Image: www.youtube.com

Options Buffet: The Flavors of Financial Opportunity

Imagine a culinary masterpiece before you, an options buffet spread with a myriad of exotic dishes and flavors. Each dish represents an option contract, a financial instrument that grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame.

Just as a discerning palate savors the complexities of a gourmet meal, an options trader must navigate the intricacies of this financial buffet. The flavors of options contracts are enticing, but the uninitiated may find themselves overwhelmed by the vast array of flavors and complexities.

Options as Culinary Ingredients: Understanding the Basics

Before embarking on our culinary journey, let’s decode the fundamental elements of options trading. A call option is likened to a chef’s herb garden, where your right to buy an asset at a specific price (the strike price) becomes a spice that enhances your culinary creations. In contrast, a put option is an ingredient that gives you the flexibility to sell an asset at a strike price, similar to a freezer that preserves your investment in case of market downturns.

The time to maturity, like the cooking time for a gourmet dish, determines the duration of your option contract. The shorter the time to maturity, the more aromatic your option becomes, but also more unpredictable, akin to a sizzling steak on the grill.

Options Trading Techniques: Culinary Creations for Market Dynamics

The art of options trading lies in skillfully blending these ingredients to create financial dishes that cater to the ever-changing market dynamics. Covered calls, for instance, are like a simmering stew, allowing you to monetize your existing assets while reducing your risk exposure much like a slow-cooked meal warms a cold evening.

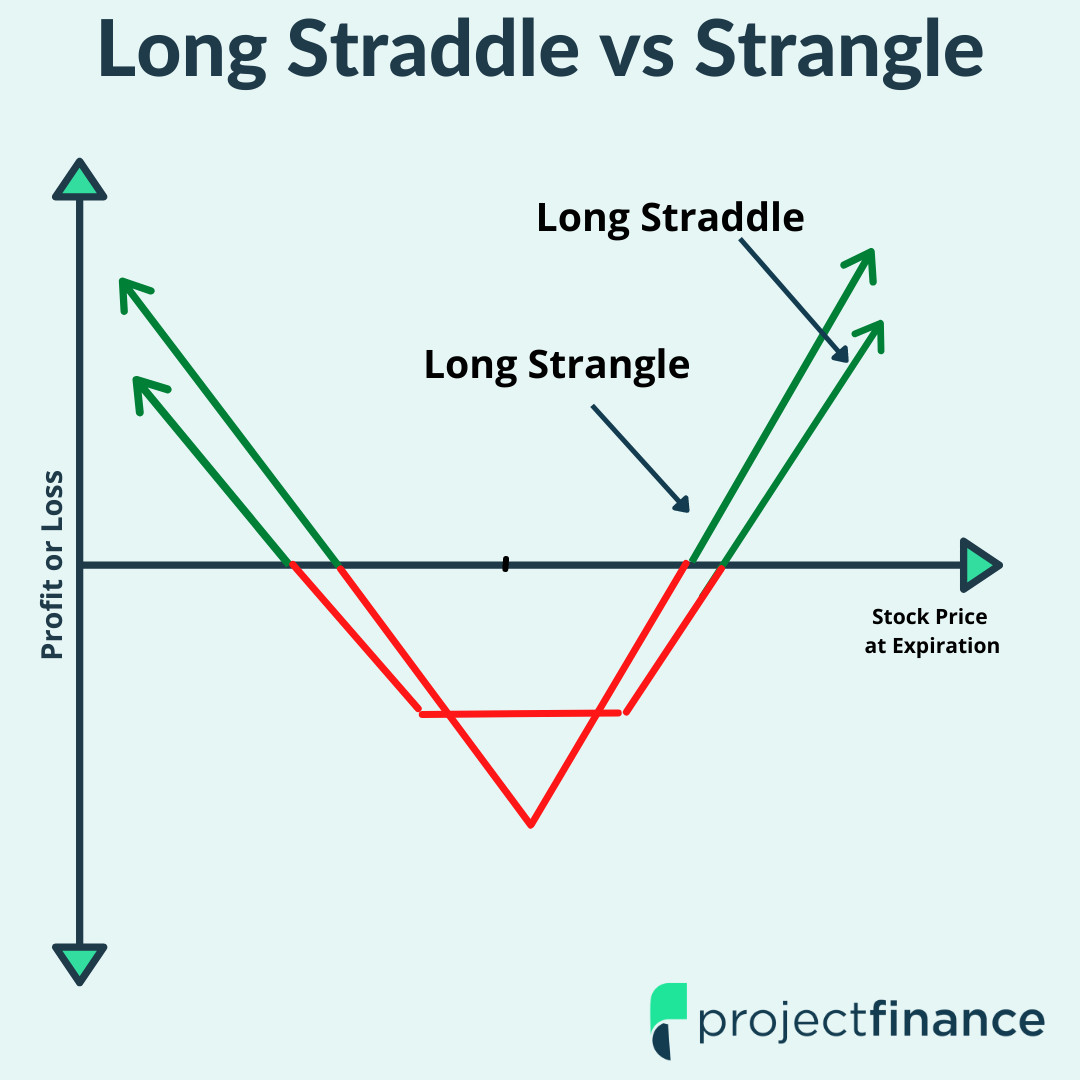

Naked calls, on the other hand, are a daring gamble, likened to a spicy ceviche that packs a punch of potential profit but also carries a risk of financial heartburn. Defensives strategies, such as protective puts or collar options, emulate healthy side dishes that protect your culinary experience from potential market volatility, shielding your investments like a well-sought-out wine.

Image: www.projectfinance.com

Market Volatility as Culinary Challenges: Navigating Spicy Markets

The volatility of the market is like an unpredictable spice that can either enhance or mar your culinary expedition. Low-volatility environments offer a comforting ambiance, akin to a gentle breeze that creates a conducive atmosphere for option experimentation.

High-volatility periods, on the other hand, are like a raging storm, demanding adaptability and caution. The options market becomes a tempestuous sea, where even the most seasoned traders may experience choppy waters.

Options Trading Analogy

Image: www.wallstreetmojo.com

Options Trading: A Culinary Skill to Master

Options trading, like culinary artistry, demands a blend of knowledge, skill, and a dash of risk-taking. By understanding the flavors of options contracts and the techniques of blending them, traders can create a portfolio that caters to their palate and achieves their financial goals.

Just as a chef’s repertoire expands with time and experience, so too does an options trader’s palette of strategies grow and evolve through continuous learning and market immersion.