Introduction:

Image: www.linkedin.com

In the realm of financial markets, where fortunes are made and lost, the allure of event-driven option trading has captivated investors seeking exceptional returns. These sophisticated investment strategies leverage the power of options to capitalize on price fluctuations driven by upcoming events that can significantly impact stock prices. This comprehensive guide delves into the intricacies of event-driven option trading, empowering readers to harness its potential for financial success.

Event-Driven Options: A Tactical Approach

Event-driven options refer to strategies that revolve around anticipated events such as earnings announcements, mergers and acquisitions, FDA approvals, and economic data releases. By meticulously studying the potential impact of these events and analyzing historical data, traders can develop options positions that aim to generate maximum profit. These strategies harness the volatility associated with key events, offering the opportunity for outsized returns.

Unveiling the Mechanics of Event-Driven Trading

A cornerstone of event-driven option trading involves carefully selecting the appropriate options contracts. Traders must consider factors such as strike price, expiration date, and implied volatility to construct positions that align with their risk tolerance and return expectations. The strategies can range from conservative trades that seek modest gains to speculative maneuvers with potentially greater rewards and risks.

Historical Earnings Performance: A Vital Metric

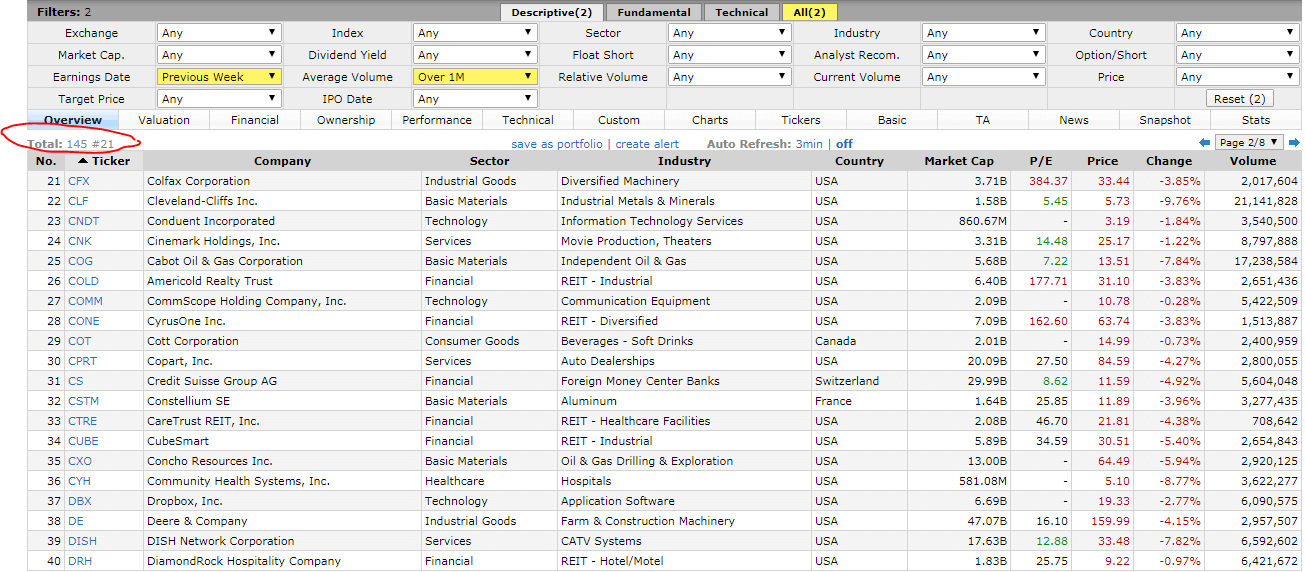

Earnings announcements are pivotal events that can dramatically influence stock prices. Traders analyze a company’s previous earnings reports, paying close attention to the extent to which it has exceeded or fallen short of analyst consensus estimates. By identifying patterns in a company’s earnings volatility, traders can make informed decisions about options positions that capitalize on potential price movements.

Mergers and Acquisitions: Unlocking Strategic Value

When companies merge or acquire others, the resulting stock price movements can present lucrative opportunities for savvy traders. Traders assess the strategic rationale behind the deal, the combined company’s growth prospects, and potential regulatory hurdles. By identifying stocks that could witness substantial price swings, traders can position themselves to capitalize on post-announcement volatility.

Biotech Events: A Crucible of Innovation

The success or failure of key events in the biotechnology sector can have a profound impact on stock prices. Traders pay close attention to clinical trial results, FDA approvals, and product launches during high-stakes events. The ability to accurately gauge the market’s reaction to these announcements can unlock significant trading opportunities in the biotech realm.

Macroeconomic News: Shaping Market Trends

The release of economic indicators such as employment data, GDP reports, and interest rate decisions can induce broad market movements. Traders who can effectively anticipate the impact of these events on stock prices can execute options strategies that capture the resulting volatility and market shifts.

Conclusion:

Event-driven option trading offers a potent avenue for traders to generate exceptional returns by leveraging their knowledge of upcoming events and the impact on stock prices. Armed with a comprehensive understanding of the strategies, techniques, and factors involved, investors can unlock the wealth-generating potential of event-driven trading.

Call to Action:

Unleash your trading prowess in the realm of event-driven options. Delve deeper into our curated resources, engage with expert traders, and embark on your journey toward financial success through this captivating and rewarding trading strategy.

Image: tradingstrategyguides.com

Event Driven Option Trading

Image: www.youtube.com