Introduction

In the realm of stock market adventures, understanding the intricate world of bid and ask prices is crucial for savvy traders and investors seeking to maximize their gains and mitigate risks. This comprehensive guide will embark on a detailed exploration of stock options trading, demystifying the bid and ask dynamics that govern these complex financial instruments. By unraveling the intricacies of this topic, we aim to empower readers with the knowledge to navigate the stock options market with confidence and precision.

Image: blog.pointzero-trading.com

Defining Stock Options and Their Significance

Stock options, essentially, grant the holder the right, but not the obligation, to buy or sell an underlying stock at a predetermined strike price within a specified timeframe. These versatile instruments provide investors with a range of strategies to speculate on future stock movements, hedge against market volatility, and potentially generate substantial profits. Understanding the bid and ask prices associated with stock options trading is fundamental to comprehending and utilizing their capabilities effectively.

Unveiling the Bid and Ask Prices

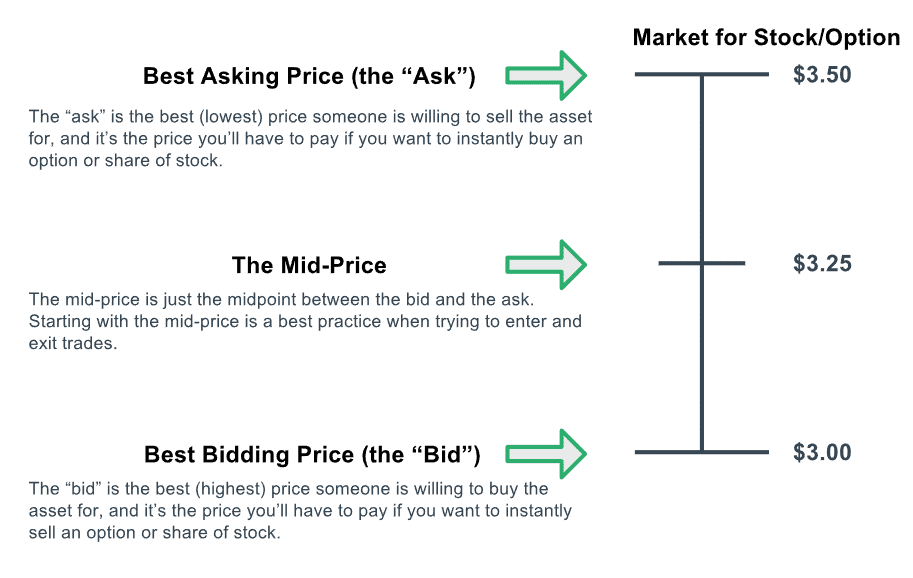

The bid price represents the highest price a buyer is willing to pay for an option contract, while the ask price indicates the lowest price a seller is prepared to accept. The difference between the bid and ask prices, known as the spread, reflects the liquidity and demand for a particular option. A tight spread signifies a liquid market, facilitating quick execution of trades at favorable prices, whereas a wide spread suggests a less active market, potentially leading to delays or unfavorable execution prices.

Factors Influencing Bid and Ask Prices

A multitude of factors converge to shape bid and ask prices in stock options trading. These include the intrinsic value of the option, its time to expiration, the volatility of the underlying stock, interest rates, and overall market sentiment. Intrinsic value measures the difference between the strike price and the current market price of the underlying stock. Time to expiration signifies the remaining lifespan of the option contract before it becomes worthless. Volatility, a measure of price fluctuations, directly influences option pricing. Interest rates also play a role, as they impact the cost of carry for options. Lastly, market sentiment, whether bullish or bearish, can significantly affect bid and ask prices.

Image: www.youtube.com

Tips for Navigating Bid and Ask Prices

To navigate the bid and ask divide effectively, consider the following tips:

- Assess Liquidity: Scrutinize the bid-ask spread to gauge market liquidity. Tight spreads indicate ample liquidity, reducing the likelihood of large price discrepancies during execution.

- Monitor Market Conditions: Stay abreast of prevailing market conditions, including interest rates, volatility, and overall sentiment. These factors can significantly influence bid and ask prices.

- Utilize Limit Orders: Specify the maximum price you are willing to pay (for buys) or the minimum price you are prepared to accept (for sells) using limit orders. This helps secure more favorable execution prices, although it may prolong trade execution.

Frequently Asked Questions (FAQs)

Q: What is the difference between the bid and ask price?

A: The bid price is the highest price buyers are willing to pay for an option, while the ask price is the lowest price sellers are ready to accept.

Q: How does the bid-ask spread impact trading?

A: A wide bid-ask spread suggests lower liquidity, potentially resulting in less favorable execution prices and increased trading costs.

Q: What factors influence bid and ask prices?

A: Intrinsic value, time to expiration, volatility, interest rates, and market sentiment are key determinants of bid and ask prices.

Stock Options Trading Bid And Ask

Image: axelprivatemarket.com

Conclusion

Embracing the complexities of bid and ask prices is paramount for successful stock options trading endeavors. By grasping the concepts outlined in this comprehensive guide, traders can enhance their understanding of these financial instruments, make more informed decisions, and potentially maximize their returns. The journey into the stock options market can be exhilarating, and with a clear comprehension of bid and ask dynamics, traders can navigate this realm with confidence and precision.

Are you intrigued by the intricacies of stock options trading? Embark on your trading journey today and unlock the potential for lucrative opportunities!