Introduction

In the realm of politics, the name Hillary Clinton has never been far from controversy. From her role in the Whitewater scandal to her email controversy as Secretary of State, Clinton has always been a lightning rod for both praise and criticism. One less-discussed aspect of her career, however, is her involvement in options trading — a form of investment that has raised some ethical and legal concerns.

Image: libertyblitzkrieg.com

Trading Controversies

In 2008, during her first presidential campaign, it was revealed that Clinton had made a series of profitable options trades while serving as a Senator from New York. The trades involved buying and selling futures contracts on a broad array of commodities, including soybeans, corn, and wheat. Critics accused Clinton of using her position to obtain non-public information that gave her an advantage in the markets.

The accusations were investigated by the Securities and Exchange Commission (SEC) and the Justice Department but ultimately no charges were filed. However, the controversy surrounding the trades has continued to dog Clinton and has been used by her opponents to question her integrity.

Legal Issues

Beyond the ethical concerns, there are also potential legal implications to Clinton’s options trading. The STOCK Act, passed by Congress in 2012, prohibits members of Congress and their staff from using non-public information for personal gain. If it were determined that Clinton used her position to obtain such information, she could be found in violation of the law.

The SEC has taken a keen interest in insider trading cases involving political figures. In March 2023, the agency charged a former aide to Clinton with insider trading, alleging that he used non-public information about Clinton’s campaign to trade stocks.

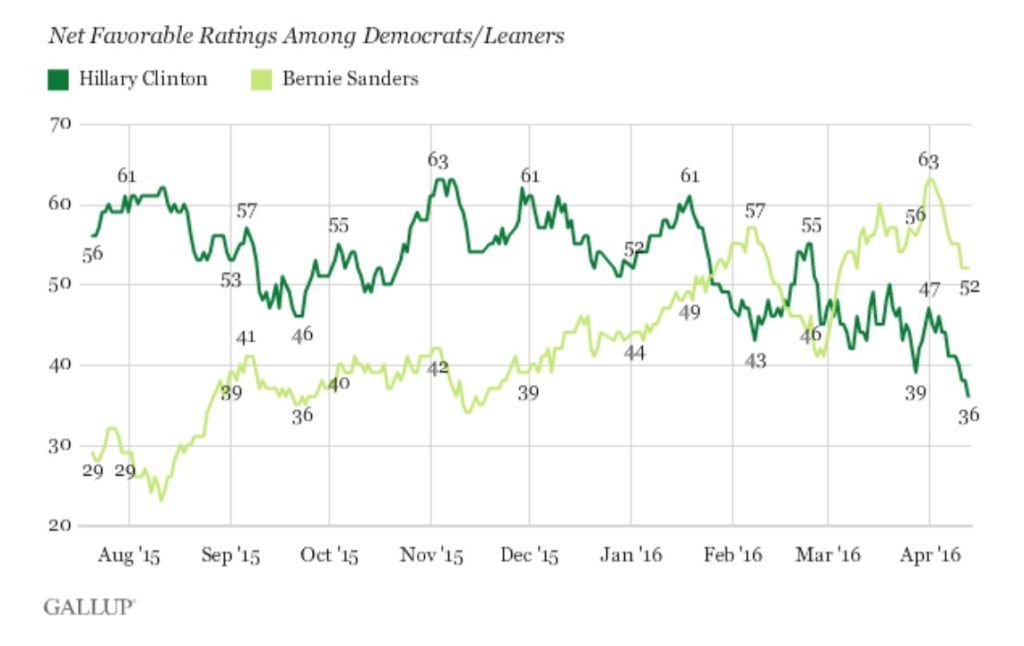

Latest Trends

The controversies surrounding Clinton’s options trading have not gone away and continue to be a source of scrutiny for her critics. In recent months, there have been renewed calls for the SEC to investigate her trades further.

There is also growing concern about the potential for insider trading among political figures in general. The STOCK Act has been criticized as being too weak and ineffective at preventing such abuse.

Image: www.ebay.com

Tips for Investors

As an investor, it is important to be aware of the potential risks of insider trading and to take steps to protect yourself. Here are a few tips:

- Be skeptical of any investment opportunities that are presented to you by someone who claims to have access to non-public information.

- Do your own research before investing in any stock or security.

- Be aware of the potential conflicts of interest that may exist between you and your investment advisor.

- If you have any concerns about insider trading, you should report them to the SEC.

By following these tips, you can help protect yourself from the risks of insider trading.

FAQs

Q: What is options trading?

A: Options trading is a type of investment that involves buying and selling futures contracts on a broad array of commodities, including soybeans, corn, and wheat.

Q: Is options trading legal?

A: Yes, options trading is legal. However, it is illegal to use non-public information to make trades.

Q: What are the potential consequences of insider trading?

A: The potential consequences of insider trading include fines, prison sentences, and disgorgement of profits.

Hillary Clinton Options Trading

Image: billspoliticalshoppe.com

Conclusion

Hillary Clinton’s involvement in options trading has been a source of controversy and legal scrutiny. While no charges have been filed against her, the allegations have raised concerns about insider trading among political figures. Investors should be aware of the potential risks of insider trading and take steps to protect themselves.

Would you like to learn more about Hillary Clinton’s options trading?