Introduction

Options trading presents an intriguing yet potentially lucrative opportunity, yet many traders grapple with calculating their profits. Options contracts inherently involve complexity, so understanding the dynamics of profit calculation is crucial. Join us on a journey to demystify the intricacies of options profit calculation, unlocking the empowering knowledge to navigate this market effectively.

Image: haipernews.com

Defining Options and Their Profit Potential

Options contracts convey the right, not the obligation, to buy or sell an underlying asset at a predetermined price and expiration date. Call options grant the right to acquire, while put options offer the right to relinquish the asset. The intrinsic value of an option contract represents the profit that would be realized if it were exercised at the present moment.

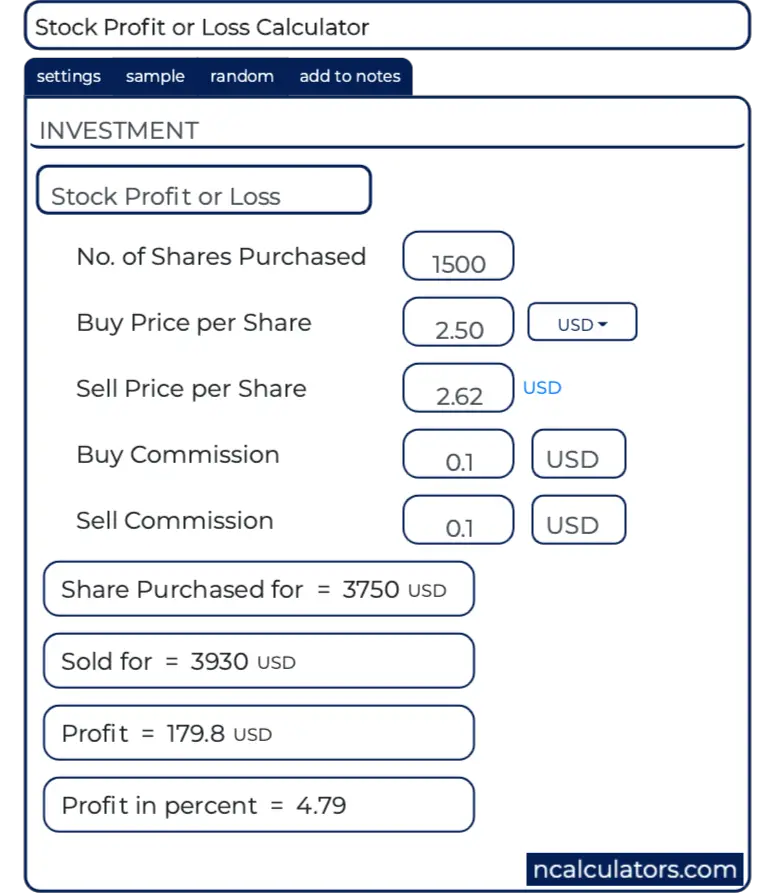

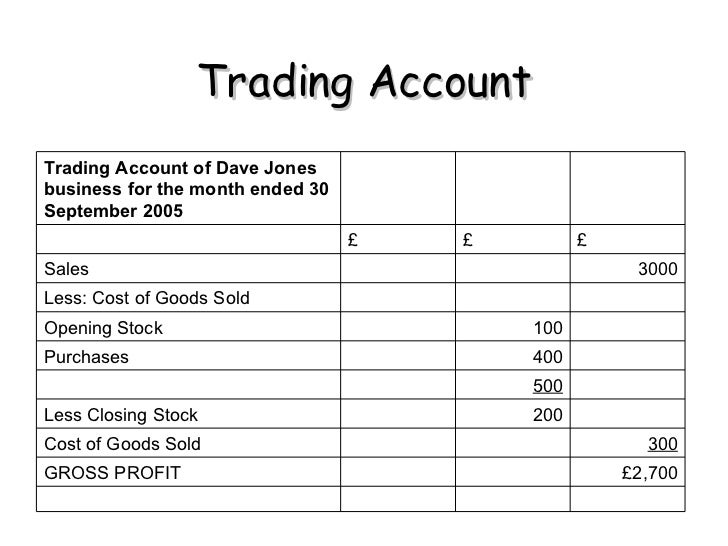

Calculating Profit in Options Trading

-

Intrinsic Value (ITM): When an option’s strike price is equal to or higher than (for call options) or equal to or lower than (for put options) the underlying asset’s current market value, the option is regarded as “in the money” (ITM). ITM options possess intrinsic value, calculated by subtracting the strike price from the current market value of the underlying asset. The maximum profit achievable from an ITM option contract is capped at its inherent worth.

-

Time Value (OTM): “Out of the money” (OTM) options are characterized by a strike price that deviates significantly from the underlying asset’s market value. While OTM options do not hold immediate intrinsic value, they retain time value, which diminishes gradually until expiration. Time value reflects the premium paid for the choice to exercise or not to exercise the option in the future.

-

Total Profit: The combined intrinsic and time values constitute the total profit of an option contract. When the total profit is positive, the trader stands to reap profits from the option trade.

Latest Trends and Developments in Options Trading

-

Algorithmic Trading: Artificial intelligence and machine learning algorithms are increasingly employed to automate options trading, fostering speed, efficiency, and optimal execution.

-

Exchange-Traded Funds (ETFs): The emergence of ETFs tracking options indices offers investors diversified exposure to the options market, mitigating risks while pursuing returns.

Image: www.schwab.com

Expert Advice for Profitable Options Trading

-

Define Goals and Risk Tolerance: Before venturing into options trading, it is imperative to establish clear financial goals and assess risk tolerance. This self-assessment helps determine suitable strategies and positions for achieving financial aspirations while managing risk.

-

Educate Yourself Continuously: Options trading demands a deep understanding of intricacies. Ongoing education through webinars, seminars, and reading industry publications ensures traders remain abreast of evolving market dynamics, maximizing their profit potential.

FAQ on Options Profit Calculation

-

Q: How do I calculate the profit of an ITM option?

A: Intrinsic Value = Current Market Value of Underlying Asset – Strike Price. -

Q: Is it possible to profit from an OTM option?

A: Yes, if the underlying asset’s price fluctuates favorably before expiration, the time value of the OTM option can appreciate, resulting in potential profit.

How To Calculate Profit In Trading Options

Image: yzypohu.web.fc2.com

Conclusion

Grasping the intricacies of profit calculation in options trading empowers individuals to make informed decisions, increasing their chances of success in this dynamic market. While we endeavored to present a comprehensive guide in this article, the topic’s boundless depth invites further exploration. Engage with discussion forums, consult reputable trading resources, and continually seek knowledge to enhance your understanding and sharpen your skills as an options trader. Let the journey of options trading be one of calculated risk, informed decisions, and profitable outcomes.

Are you ready to embark on the exciting journey of options trading? Let us know in the comments below!