In the fast-paced realm of financial markets, option trading stands out as a double-edged sword—a path to potential riches or an avenue for substantial losses. Embarking on this perilous journey requires an unwavering understanding of expected returns, a crucial metric that serves as a guiding light amidst the uncertainties that lie ahead.

Image: www.youtube.com

Navigating the Maze of Option Trading

Options, financial instruments imbued with the power of anticipation, grant the buyer the privilege but not the obligation to buy or sell an underlying asset at a predetermined price on a specified date. This captivating world beckons the curious souls seeking lucrative returns, yet it also harbors hidden pitfalls for the unwary.

Stepping into this intricate domain, traders encounter a myriad of option strategies, each crafted to accommodate distinct risk appetites and profit horizons. Some seek refuge in the conservative realms of covered calls, where premiums provide a steady stream of income. Others, driven by an unyielding thirst for adrenaline, wander into the treacherous trails of naked puts, where the stakes are higher, but so too are the potential rewards.

Deciphering Expected Returns: A Gateway to Informed Decisions

Amidst the clamor of option trading, expected returns serve as an indispensable tool, enabling traders to discern the likelihood of achieving profitable outcomes. This crucial metric paints a vivid picture of potential profits, guiding investors as they navigate the volatile seas of financial markets.

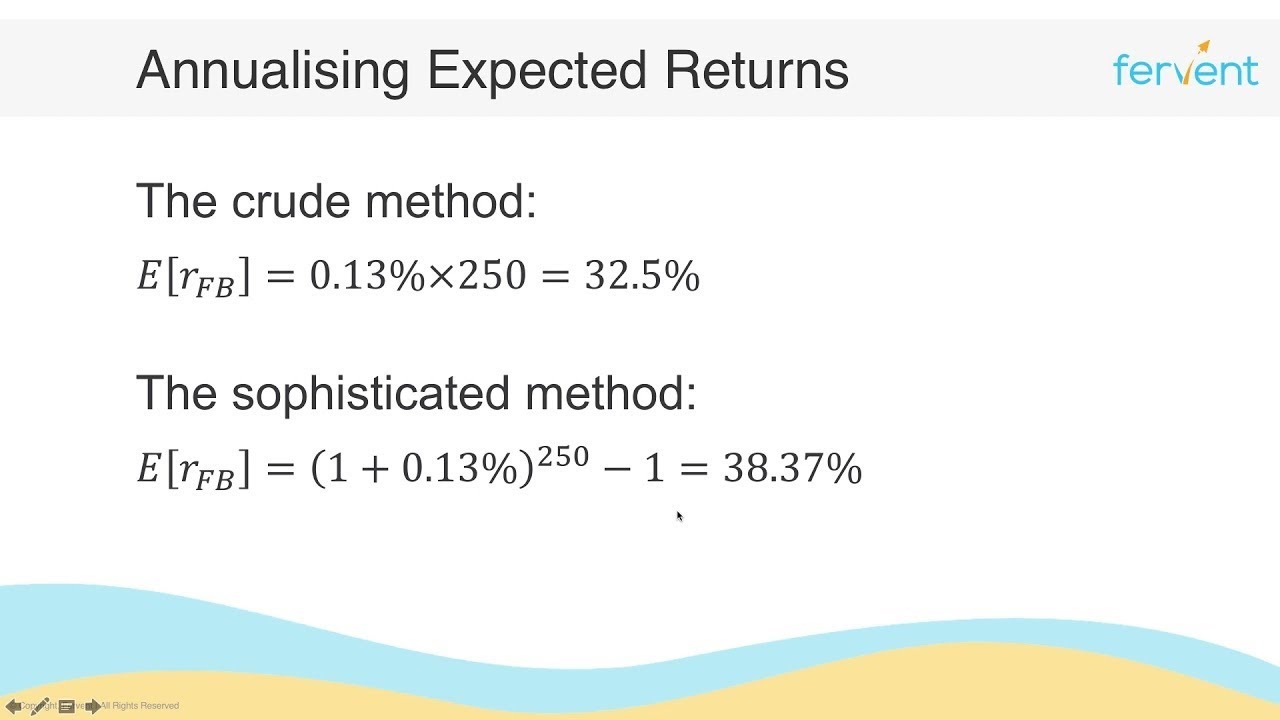

Expected returns, calculated by factoring in a tapestry of intricate mathematical formulas and historical data, provide a glimpse into the anticipated trajectory of option contracts. They offer invaluable insights, empowering traders to make informed decisions, whether it be entering a tantalizing trade or steering clear of a precarious path.

Harnessing Expert Insights and Actionable Tips

Along this exhilarating odyssey, traders are well-advised to seek the wisdom of seasoned experts, who have weathered the storms and emerged victorious. These financial navigators impart invaluable lessons, guiding traders toward profitable shores and steering them away from treacherous shoals.

-

Robert Whaley, an eminent professor of finance at Vanderbilt University, emphasizes the significance of understanding option pricing models. Recognizing that these models are not foolproof but can serve as valuable tools, he advises traders to treat them with a healthy dose of skepticism.

-

Mark Rubinstein, a renowned finance expert, echoes the importance of diversification. He reminds traders that not all options are created equal, cautioning against concentrating investments in a single contract or strategy.

By assimilating these expert insights and embracing practical tips, traders can forge a path toward achieving their financial aspirations.

Image: top10stockbroker.com

Option Trading Expected Return

Image: fr.cs-finance.com

Conclusion: Embracing Expected Returns for Triumphant Trades

The allure of option trading lies in its potential for substantial returns, but venturing into this realm requires a deep understanding of expected returns. By grasping the intricacies of this crucial metric and leveraging the guidance of experienced professionals, traders can astutely navigate the complexities of option trading, unlocking the doors to potential profits.

As you embark on this exhilarating journey, remember that the path to financial triumph is paved with knowledge, prudent decision-making, and an unwavering belief in your abilities. Embrace the power of expected returns and conquer the challenges that lie ahead. The rewards that await you at the end of this extraordinary odyssey are well worth the effort and dedication you invest today.