike price, safeguarding your portfolio from financial erosion.

The Mechanics of Options Trading

To fully grasp the intricacies of options trading, a deeper dive into the underlying mechanisms is essential. Let’s explore the three pillars upon which options rest:

- Premiums: The Cost of Options

Just as acquiring any valuable asset incurs a cost, buying an option requires you to pay a premium, which reflects the value of the right it bestows. The premium fluctuates based on several factors, including the option type (call or put), strike price, expiration date, and the underlying asset’s price and volatility.

- Expiration Dates: Limited Lifespans

Options do not possess an indefinite lifespan; they expire on a predetermined date, which can be a matter of weeks, months, or even years. Exercising or selling an option before its expiration date is crucial, as it becomes worthless thereafter.

- The Greeks: Measuring Risk and Reward

Understanding the “Greeks” is a hallmark of options mastery. These Greek letters represent mathematical parameters that measure various aspects of an option’s value and risk sensitivity to changes in underlying asset price, volatility, time, and interest rates. Proficiency in interpreting the Greeks empowers traders to make more informed decisions.

Options in Action: A Strategic Arsenal

The versatility of options extends far beyond their inherent value; they can be deployed as potent tools in a trader’s strategic arsenal:

- Hedging: Protecting from Market Swings

Options serve as a bastion against market fluctuations. For example, an investor holding a portfolio of stocks can hedge against a potential market downturn by purchasing put options on an index that tracks the overall stock market. Should the market tumble, the put options would increase in value, potentially

Image: sites.psu.edu

How Do Options Work In Trading

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Image: cuartoymita.net