Embark on a Journey of Opportunity with Informed Minimum Capital

Venturing into the world of options trading can be an exciting and potentially lucrative endeavor. However, it’s crucial to establish a solid foundation by understanding the minimum capital requirement. This article will provide an in-depth exploration of the minimum capital needed for option trading, guiding you towards making informed decisions and unlocking boundless opportunities in this dynamic market.

Image: www.financialfalconet.com

Delving into the Essentials of Option Trading

Options trading involves the buying and selling of contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined time frame. As an options trader, you have the flexibility to capitalize on market movements without taking direct ownership of the underlying asset.

Unveiling the Minimum Capital Conundrum

The minimum capital required for option trading varies depending on the broker you choose, the options contracts you intend to trade, and your individual risk tolerance. Generally, brokers set a threshold to ensure that traders have sufficient funds to cover potential losses and maintain a margin account.

Determining Your Ideal Minimum Capital

To determine the appropriate minimum capital for your trading needs, consider the following factors:

-

Brokerage Margin Requirements: Brokerages typically set specific margin requirements for each options contract, influencing the minimum capital needed to open a position.

-

Volatility of Underlying Asset: The price fluctuations of the underlying asset impact the minimum capital needed. Higher volatility often necessitates a higher minimum capital to manage potential risks.

-

Risk Tolerance: Assess your risk tolerance and determine an acceptable level of capital you’re comfortable potentially losing.

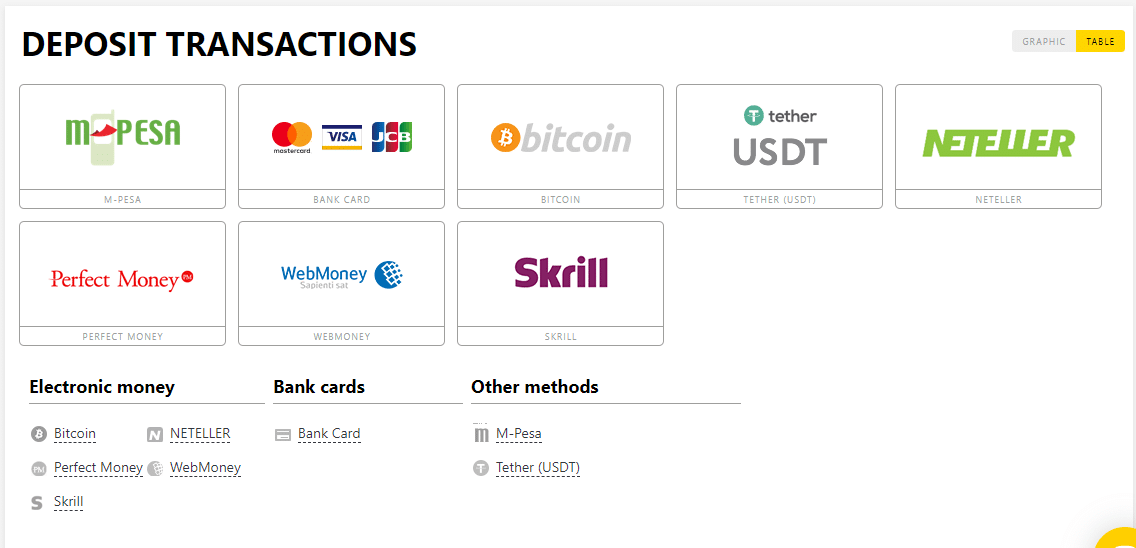

Image: forextradingbonus.com

Navigating Capital Requirements for Different Options Strategies

Option trading strategies vary in their capital requirements. Here’s a breakdown:

-

Buying Options: Buying options typically requires less capital upfront, as you only pay the option premium.

-

Selling (Naked) Options: This strategy has a higher capital requirement since you assume the obligation to fulfill the contract if exercised.

-

Covered Calls: Selling covered calls allows you to collect premiums but requires you to hold the underlying asset, increasing capital needs.

Expert Insights: Minimizing Capital Constraints

Seasoned options traders recommend these strategies for managing minimum capital:

-

Small Position Sizing: Start with smaller positions to limit potential losses while gaining experience.

-

Utilize Spreads: Spreads involve buying and selling options at different strike prices, reducing the initial capital outlay.

-

Consider Margin Accounts: Margin accounts allow you to borrow additional capital, but exercise caution and manage risk accordingly.

Option Trading Minimum Capital

Conclusion: Unlocking Possibilities with Informed Capitalization

Understanding the option trading minimum capital requirement is a cornerstone for successful trading. By considering the various factors outlined in this article, you can determine the ideal minimum capital for your individual circumstances. Embrace the opportunities presented by options trading while exercising prudent risk management. Remember, knowledge is your greatest asset in navigating the dynamic world of financial markets.