Delving into the Dynamics of Option Trading Profits

The world of option trading offers immense potential for financial gain, but calculating profits can be a complex endeavor. Options, as financial instruments, provide the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Understanding how to calculate profits in this dynamic market is crucial for success.

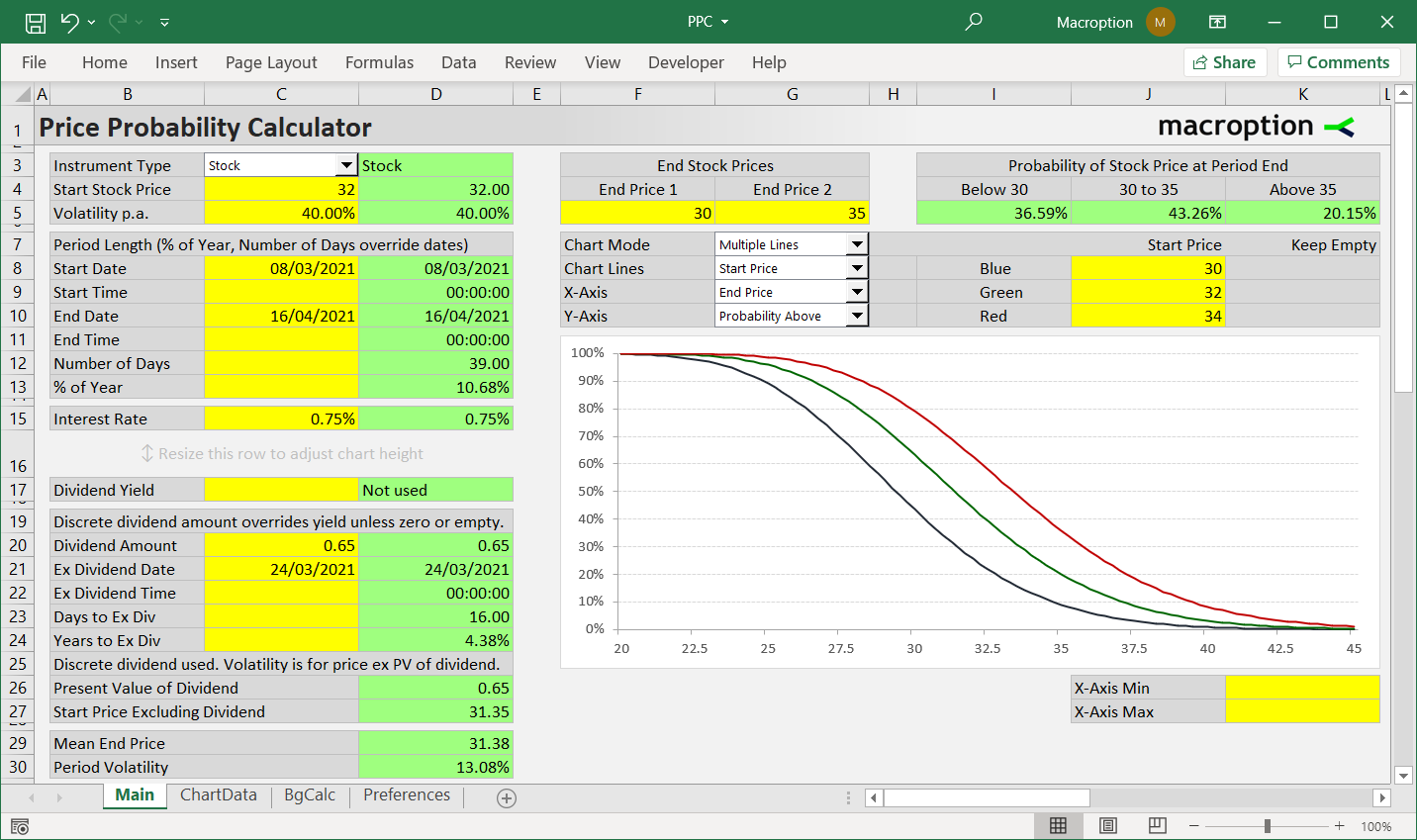

Image: aneeqaisling.blogspot.com

Understanding the Nuances of Profit Calculation

Calculating profits in option trading involves factoring in several key variables. The intrinsic value of the option determines its value based on the difference between the strike price and the current market price of the underlying asset. Extrinsic value, on the other hand, reflects the premium paid for the option’s time value and volatility.

Profitability in option trading hinges on accurate estimation of the option’s premium value. This value represents the amount paid to acquire the right to exercise the option contract. To calculate the premium, consider the option’s strike price, expiration date, type (call or put), and implied volatility.

Factors Influencing Profit Margins

A myriad of factors shape profit margins in option trading. Volatility, a measure of price fluctuations, plays a pivotal role. Higher volatility tends to translate into higher option premiums, increasing potential profits. Market conditions, such as macroeconomic trends and geopolitical events, also have significant bearings on option prices and profitability.

Time decay is another crucial factor to consider. As the option’s expiration date approaches, the extrinsic value gradually diminishes, potentially eroding potential profits. Consequently, traders must time their option trades strategically to capture maximum benefit from time value.

Maximizing Profits through Strategic Trading

To enhance profitability in option trading, employ these expert tips:

-

Embrace Delta Hedging: Offset potential risks by employing delta hedging techniques, mitigating fluctuations in the underlying asset’s price.

-

Leverage Vertical Spreads: Construct vertical spread strategies, combining call and put options with varying strike prices, to limit profit potential but reduce risk exposure.

-

Monitor Volatility: Stay attuned to volatility trends and adjust trading strategies accordingly. Higher volatility typically favors options with longer time to expiration, while lower volatility benefits nearer-term options.

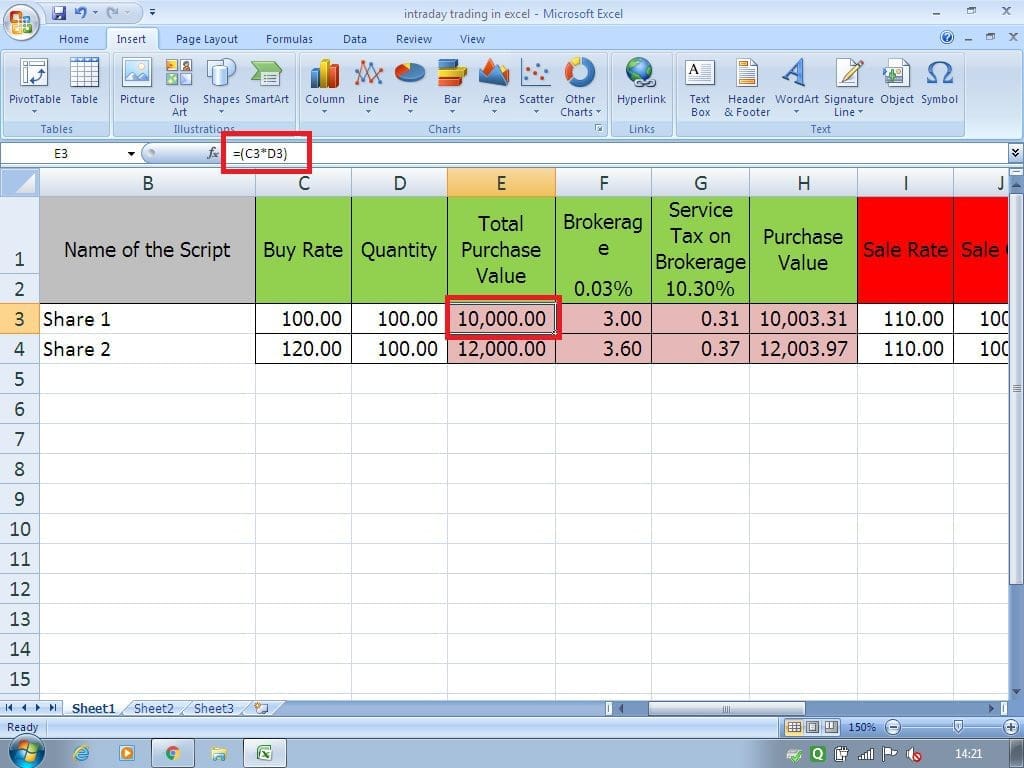

Image: www.stockmaniacs.net

Common FAQs on Option Trading Profit Calculation

-

Q: How is profit calculated in the case of a call option?

-

A: Profit is determined by subtracting the premium paid from the difference between the strike price and the underlying asset’s selling price.

-

Q: What is the impact of expiration date on option profitability?

-

A: As the expiration date approaches, time decay accelerates, eroding the extrinsic value of the option and potentially reducing potential profits.

Option Trading Profit Calculation

Conclusion

Delving into the intricacies of option trading profit calculation empowers traders with the knowledge to navigate this dynamic market effectively. By understanding the underlying principles, embracing strategic techniques, and factoring in key variables, traders can maximize their profit potential, transform risk into opportunity, and forge a successful path in the world of options.

Are you ready to embrace the world of option trading? Let this comprehensive guide serve as your compass, unlocking the potential for financial success.