Do you have a burning desire to delve into the realm of financial freedom and secure your financial future? If so, understanding the intricacies of stock option trading is an essential step towards achieving your financial goals. In this meticulously crafted article, we will embark on an immersive journey through the stock option trading landscape, empowering you with the knowledge and strategies to navigate this complex yet rewarding financial terrain. You will gain insights into the stock option trading rules, exploration of real-world scenarios, and practical tips from industry experts, equipping you with the knowledge and confidence to conquer the financial markets.

Image: www.ekunji.com

Navigating the Labyrinth of Stock Option Trading Rules: A Comprehensive Overview

Stock options are versatile financial instruments that grant the holder the right, but not the obligation, to buy or sell a specific number of shares of a company’s stock at a predetermined price within a specified period. This unique characteristic offers traders a unique opportunity to capitalize on market movements while managing potential risks. Understanding the rules that govern stock option trading is the cornerstone of success in this arena, and in this article, we will provide a comprehensive overview of these essential regulations.

First and foremost, it is imperative to grasp the concept of the two primary types of stock options: calls and puts. Call options provide the holder with the right to buy the underlying asset at a predetermined price, while put options grant the holder the right to sell the underlying asset at a predetermined price. The buyer of an option acquires the right to exercise this option at their discretion, while the seller assumes the obligation to fulfill the contract if the buyer chooses to exercise their right.

To engage in stock option trading, it is essential to establish a brokerage account with a reputable and regulated financial institution. Various brokers offer specialized services tailored to option traders, providing access to trading platforms, research tools, and expert guidance. Once your brokerage account is established, you can commence trading stock options by selecting an underlying asset, determining the type of option you wish to acquire (call or put), and specifying the strike price and expiration date.

The intricacies of stock option trading extend beyond these fundamental concepts, encompassing a vast array of strategies and nuances. Covered calls involve selling a call option while owning the underlying asset, a strategy that generates income but limits upside potential. Conversely, protective puts involve purchasing a put option while owning the underlying asset, providing downside protection but at the expense of premium payments. The spectrum of strategies is diverse and multifaceted, and understanding these variations can significantly enhance your ability to navigate the complexities of the market.

For novice traders venturing into the world of stock option trading, paper trading can prove to be an invaluable tool. Paper trading platforms simulate real-world trading environments, allowing traders to hone their skills and experiment with different strategies without risking capital. This risk-free environment enables traders to develop a deeper understanding of market dynamics and refine their trading strategies before committing real money.

Unleashing the Power of Stock Option Trading: Real-World Scenarios and Expert Insights

As we progress beyond the theoretical underpinnings of stock option trading rules, it is essential to delve into real-world scenarios and industry insights to illustrate the practical applications of these concepts. One such example is the strategic use of covered calls to generate income. Imagine you own 100 shares of Apple stock, currently trading at $100 per share. By selling a covered call option with a strike price of $105 and an expiration date of three months, you receive a premium payment in exchange for the obligation to sell your shares at $105 if the stock price rises above that level during the option’s lifespan.

This strategy generates income through the premium received and allows you to participate in the upside potential of the stock, albeit with a capped profit potential at the strike price. Alternatively, protective puts can provide downside protection in uncertain market conditions. Consider a scenario where you hold a portfolio of technology stocks and anticipate a potential market downturn. Purchasing a protective put option with a strike price slightly below the current market price can offer peace of mind, as it guarantees the right to sell your shares at the strike price, mitigating potential losses in the event of a market sell-off.

These examples underscore the versatility of stock option trading strategies, demonstrating how these instruments can be tailored to specific investment goals and risk appetites. To glean further insights from seasoned professionals, we sought the perspectives of industry experts who shared their invaluable wisdom. “Understanding the Greeks is crucial for stock option trading success,” emphasized Jonathan Weber, an experienced options trader. “These metrics quantify the sensitivity of option prices to various market factors, empowering traders to make informed decisions and manage risk effectively.”

Another expert, Sarah Lee, highlighted the importance of staying abreast of market trends and company-specific news that can influence stock option prices. “Regularly monitoring news sources, earnings reports, and economic data is essential for identifying trading opportunities and avoiding potential pitfalls,” Lee advised. These expert insights provide invaluable guidance, underscoring the importance of continuous learning and diligent research in the dynamic world of stock option trading.

Image: www.youtube.com

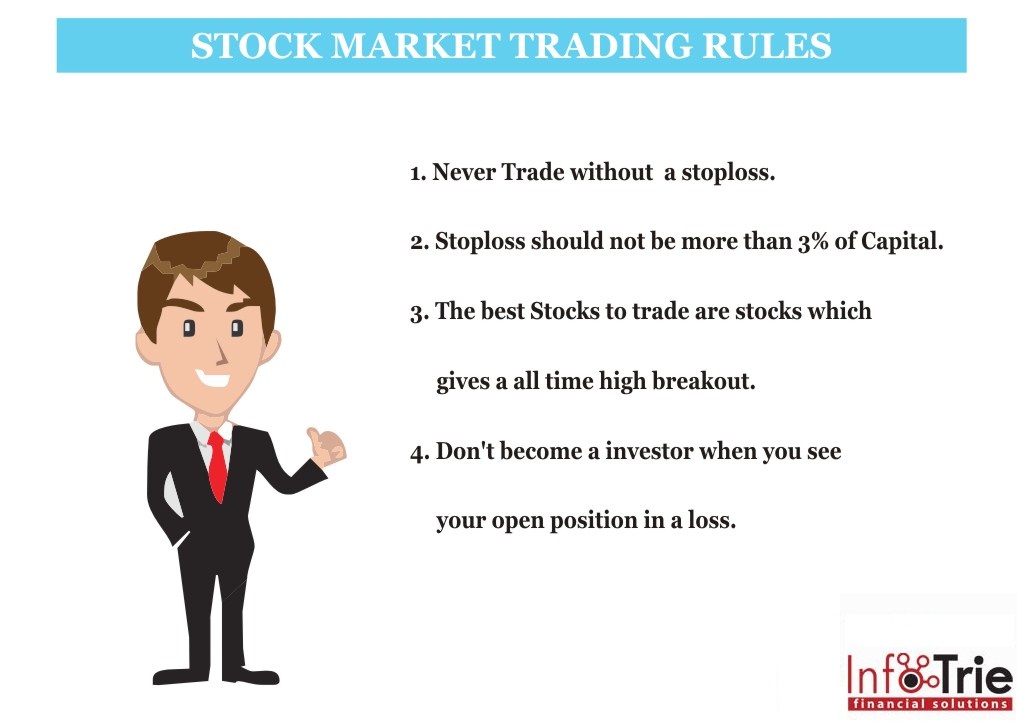

Stock Option Trading Rules

Empowering Traders with Practical Tips: A Path to Stock Option Trading Success

As we approach the culmination of this comprehensive guide to stock option trading rules, it is befitting to impart practical tips that can significantly enhance traders’ performance and increase their chances of success. One such tip is to start small and gradually increase trading volume as experience and confidence grow. Excessive leverage and overtrading can magnify losses, especially for novice traders, and exercising caution is paramount to long-term success.

Before executing any trades, it is imperative to conduct thorough research and analysis to develop a comprehensive understanding of the underlying asset and the factors that may affect its price. This includes examining the company’s financial statements, industry trends, competitive landscape, and any relevant news or events that could impact its performance.

Furthermore, effective risk management is the cornerstone of profitable stock option trading. Determine your risk tolerance and establish clear entry and exit points for each trade. Using stop-loss orders can help limit potential losses and preserve capital. Additionally, diversifying your portfolio across multiple