The financial landscape is replete with opportunities for growth and diversification. Among the myriad offerings, futures and options trading stands out as a compelling avenue to expand your wealth-building horizons. To embark on this transformative journey, you must equip yourself with the knowledge and tools necessary for success, starting with an understanding of futures and options trading accounts.

Image: www.binance.com

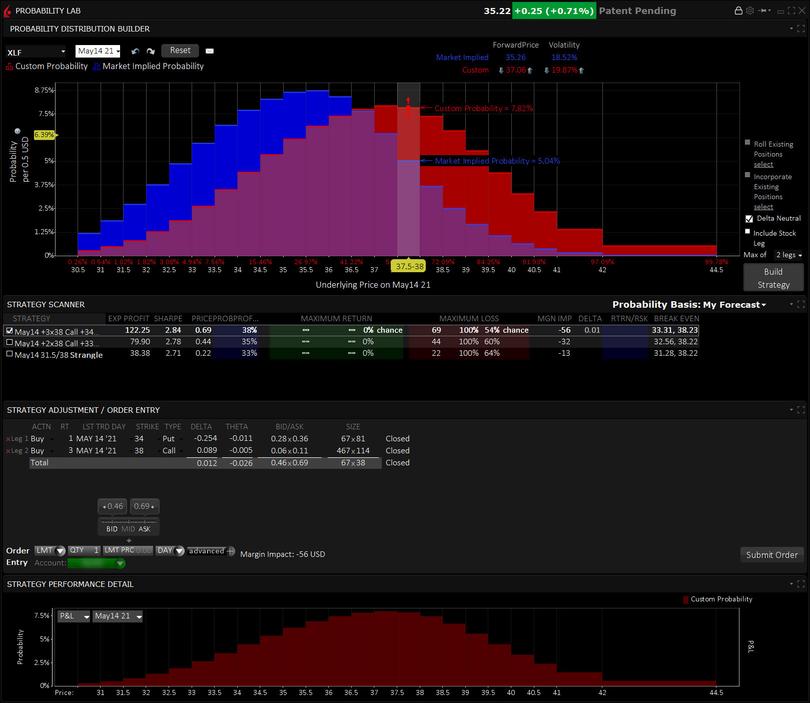

Futures and options hold immense potential for savvy investors seeking leveraged returns. Futures contracts obligate you to buy or sell an underlying asset at a predetermined price on a specific date, effectively locking in future prices. Options contracts, on the other hand, confer the right but not the obligation to engage in such transactions.

Navigating the Futures and Options Trading Landscape

Trading futures and options empowers you with greater flexibility and control over your investments. However, it is crucial to proceed with informed decision-making, meticulously evaluating the risks and rewards involved.

To begin, you must establish a futures and options trading account with a reputable broker. This account serves as the gateway to access these markets, facilitating the execution of your trading strategies and the management of your assets.

Key Considerations for Selecting a Broker

- Credibility and Regulation: Ensure your chosen broker is licensed and regulated by a recognized financial authority.

- Product Offerings: Determine if the broker offers the specific futures and options contracts that align with your investment objectives.

- Trading Platform: Assess the user-friendliness, functionality, and overall performance of their trading platform.

- Fees and Commissions: Compare the fees and commissions charged by different brokers to optimize your profitability.

- Customer Support: Seek brokers who provide exceptional customer support to assist you in navigating any challenges you may encounter.

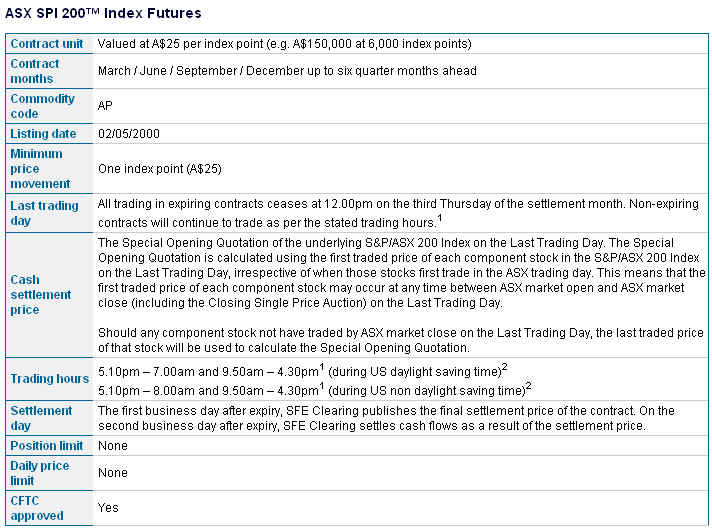

Essential Elements of a Futures and Options Trading Account

A comprehensive futures and options trading account typically encompasses the following core features:

- Account Balance: This reflects the total value of your account, including initial capital, profits, and losses.

- Real-Time Market Data: Access to real-time market data is crucial for informed decision-making, enabling you to track price movements and market dynamics.

- Trading Tools: Sophisticated trading tools, such as charting software and technical indicators, empower you with valuable insights for analyzing market trends and identifying trading opportunities.

- Position Monitoring: Track your open positions, monitor their performance, and manage risk exposure effectively.

- Order Management: Submit, modify, and cancel orders seamlessly, ensuring timely execution of your trading strategies.

Image: pyqudow.web.fc2.com

Empowering Investors: Tips and Expert Advice

Embarking on futures and options trading requires a combination of knowledge, skill, and strategic planning. Here are some invaluable tips and expert advice to enhance your trading experience:

Effective Risk Management

- Risk Tolerance Assessment: Determine your risk tolerance and ensure it aligns with the inherent volatility of futures and options trading.

- Position Sizing: Calculate appropriate position sizes based on your risk tolerance and account balance to avoid excessive exposure.

- Diversification: Spread your investments across different assets and strategies to mitigate risk.

Enhanced Trading Strategies

- Technical Analysis: Use technical analysis tools to identify patterns, trends, and potential trading opportunities in the market.

- Fundamental Analysis: Conduct in-depth research to understand the fundamental factors driving price movements and make informed investment decisions.

- Trend Following: Identify ongoing market trends and align your trades accordingly to capture momentum and maximize profitability.

FAQs on Futures and Options Trading Accounts

- Q: What is the difference between futures and options?

- Q: What are the benefits of futures and options trading?

- Q: How do I open a futures and options trading account?

- Q: How much capital do I need to start trading futures and options?

- Q: Is futures and options trading suitable for beginners?

A: Futures contracts obligate you to buy or sell an underlying asset on a specific date, while options contracts confer the right but not the obligation to do so.

A: Futures and options provide leverage, flexibility, and the potential for substantial returns. However, they also carry significant risk that must be carefully managed.

A: Approach a reputable broker, complete their account application form, provide supporting documentation, and fund your account.

A: The minimum capital required varies by broker, but generally, a substantial amount is necessary to accommodate the inherent leverage and risk involved.

A: Futures and options trading require a comprehensive understanding of financial markets, risk management, and trading strategies. Beginners are advised to gain sufficient knowledge and experience before venturing into these complex markets.

Futures And Options Trading Account

Image: www.interactivebrokers.com

Conclusion: Embracing Financial Opportunity

Futures and options trading accounts open up a world of possibilities for investors seeking financial empowerment. By establishing an account with a reputable broker, leveraging the right tools and strategies, and managing risk prudently, you can unlock the transformative potential of these markets.

Whether you are an experienced trader or a novice exploring new avenues for wealth creation, futures and options trading offer a compelling opportunity to expand your financial horizons and embrace the transformative power of financial markets. Are you ready to embark on this exciting journey and unlock your trading potential?