Introduction

The world of finance can be a labyrinthine maze, but options trading offers a unique pathway to potentially navigate the complexities and reap rewarding returns. Yet, embarking on this financial adventure requires a clear understanding of the minimum amount required to participate in this dynamic market. As we delve into this comprehensive guide, we’ll illuminate the ins and outs, empowering you with the knowledge and confidence to make informed decisions about options trading.

Image: blog.joinfingrad.com

Deciphering the Minimum Amount

The minimum amount required for options trading varies across different platforms and depends on factors such as the brokerage fees, exchange fees, and the security you intend to trade. Typically, online brokerages set a minimum deposit threshold to open an options trading account. This amount can range from a few hundred dollars to several thousand dollars.

Factors Influencing the Minimum Amount

Apart from the brokerage fees and minimum deposit requirements, the minimum amount needed for options trading is also influenced by the following factors:

-

Option Contract Size: Each option contract represents 100 shares of the underlying asset. The total value of the contract is determined by the option’s strike price and the current price of the underlying asset.

-

Volatility of the Underlying Asset: The volatility of the underlying asset can impact option premiums. More volatile assets tend to have higher option premiums, which will increase the minimum amount required.

-

Trading Strategy: Depending on the trading strategy you employ, such as buying calls, puts, or spreads, the minimum amount required may vary.

Breakdown of Minimum Costs

To provide a clearer picture of the minimum costs associated with options trading, let’s break down the key components:

-

Brokerage Fees: Brokerage fees vary across platforms and can include account maintenance fees, trading commissions, and option assignment fees.

-

Exchange Fees: Exchanges charge fees for facilitating trades, and these fees can vary depending on the exchange and the type of order placed.

-

Option Premium: The option premium is the amount the buyer pays to the seller of the option. This premium is determined by factors like strike price, time to expiration, volatility, and supply and demand.

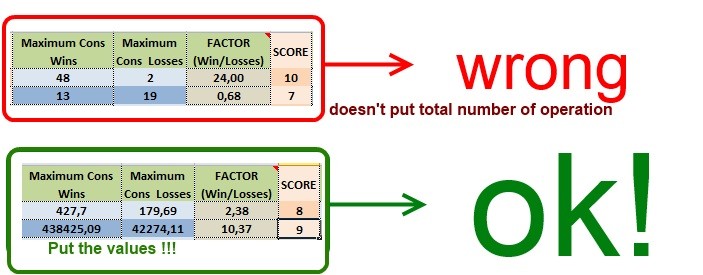

Image: www.mql5.com

Assessing Your Options

Evaluating your financial circumstances is crucial before jumping into options trading. Determine the amount you’re comfortable investing, considering your risk tolerance and investment goals. Remember, options trading carries inherent risks that can result in substantial losses.

If you’re new to options trading, consider starting with smaller amounts and gradually increase your investment as you gain experience and knowledge.

Expert Advice and Tips

Seasoned options traders emphasize the importance of prudent money management and risk mitigation strategies. Here are some valuable tips to keep in mind:

-

Start with a Demo Account: Practice trading options in a simulated environment using a demo account to gain experience without risking real capital.

-

Educate Yourself: Immerse yourself in resources to enhance your understanding of options trading concepts and strategies.

-

Consult with a Financial Advisor: Consider seeking guidance from a qualified financial advisor who can provide personalized advice based on your specific circumstances.

Minimum Amount Required For Options Trading

Conclusion

Understanding the minimum amount required for options trading is a critical stepping stone towards navigating this dynamic market. By considering the various factors that influence this minimum amount, you can make informed decisions that align with your financial capabilities and trading objectives. Remember, options trading involves both opportunities and risks, so approach it with a well-informed and cautious mindset. We encourage you to explore further resources and consult with experts to build a solid foundation for your options trading journey.