The world of options trading, a realm of sophisticated financial instruments, offers tantalizing opportunities for savvy investors seeking to leverage stock market fluctuations. However, venturing into this arena comes with its own set of parameters, and understanding the minimum trade requirements is paramount. The amount of capital required to engage in options trading varies across different exchanges and brokerages, but comprehending these requirements is crucial for making informed decisions.

Image: www.forbes.com

A Basic Understanding of Options Trading

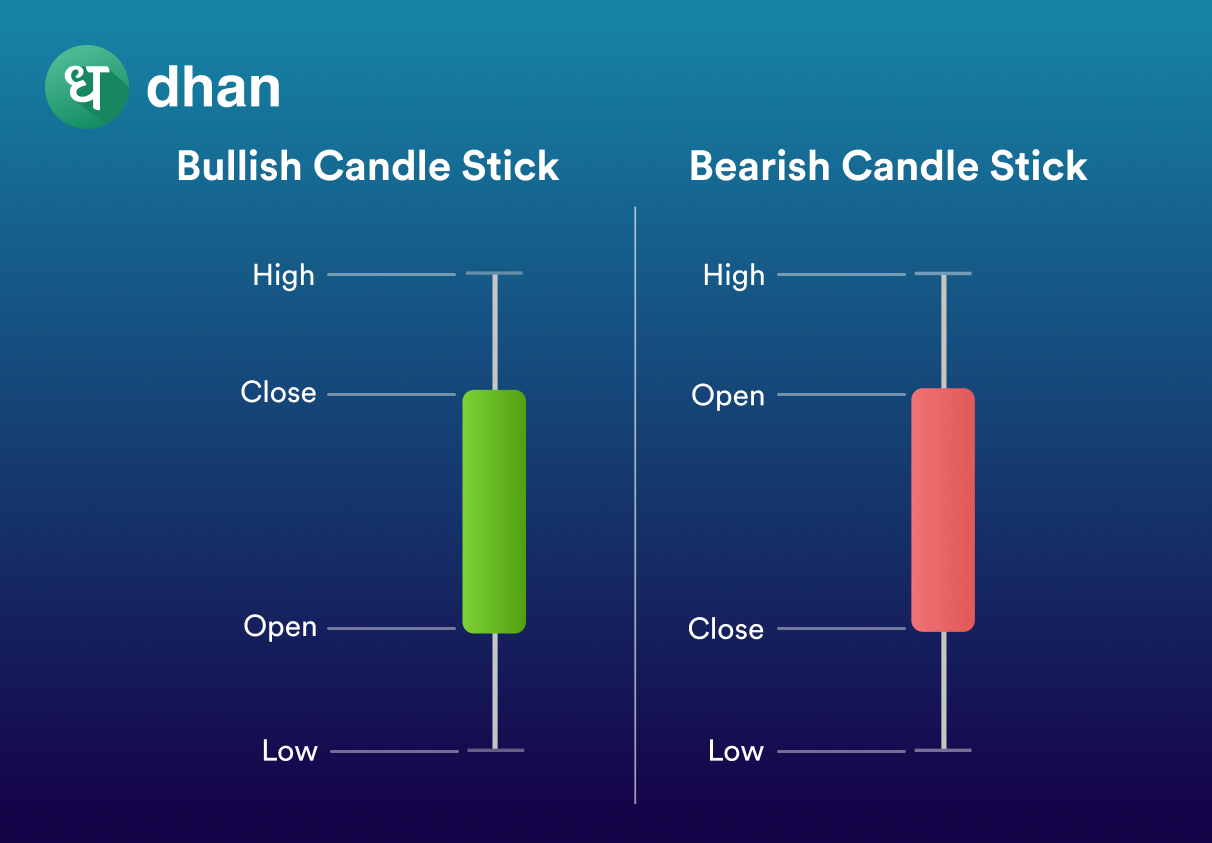

Options contracts, unlike stocks, don’t represent ownership in an underlying asset but confer the right, not the obligation, to buy (call option) or sell (put option) that asset at a predefined price within a specified time frame. This flexibility gives investors a myriad of strategic possibilities, but it’s essential to know that options trading involves certain risks and complexities.

Minimum Trade Requirements: A Variable Landscape

The minimum amount required to trade options varies depending on the specific option contract being traded. This threshold is influenced by several factors, including the stock price, volatility, and specific exchange requirements. Moreover, different brokerages may impose their own minimum trade requirements, adding another layer of variability.

In broad terms, most exchanges establish a minimum trading unit for options contracts, typically measured in contracts. This unit, also known as a round lot, is usually set at 100 shares. In other words, to trade options on a stock, an investor would need to purchase or sell a minimum of 100 contracts, representing 10,000 shares of the underlying stock.

The Impact of Market Volatility

Market volatility, a measure of the rate and magnitude of price changes in a stock, significantly impacts minimum trade requirements. The more volatile the underlying stock, the higher the potential risk associated with trading options on that stock. Therefore, exchanges often set higher minimum trade requirements for options on highly volatile stocks.

Image: blog.dhan.co

Variations Across Exchanges and Brokerages

Different exchanges have unique minimum trade requirements for options contracts. For example, the Chicago Board Options Exchange (CBOE) and NASDAQ OMX PHLX establish distinct minimum trade requirements for various options series.

Likewise, brokerages can set their own minimum trade requirements. These requirements might be influenced by the brokerage’s risk management policies, the available trading platforms, and the specific options contracts offered.

Navigating Minimum Trade Requirements with Informed Decisions

Understanding minimum trade requirements is instrumental in planning options trading strategies and managing risk effectively. By researching exchange and brokerage requirements, investors can choose appropriate options contracts that align with their financial goals and risk tolerance.

Options Trading Minimum Amount

Conclusion

Embracing the world of options trading requires a comprehensive understanding of minimum trade requirements. By familiarizing themselves with exchange and brokerage requirements, investors can avoid potential obstacles and maximize their opportunities in this dynamic market. The ability to trade options strategically, within the parameters of established minimum trade requirements, unlocks a realm of financial possibilities, empowering investors to harness the potential of the options market.