Introduction

In the labyrinthine world of financial markets, options trading emerges as a complex yet potentially lucrative domain. Amidst a multitude of strategies, uncovered options trading stands out as a bold and often misunderstood technique. Understanding the essence of uncovered options trading and its implications is paramount for discerning investors seeking to harness its power. This comprehensive guide will unravel the intricacies of uncovered options strategies, empowering you with the knowledge to navigate the markets with confidence.

Image: www.warriortrading.com

Delving into Uncovered Options Trading

Fundamentally, uncovered options trading involves selling or writing an option contract without owning or controlling the underlying asset. This unique characteristic differentiates it from covered options strategies, where the underlying asset is owned by the trader executing the option. Engaging in uncovered options trading requires a higher level of risk tolerance and a thorough comprehension of both the potential rewards and perils associated with such a strategy.

Unveiling the Types of Uncovered Options Strategies

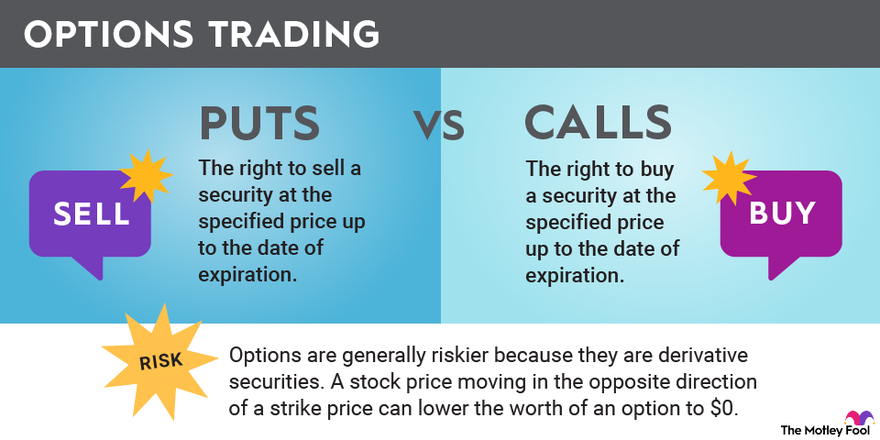

Within the realm of uncovered options trading, two primary strategies emerge: uncovered calls and uncovered puts. Uncovered call strategies involve selling call options, granting the buyer the right to purchase the underlying asset at a specified price on or before a designated date. Conversely, uncovered put strategies entail selling put options, providing the buyer with the right to sell the underlying asset under similar conditions.

Navigating the Pros and Cons

As with any financial strategy, uncovered options trading carries its inherent advantages and drawbacks. Embracing its merits, uncovered options strategies offer traders the potential to generate substantial income through premiums collected from selling options contracts. Moreover, the technique allows for flexible risk management, enabling traders to tailor their strategies to varying market conditions.

However, the path to uncovered options trading is not without its perils. Elevated risk remains an intrinsic aspect of these strategies, as traders bear the obligation to fulfill the contract if exercised by the buyer. Significant losses can accumulate if the underlying asset’s price moves against the trader’s position.

Image: www.fool.com

Mastering the Art of Uncovered Options Trading

Successfully navigating the intricacies of uncovered options trading requires a prudent approach and a keen understanding of market dynamics. Aspiring traders should meticulously research potential underlying assets, assess market trends, and develop robust risk management strategies. Seeking professional guidance from experienced brokers or mentors can prove invaluable in refining one’s skills and minimizing potential pitfalls.

What Is Uncovered Option Trading

Image: financewikki.com

Conclusion

Uncovered options trading presents a bold and potentially rewarding avenue for investors seeking to harness the power of options contracts. By embracing the knowledge shared within this comprehensive guide, you embark on a journey to unravel the secrets of uncovered options strategies. Remember, venturing into uncovered options trading demands a discerning eye, risk tolerance, and an unwavering commitment to continuous learning. Armed with this newfound understanding, you possess the tools to navigate the financial markets with heightened confidence and the potential to reap bountiful rewards.