In the dynamic world of investing, options trading stands as a powerful tool for savvy investors seeking to navigate market volatility, generate income, and potentially maximize returns. While the allure of options trading is undeniable, understanding the concept of expected returns is crucial for making informed decisions and achieving long-term success.

Image: www.mystockodds.com

What are Options and Expected Returns?

Options contracts provide investors with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. The expected return of an options contract represents the potential profit or loss an investor can anticipate from trading that contract over its lifetime. Expected returns are influenced by a plethora of factors, including the underlying asset’s price, strike price, expiration date, volatility, and interest rates.

Understanding Expected Returns in Options Trading

Determining the expected return for an options contract involves utilizing mathematical models that take into account the aforementioned factors. Advanced statistical techniques, such as the Black-Scholes model, provide investors with a baseline estimate of an option’s expected return. However, it’s important to note that these models rely on assumptions that may not always hold true in the real world.

The expected return for an options contract can be positive or negative, depending on whether the option’s value increases or decreases over its lifetime. A positive expected return indicates the potential for profit, while a negative expected return suggests a potential loss.

Factors Influencing Options Expected Returns

A comprehensive understanding of the factors that influence options expected returns is paramount for successful trading.

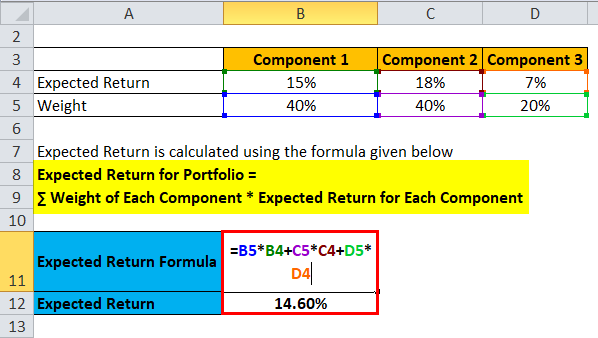

Image: www.educba.com

1. Underlying Asset Price:

The underlying asset’s price is a critical determinant of options expected returns. Options with the right to buy (call options) will have a higher expected return if the underlying asset price increases. Conversely, options with the right to sell (put options) will have a higher expected return if the underlying asset price decreases.

2. Strike Price:

The strike price is the price at which the underlying asset can be bought or sold using the option. Options with higher strike prices typically have lower expected returns compared to those with lower strike prices, as the former requires the underlying asset’s price to move further in order to generate profit.

3. Expiration Date:

The expiration date dictates the timeframe within which the option can be exercised. Options with longer expirations generally have higher expected returns, as there is a greater likelihood for the underlying asset’s price to change significantly over a longer period.

4. Volatility:

Volatility measures the extent of price fluctuations in the underlying asset. Higher volatility favors short-term trading strategies, as options with shorter expirations benefit from rapid price movements.

5. Interest Rates:

Interest rates can impact the expected returns of options that are considered interest rate sensitive, such as those involving bonds. Higher interest rates can have a negative effect on the expected return of long-term options.

Expert Insights: Maximizing Expected Returns

Seasoned options traders offer valuable insights for maximizing expected returns:

-

Thorough Research and Strategy: Conduct extensive research on the underlying asset and key market factors to develop a trading strategy that aligns with your risk tolerance and financial goals.

-

Scenario Analysis: Use analytical tools to evaluate multiple market scenarios and assess the potential impact on options expected returns before making a trade.

-

Risk Management: Implement sound risk management techniques, such as setting stop-loss orders and managing overall portfolio risk, to minimize potential losses.

Options Trading Expected Returns

Image: www.youtube.com

Conclusion: Unleashing Options Trading Potential

Options trading offers a powerful means for investors to navigate market volatility and potentially achieve significant returns. Understanding expected returns is crucial for successful trading, as it provides valuable insights into the potential profit or loss an investor can anticipate from an options contract. By carefully considering the factors that influence expected returns and incorporating expert advice, investors can devise informed trading strategies that maximize their chances of profitability in the dynamic world of options trading. Remember, the pursuit of financial success through options requires a diligent approach, ongoing learning, and responsible risk management. Embrace the challenges and opportunities of options trading, and unlock the potential for market domination.