Options trading has carved a niche in the financial realm as a potent tool for investors seeking flexibility and the potential for substantial returns. Understanding how profit is calculated in options trading is paramount to navigating this dynamic market successfully. In this comprehensive guide, we’ll delving into the mechanics of options profit calculation, empowering you with the knowledge to make informed decisions and maximize your earnings.

Image: www.seeitmarket.com

What is Options Trading?

Options trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specified price within a predetermined timeframe. These contracts come in two primary flavors: calls, which confer the right to buy, and puts, which offer the right to sell.

The Anatomy of an Options Contract

Before we delve into the profit calculation process, it’s imperative to grasp the core components of an options contract:

- Underlying asset: The stock, bond, or other financial instrument that the option contract references.

- Strike price: The predetermined price at which the buyer can exercise their right to buy or sell the underlying asset.

- Expiration date: The date on which the option contract expires, rendering it worthless if not exercised.

- Premium: The price that the buyer pays the seller upfront to acquire the option contract.

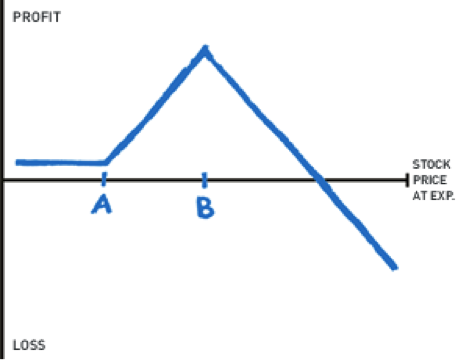

Calculating Profit in Options Trading

The profit earned from options trading hinges on the relationship between the option’s premium and the underlying asset’s price at the time of exercising the contract or its expiration. Here’s how it works:

For Call Options:

- If the underlying asset’s price rises above the strike price, profit is calculated as the difference between the sale price of the asset and the sum of the strike price and the premium paid.

- For Example: You purchase a call option with a strike price of $100 for a premium of $5. If the stock price rises to $110 at expiration, you can sell the option for $10 or exercise it, buying the stock for $100 and immediately selling it for $110, netting a profit of $5 (aside from commissions).

For Put Options:

- Conversely, with put options, profit is earned if the underlying asset’s price falls below the strike price. The profit calculation follows the same formula, but the result is reversed.

- Suppose you purchase a put option with a strike price of $100 for a premium of $5. If the stock price drops to $90 at expiration, you can sell the option for $10 or exercise it, selling the stock for $100 and immediately buying it back for $90, netting a profit of $5 (excluding commissions).

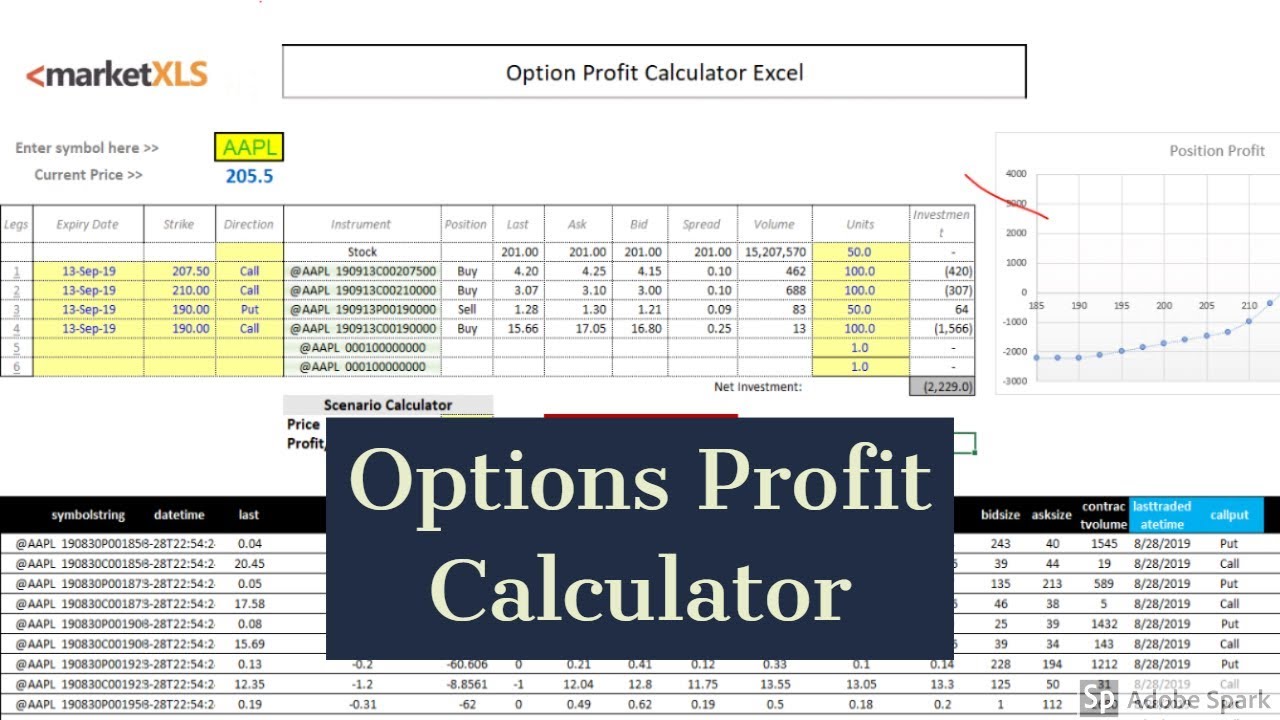

Image: www.youtube.com

Factors Influencing Profit

The profitability of an options trade is influenced by a multitude of factors, including:

- Volatility: The greater the volatility of the underlying asset, the higher the potential for profit.

- Time to expiration: The more extended the time until expiration, the greater the possibility of the option’s value increasing.

- Interest rates: Options pricing considers the prevailing interest rates, which can impact the premium’s value.

- Supply and demand: Market forces, such as supply and demand, can also influence option prices.

Expert Insights and Actionable Tips

To maximize your success in options trading, consider these insights from industry experts:

- “The key to profitable options trading lies in understanding the delicate balance between risk and reward.” – Mark Douglas, renowned trading coach

- “Choose options with ample time to expiration to allow for unexpected market movements.” – Nassim Nicholas Taleb, author of “The Black Swan”

- “Always conduct thorough research before entering any options trade, considering the underlying asset, market conditions, and your financial goals.” – Warren Buffett, renowned investor

How Profit Is Calculated In Options Trading

Conclusion

Understanding how profit is calculated in options trading is indispensable for making informed decisions and achieving success in this dynamic market. By embracing a holistic approach, taking into account the intricate factors at play, and implementing expert strategies, you can unlock the transformative potential of options trading. Remember, profit is not guaranteed, but with the right knowledge and execution, you can increase your odds of financial triumph.