Trading stock options has gained immense popularity among investors in recent years, offering the potential for substantial returns while diversifying investment portfolios. This comprehensive guide will delve into the intricate world of stock options trading, empowering you with the knowledge and strategies you need to navigate this dynamic financial landscape successfully.

Image: niyudideh.web.fc2.com

Introduction to Stock Options

Stock options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell an underlying stock at a predetermined price (strike price) within a specified time frame (expiration date). As a result, they provide a unique way to speculate on the future movement of a stock without the hefty upfront investment required in traditional stock trading.

Types of Stock Options

There are two primary types of stock options:

-

Call Options: Give the holder the right to buy the underlying stock at the strike price. They are typically used when investors anticipate a rise in stock price.

-

Put Options: Give the holder the right to sell the underlying stock at the strike price. They are typically used when investors anticipate a decline in stock price.

Understanding Option Premiums

The price of an option, known as the premium, is determined by several factors, including the underlying stock’s price, time to expiration, strike price, and volatility. The higher the premium, the greater the potential payoff.

Image: blog.thetrader.top

Trading Strategies

There are various trading strategies that can be employed in stock options trading, each with its own set of risks and potential rewards. Here are a few common approaches:

-

Bullish Strategies: Used when an investor expects the stock price to rise, such as purchasing call options or selling put options.

-

Bearish Strategies: Used when an investor expects the stock price to fall, such as purchasing put options or selling call options.

-

Neutral Strategies: Involve a combination of call and put options with different strike prices to generate income from the passage of time.

Risks of Stock Options Trading

Leverage can be a double-edged sword. While it amplifies potential profits, it can also magnify losses. Stock options carry inherent risks, including:

-

Time Decay: Options lose value as expiration approaches, even if the underlying stock price doesn’t change.

-

Unfavorable Market Conditions: Market volatility, interest rates, and economic events can impact option prices.

-

Limited Profit Potential: Unlike stock ownership, with options, profits are limited to the premium paid.

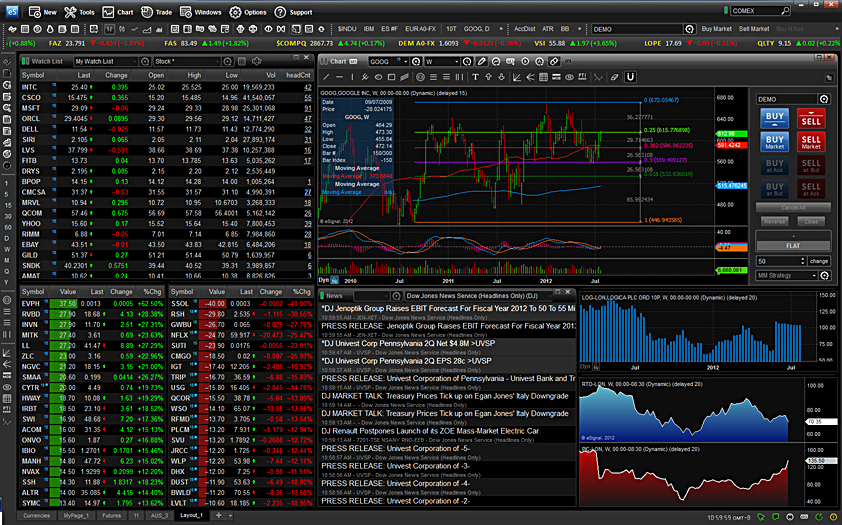

Best Stocks Options Trading

Image: www.pinterest.com

Conclusion

Stock options trading presents an exciting opportunity for savvy investors seeking to optimize returns and diversify portfolios. However, it is crucial to approach this market with a thorough understanding of options contracts, trading strategies, and risk management techniques. By embracing a disciplined approach and leveraging the right strategies, traders can harness the power of stock options to maximize their investment performance.