Introduction

Embarking on the journey of options trading may seem daunting, especially for those with limited capital. Traditionally, options trading has been accessible only to traders with substantial minimum account balances. However, the advent of no minimum firm accounts has democratized options trading, making it feasible for individuals of all investment levels to engage in this lucrative market.

Image: www.cpnmestadio3.com

Options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset at a predetermined price, offer immense potential for returns. Understanding the intricacies of options trading can empower investors to navigate market volatility and capitalize on opportunities.

Understanding Options Basics

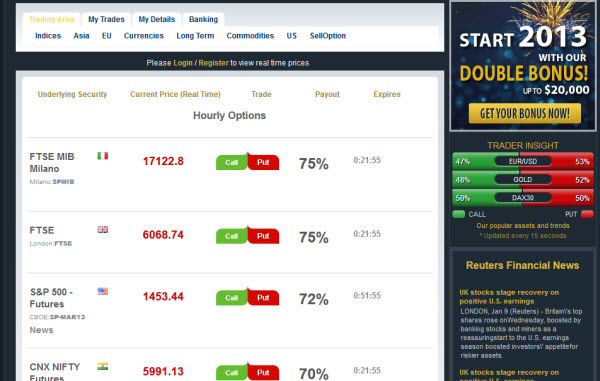

Options fall under two primary categories: calls and puts. Call options grant the buyer the right to purchase an underlying asset, such as a stock or index, at a certain price known as the strike price. Put options, on the other hand, confer the right to sell an underlying asset at the strike price.

When an investor believes the underlying asset will increase in value, they purchase a call option. Conversely, when they anticipate a decline, they acquire a put option. The value of an option depends on several factors, including the underlying asset’s price, strike price, time to expiration, and market volatility.

Advantages of Trading Options with No Minimum Account

Trading options with no minimum firm account eliminates the barrier of entry for aspiring options traders. This allows individuals to start with a small investment and gradually increase their capital as they gain experience and confidence.

Moreover, no minimum account firms typically offer low trading commissions and flexible account features. This cost efficiency enables investors to maximize their returns and focus on their trading strategies rather than excessive transaction costs.

Selecting a No Minimum Firm Account Broker

Choosing the right broker for options trading is crucial. Consider factors such as regulatory compliance, trading platform functionality, trading fees, and customer support. Look for brokers that offer educational resources and provide dedicated support for beginner options traders.

Research and compare different brokers to find the one that best aligns with your trading needs and risk tolerance. It’s also essential to check the firm’s financial stability and track record.

Image: www.youtube.com

Trading Strategies with Limited Capital

Trading options with limited capital requires a well-defined strategy. Focus on understanding the underlying assets you’re trading and study historical trends. Option chains can provide valuable insights into potential trade opportunities.

Consider spread trading, a strategy that involves buying and selling options with different strike prices or expiration dates. Spreads can limit risk and increase the probability of profit. Vertical spreads are particularly suitable for traders with limited capital.

Managing Risk and Limiting Losses

Risk management is paramount in options trading. Always consider the worst-case scenario and the maximum amount you’re willing to lose on any trade. Determine the profit targets and stop-loss levels in advance for each position.

Monitor your portfolio regularly and adjust your positions as needed based on market conditions. Avoid emotional trading and stick to your trading plan to minimize losses and protect your capital.

Options Trading With No Minimun Fir Account

Image: binaryoptionstv.wordpress.com

Conclusion

Options trading with no minimum firm account opens up the world of derivatives to a broader spectrum of investors. By embracing the fundamentals of options and employing effective strategies, individuals can harness the potential of options to enhance their financial returns and achieve their investment goals. Remember to prioritize risk management, conduct thorough research, and consult reputable sources for continuous learning and improvement.