In the heart of the financial world, where fortunes are made and lost in the blink of an eye, there lies a realm of intrigue and uncertainty—options trading. Like a siren’s call, it beckons traders with the promise of vast riches, yet holds the potential to wreck their financial vessel if they dare to venture too carelessly.

Image: www.cmcmarkets.com

One fateful day, as I sat in the bustling trading room, my gaze fell upon a screen flickering with intricate graphs and complex calculations. It was the embodiment of volatility, a force that governed the erratic dance of asset prices. In that instant, I knew I had to delve deeper into this enigmatic realm.

Unveiling Volatility: The Essence of Options Trading

In the world of finance, volatility reigns supreme as the measure of an asset’s price fluctuations. It reflects the traders’ collective emotionality, their hopes, and their fears, creating a dynamic landscape where fortunes can be won or lost on calculated gambles.

Options, financial instruments that derive their value from the underlying asset’s price, are closely intertwined with volatility. Traders employ options to speculate on future price movements, either betting on the market’s ascent or decline. But with great potential comes great risk, and those who venture into options trading must tread carefully to avoid the pitfalls that lay in wait.

Navigating the Market of Mayhem: Options Trading Strategies

Like a skilled navigator charting a course through treacherous waters, an options trader must employ a well-defined strategy to navigate the choppy seas of volatility. Various approaches exist, each with its own strengths and weaknesses, but one fundamental principle remains constant: manage risk through careful position sizing and disciplined execution.

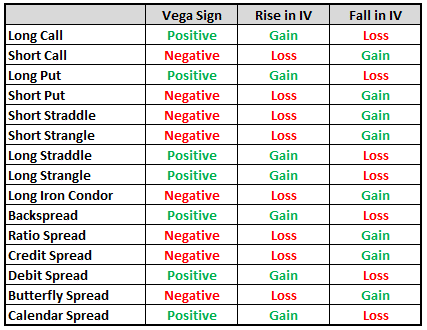

Some opt for strategies that seek to maximize returns when volatility spikes, while others pursue steady gains by capitalizing on the market’s natural tendency to oscillate. There are strategies that seek to minimize losses when the market turns against them and those that aim to capture premium payments from other traders in exchange for taking on more risk.

Tips and Expert Insights for Options Traders

From my years navigating the treacherous waters of options trading, I have gleaned a treasure trove of wisdom that I am eager to share with fellow traders. Foremost among these pearls is the importance of mastering risk management. Volatility is an unpredictable mistress, and traders must employ strategies that protect their capital from her volatile whims.

Another invaluable lesson is the art of patience. Options trading is not a get-rich-quick scheme, but rather a discipline that demands patience and perseverance. Impulsive decisions and emotional trading can lead to ruin, while those who approach the market with a clear plan and disciplined execution have a greater chance of success.

Image: optionstradingiq.com

FAQs on Options Trading and Volatility

Q: What is the simplest way to explain options trading?

A: Options are like contracts that give traders the right (but not the obligation) to buy or sell an underlying asset at a set price within a specified time frame.

Q: How can I reduce risk in options trading?

A: Employ risk management strategies like position sizing, stop-loss orders, and hedging techniques to mitigate potential losses.

Q: What is the key to success in options trading?

A: Patience, discipline, and a thorough understanding of volatility and risk management principles are crucial for consistent profitability.

Options Trading And Volatility

Image: investmentu.com

Conclusion: Embracing Uncertainty with Knowledge and Skill

Options trading is not for the faint of heart. It is a realm where volatility reigns, and fortunes are won and lost in the ebb and flow of the market’s unpredictable tides. However, with a firm grasp of volatility, a well-defined strategy, and a commitment to risk management, traders can navigate this enigmatic realm with a greater chance of success.

Are you ready to venture into the world of options trading and volatility? The path may be fraught with challenges, but the rewards for those who embrace uncertainty with knowledge and skill can be immense. The choice is yours: to sit on the sidelines as others reap the rewards, or to join the ranks of those who dare to master the art of navigating the volatile waters of finance.