Title: Unraveling the Intricacies of Options Trading: A Comprehensive Guide with Real-World Examples

Image: www.youtube.com

In the realm of financial markets, options trading stands out as a powerful strategy that offers both immense opportunities and potential risks. For those seeking to delve into this captivating domain, a profound understanding of options trading is paramount. In this comprehensive guide, we will embark on a detailed exploration of options trading, demystifying its concepts and providing real-world examples to illuminate its practical applications.

The Anatomy of Options Trading

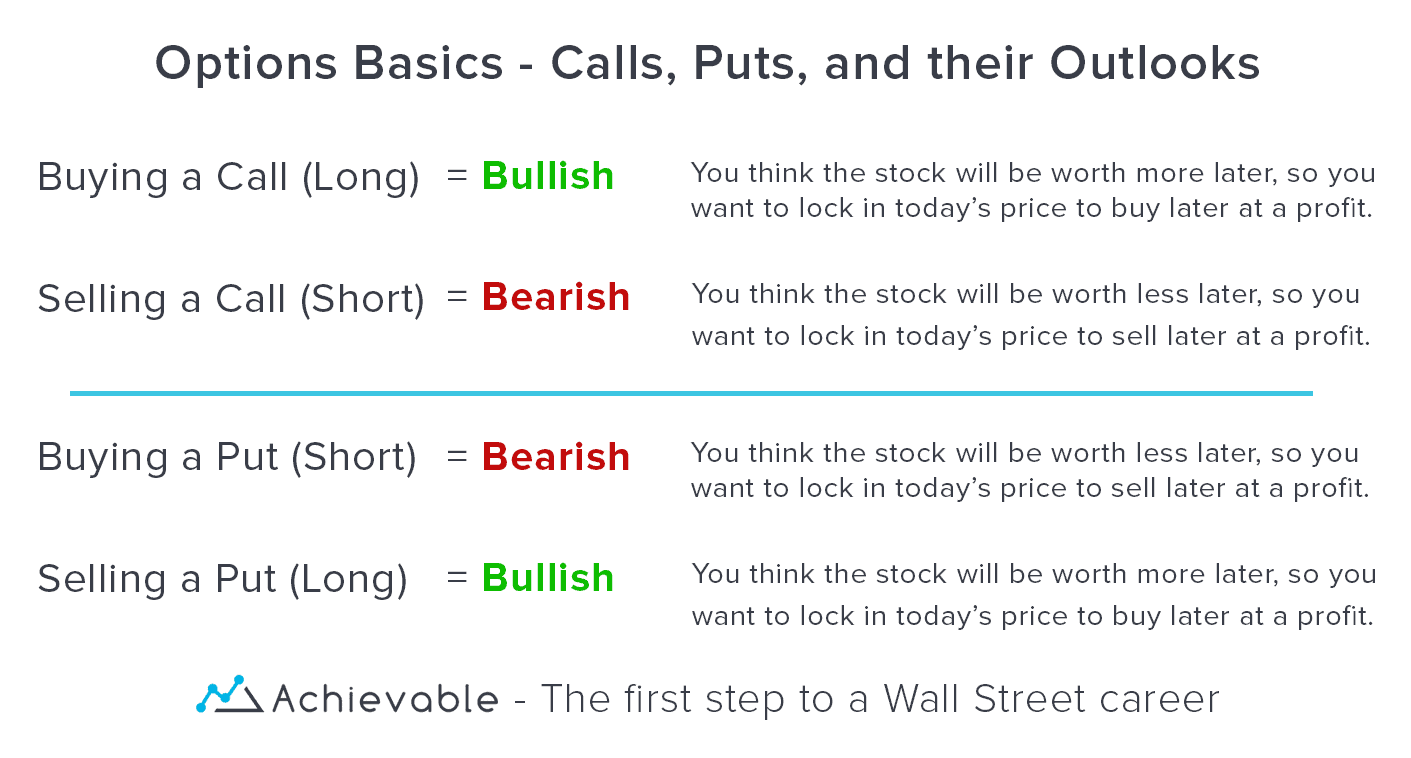

At its core, options trading involves the buying and selling of contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset – such as a stock, commodity, or currency – at a specified price on or before a predetermined date. These contracts, known as options, come in two distinct flavors:

-

Call Options: Empower the holder with the right to buy the underlying asset at a specific price, called the “strike price,” on or before the contract’s expiration date.

-

Put Options: Grant the holder the right to sell the underlying asset at the strike price on or before the expiration date.

Understanding these fundamental concepts is crucial for navigating the intricacies of options trading and devising successful strategies.

Real-World Options Trading Examples

To cement our understanding, let’s delve into compelling real-world examples that illustrate the practical applications of options trading:

1. Hedging Against Market Volatility: Imagine you own 100 shares of Apple stock that you believe will remain stable in value but are concerned about a potential decline. To protect your investment, you could purchase a put option contract that gives you the right to sell each share at a predetermined price. If the stock price plummets, you can exercise your option and sell at the higher strike price, mitigating your losses.

2. Speculating on Market Movements: On the other hand, suppose you possess a strong conviction that a particular stock is poised to surge in value. In such a scenario, you could purchase call options on that stock, allowing you to potentially reap the rewards of its price appreciation without committing to an outright purchase.

3. Enhancing Returns: Options trading can also serve as a tool for enhancing returns. By selling covered calls on stocks you own, you can generate additional income if the stock price remains below the strike price. Conversely, selling cash-secured puts on stocks you’re interested in acquiring can effectively lower your purchase price should the price decline.

Image: blog.achievable.me

Options Trading Exercise Example

Image: eaglesinvestors.com

Conclusion

Options trading presents an array of opportunities for investors seeking to navigate the financial markets strategically. However, it’s imperative to approach options trading with a thorough understanding of its concepts and risks. This comprehensive guide, coupled with real-world examples, provides a solid foundation for aspiring options traders. By unraveling the intricacies of this fascinating realm, you can unlock its potential and empower yourself to make informed decisions in the pursuit of financial success.