Introduction

In the fast-paced world of corporate finance, managers are constantly seeking ways to maximize their returns while mitigating risks. Options trading has emerged as a popular instrument for corporate managers due to its potential for both hedging and speculative benefits. In this article, we will explore the role of options trading in corporate finance and provide guidance for managers considering incorporating it into their investment strategies.

Image: www.thelookdriebergen.nl

Options Trading in Corporate Finance

Options trading involves the purchase or sale of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. This flexibility allows corporate managers to tailor their risk and reward profiles based on their specific objectives.

Hedging: Mitigating Risk

Corporations often use options to hedge against risks associated with price fluctuations in underlying assets, such as commodities, currencies, or stocks. For example, a company that purchases large quantities of oil may purchase options to sell oil at a fixed price in the future, protecting against potential price declines that could impact their profitability.

Speculation: Seeking Returns

While hedging is a defensive strategy, options trading can also be used speculatively to generate returns. Corporate managers may purchase options with the expectation that the underlying asset will increase in value, giving them the right to sell it at a profit. However, speculative options trading carries a higher degree of risk and should be undertaken with caution.

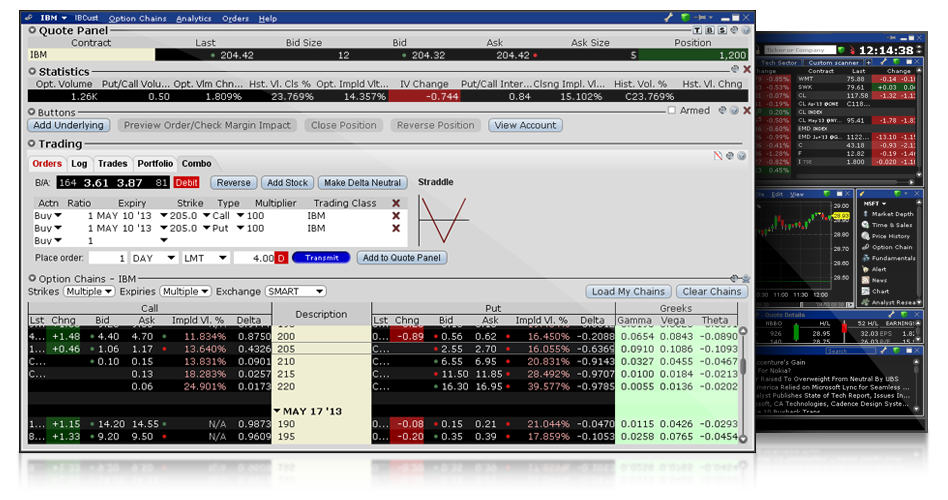

Image: www.interactivebrokers.com.hk

Latest Trends and Developments

The landscape of options trading continues to evolve, with advancements in technology and regulatory changes influencing its practice. Virtual trading platforms and mobile applications have made options trading more accessible for corporate managers, while the growth of exchange-traded funds (ETFs) that track options strategies has simplified investment processes.

Tips and Expert Advice

For corporate managers considering options trading, the following tips can help:

- Understand the risks: Before trading options, it is crucial to fully comprehend the potential risks and rewards involved.

- Seek professional advice: Consult with licensed financial advisors who specialize in options trading to help navigate complex strategies and make informed decisions.

- Start small and gradually increase: Beginners should start with small positions to gain experience and understand the dynamics of options trading before making significant commitments.

FAQ on Options Trading

Q: What is the benefit of using options in corporate finance?

A: Options offer both hedging and speculative benefits, allowing corporate managers to mitigate risks or seek returns based on their objectives.

Q: Is options trading suitable for all corporate managers?

A: No, options trading requires a thorough understanding of financial markets and risk management principles. It is not suitable for all corporate managers.

Do Corporate Managers Look At Options Trading

Image: www.tastylive.com

Conclusion

Options trading can be a valuable tool for corporate managers seeking risk mitigation or return enhancement. By understanding the intricacies of options trading and adhering to sound investment principles, managers can leverage this instrument to make informed decisions and enhance their financial strategies. We encourage you to explore this topic further and consult with financial professionals to determine if options trading is a suitable strategy for your corporate finance goals.