Indulge in the Delicacies of Trading Options for a Zestful Portfolio

Like a seasoned chef orchestrating a culinary masterpiece, savvy investors wield option trading as a tantalizing tool to enhance their portfolios. In this delectable guide, we will delve into the world of tasty option trading, unraveling its complexities and empowering you to navigate its sweet and salty challenges.

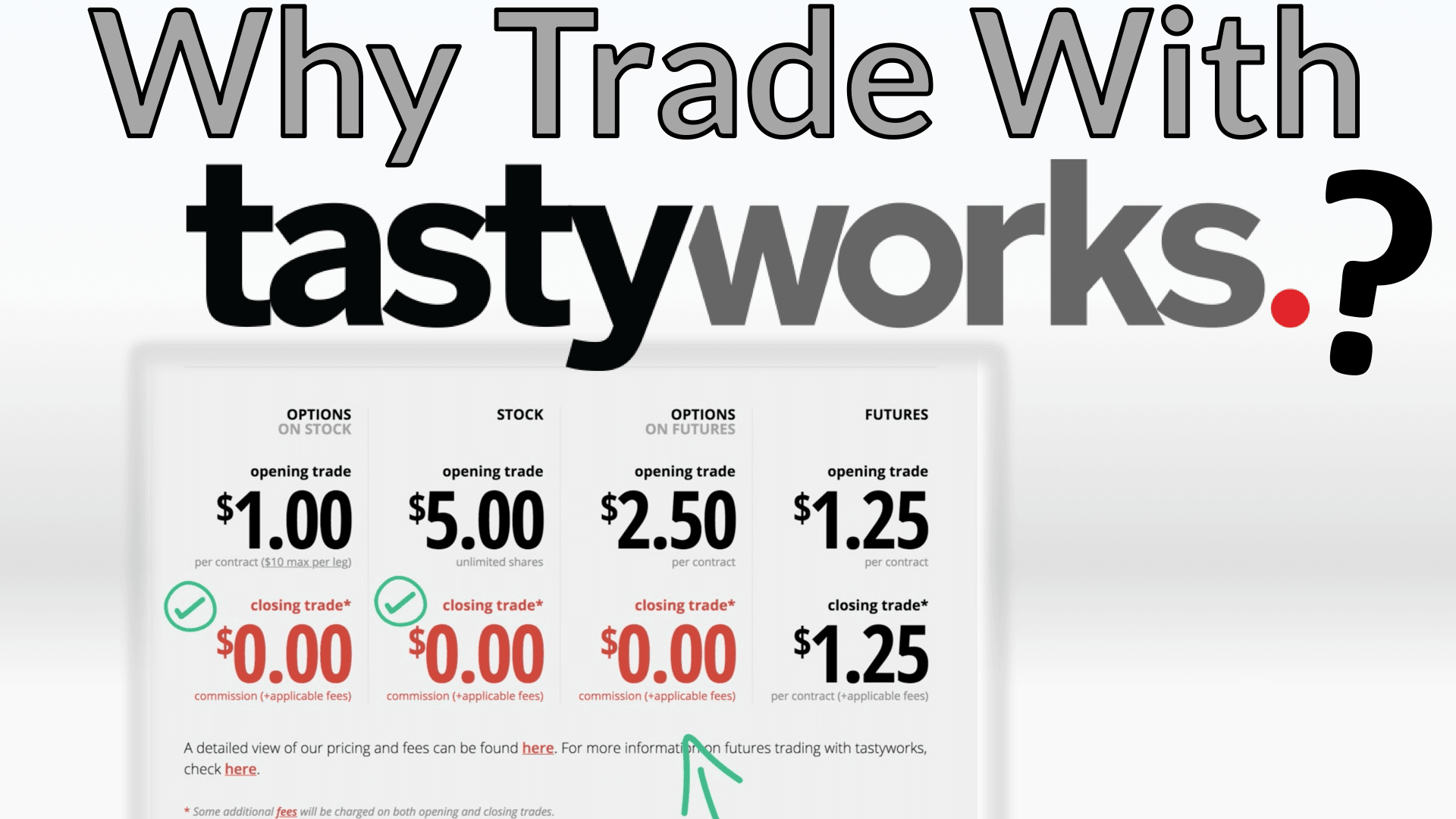

Image: www.projectoption.com

A Culinary Quest: Understanding Option Trading

Envision an exotic market where you have the tantalizing option to place a “bet” on the future performance of an underlying asset, such as stocks, indices, or commodities. This bet, known as an option contract, grants you the right, but not the obligation, to buy or sell that asset at a predetermined price on a specific date. It’s like owning a gourmet coupon that gives you the flexibility to reap the rewards of a price swing without the upfront investment.

Unveiling the Masterpiece: Call and Put Options

The primary flavors in the option trading world are call and put options. Call options give you the sweet taste of buying at a later date, while put options allow you to savor the tangy thrill of selling down the road. By carefully selecting the underlying asset and the strike price, you create a personalized investment symphony that dances to the tune of your financial goals.

Deciphering the Ingredients: Expiration Dates and Premiums

No option masterpiece is complete without understanding its freshness. Each option contract has an expiration date, the moment when its flavorsome potential fades. Additionally, you must pay a premium, the cost of acquiring the option, which acts like an upfront investment. These ingredients determine the potential profitability and risk associated with your option trade.

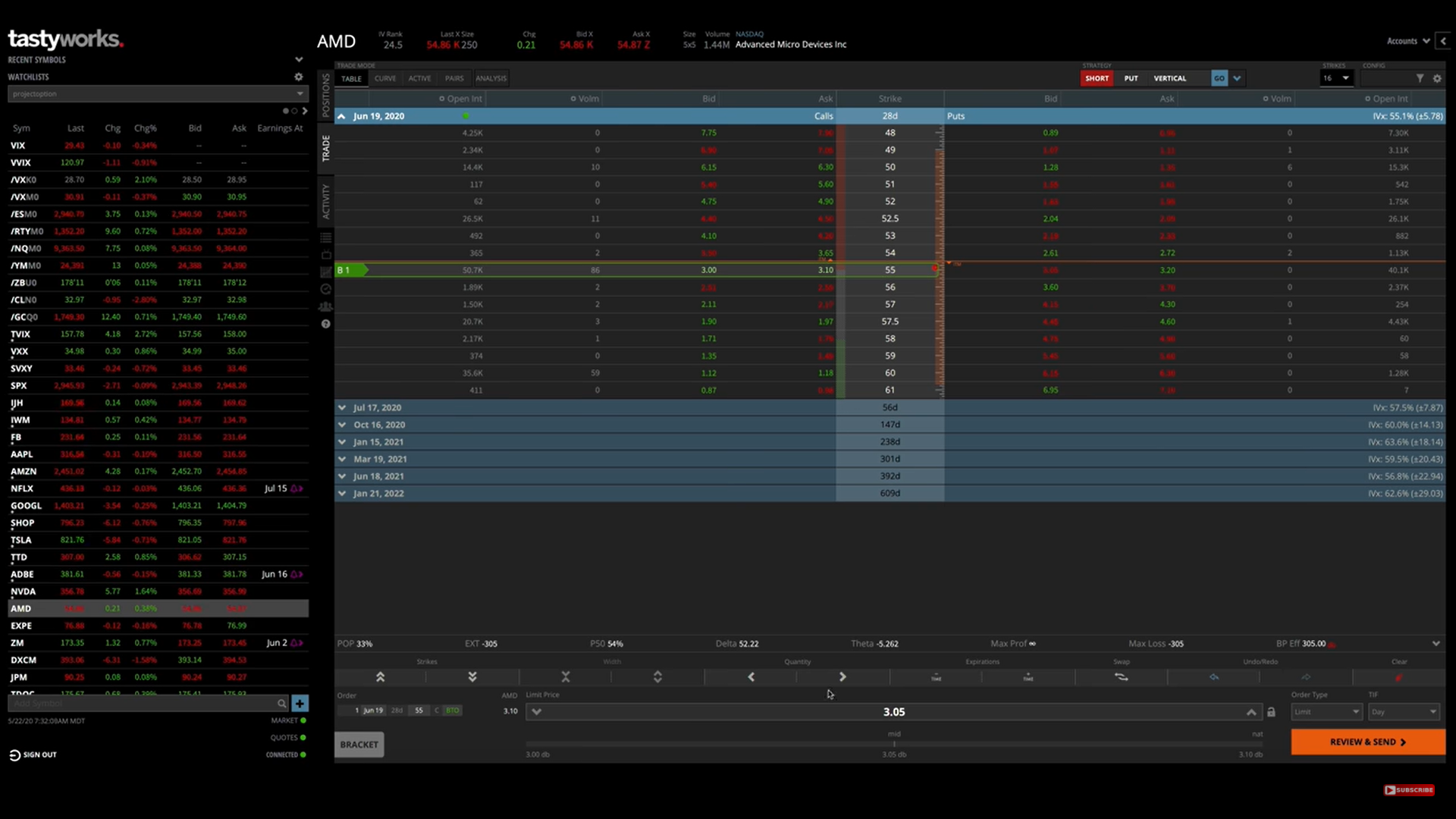

Image: www.twoinvesting.com

Navigating the Culinary Landscape: Market Factors

Like a skilled chef dancing to the rhythm of the market, successful option traders dance with supply and demand, inflation, and interest rates. By understanding the underlying currents that sway asset prices, you can make informed decisions and balance the sweetness of potential gains with the sourness of potential losses.

Crafting Your Exquisite Dish: Strategies and Techniques

The world of option trading is a culinary playground where you can experiment with various strategies and techniques. Whether it’s the savory flavor of covered calls, the zesty kick of iron condors, or the balanced blend of delta-neutral strategies, each recipe offers unique risk-reward profiles to suit every palate.

Seek Culinary Guidance: Expert Insights and Practical Tips

To elevate your option trading skills, immerse yourself in the wisdom of culinary masters – seasoned experts and experienced traders. Their insights will guide you through the intricacies of specific strategies, share time-tested techniques, and help you navigate the volatile market landscape with greater confidence.

Tasty Option Trading

Image: www.projectoption.com

Savoring the Delectable Conclusion

Trading options, like any culinary adventure, requires a balance of flavors – calculated risks, strategic thinking, and a dash of culinary flair. This guide provides a foundational recipe for success, empowering you to explore the delectable world of option trading and savor the sweet rewards of enhanced investment returns.

Remember, every culinary masterpiece begins with experimentation. Embrace the learning curve, embrace the risks, and let the market be your canvas as you craft your own unique portfolio symphony. The world of tasty option trading awaits your discerning palate – indulge, savor, and reap the fruits of your investment labor.