Introduction:

In the ever-evolving world of finance, options trading has emerged as a powerful tool that empowers investors to hedge risks and potentially amplify returns. Among the plethora of investment opportunities, Nio options trading stands out as an intriguing proposition that demands attention.

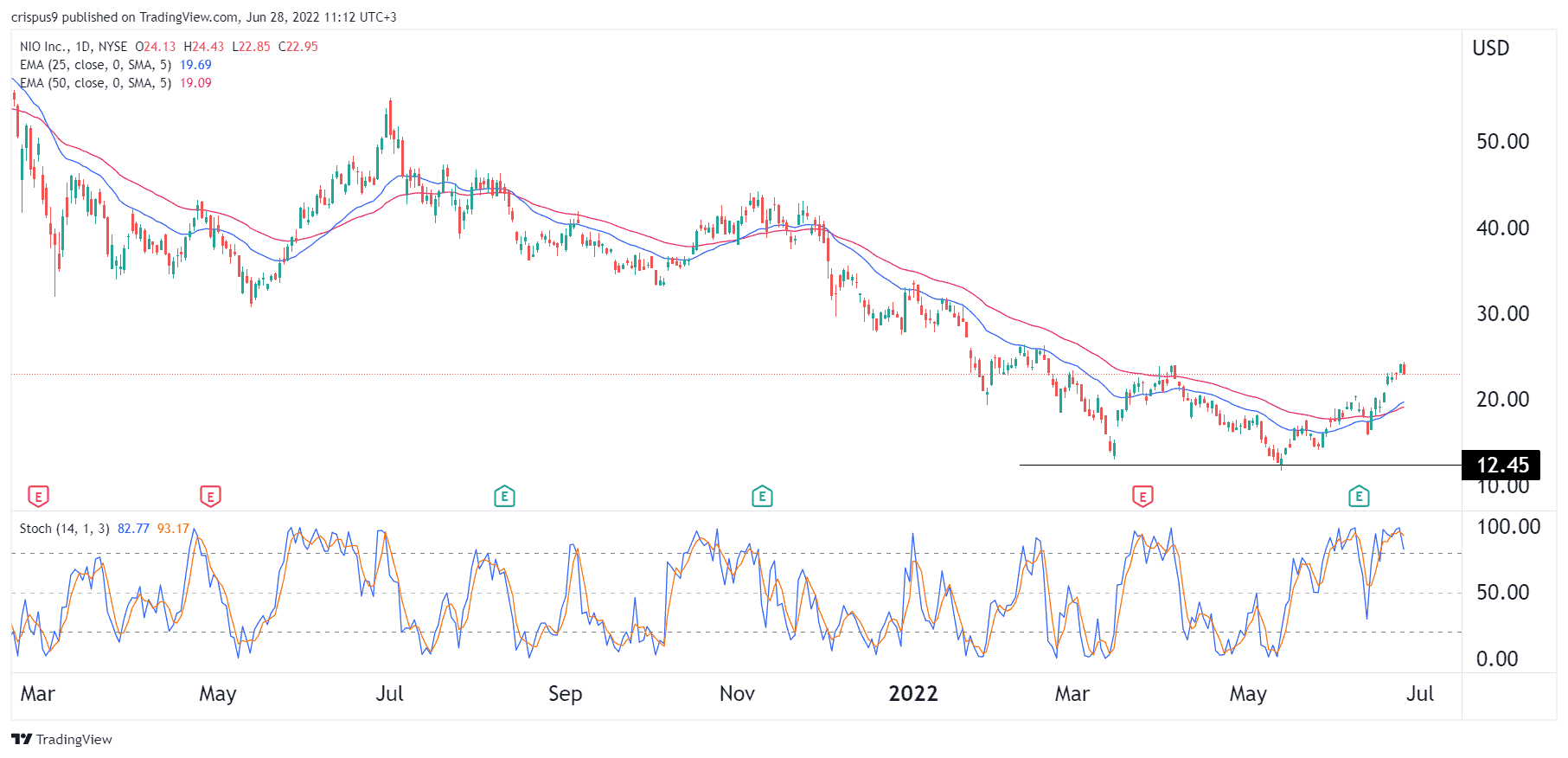

Image: www.tradingview.com

Nio, a Chinese electric vehicle manufacturer, has captured the imagination of investors globally due to its impressive growth trajectory and ambitious expansion plans. With a significant presence in the world’s largest automotive market, Nio offers a unique opportunity for investors seeking exposure to the burgeoning electric vehicle sector. By leveraging Nio options, traders can harness the power of this rising star while mitigating potential risks.

Delving into Nio Options:

Basics of Options Trading:

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset (in this case, Nio shares) at a predetermined price within a specified time frame. There are two main types of options: calls and puts.

Understanding Calls and Puts:

Call options confer the right to buy Nio shares at a specified strike price on or before the expiration date. Traders purchase call options when they anticipate a rise in Nio’s stock value. Put options, on the other hand, provide the right to sell Nio shares at a specified strike price. Put options are typically purchased when traders expect a decline in the stock’s value.

Image: www.thestreet.com

Key Features of Nio Options:

- Expiration date: Options contracts have a specific expiration date, beyond which they become worthless.

- Strike price: This is the predetermined price at which the trader can buy or sell Nio shares.

- Premium: The price paid to acquire an options contract.

Strategic Applications of Nio Options:

Hedging Risk:

Options can be used as a defensive strategy to protect existing Nio stock positions from potential losses. By purchasing put options, traders can offset the downside risk associated with market downturns or specific company-related events.

Leverage Gains:

Options offer leverage, allowing traders to control a significant number of Nio shares with a relatively small investment. This magnification effect can amplify potential profits but also magnify potential losses.

Speculating on Market Trends:

Traders can use options to speculate on future market trends related to Nio. By purchasing call options, traders can bet on a rise in the stock price, while put options enable speculation on a price decline.

Insights and Trends in Nio Options Trading:

The Nio options market has witnessed significant activity as investors seek to capitalize on the company’s growth prospects. Historically, Nio options have been characterized by moderate volatility, offering opportunities for both conservative and aggressive traders.

Recent trends indicate an increase in call option volume, suggesting that traders are optimistic about Nio’s future performance. However, it is crucial to exercise caution and conduct thorough research before making any trading decisions.

Nio Options Trading

Image: www.investingcube.com

Conclusion:

Nio options trading presents a versatile tool for investors to manage risk, leverage gains, and speculate on market trends. Understanding the basics of options, strategic applications, and market insights is essential for navigating this dynamic trading landscape. By embracing a prudent approach and conducting thorough due diligence, traders can harness the potential of Nio options while minimizing risks.

Disclaimer: This article serves as a general guide and should not be construed as financial advice. Options trading involves inherent risks and is not suitable for all investors. Prior to engaging in options trading, investors should consult with a qualified financial advisor to assess their risk tolerance and investment goals.