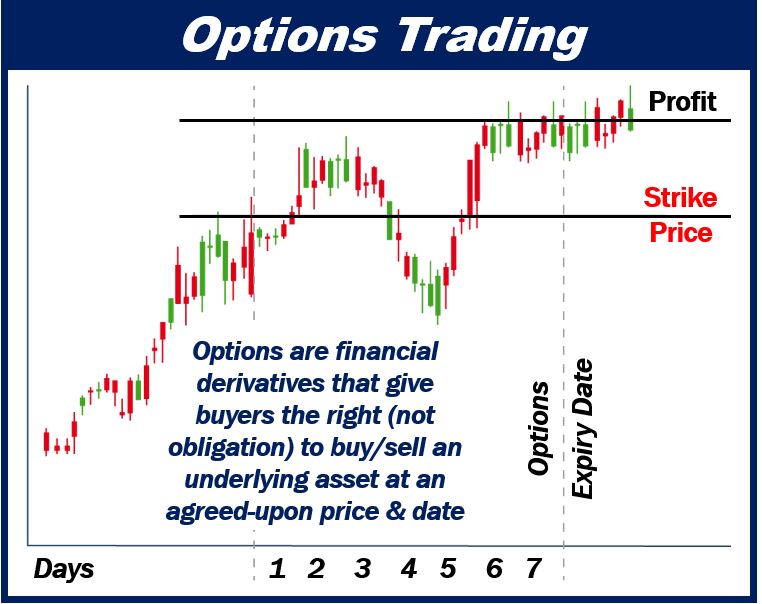

Introduction to News Options Trading

In today’s fast-paced world of financial markets, options trading has emerged as a powerful tool for investors seeking to navigate volatility and harness opportunities. Among the different types of options strategies, news options trading stands out as a unique way to capitalize on the impact of market-moving announcements. This article delves into the world of news options trading, explaining its fundamentals, latest trends, and potential benefits for investors.

Image: marketbusinessnews.com

Understanding News Options Trading

News options trading involves buying or selling options contracts that derive their value from the expected market reaction to upcoming news announcements. These announcements can range from central bank policy updates to corporate earnings reports and high-impact economic data releases. By understanding the potential market impact of such events, traders can position themselves to profit from the subsequent price movements.

Key Concepts in News Options Trading

To navigate the realm of news options trading, it’s essential to grasp some key concepts. Firstly, volatility plays a crucial role. Options premiums are often priced higher when volatility is elevated, as investors anticipate larger price swings after the news announcement. Secondly, time decay is another important factor. As the expiration date approaches, options lose their time value, which can impact profitability. Additionally, understanding the different types of options contracts (i.e., calls and puts) and their payoff structures is essential.

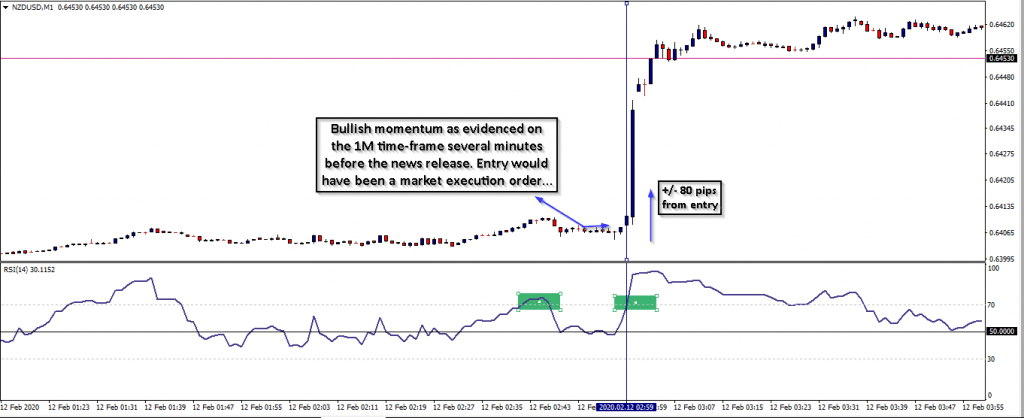

How News Options Trading Works

When an impactful news event is expected, traders analyze the potential market impact and identify the most appropriate options strategy. For instance, if a positive earnings announcement is anticipated, buying a call option (a bet on price increase) may yield profits if the stock price rises after the event. Conversely, if bearish news is expected, a put option (a bet on price decrease) could provide gains if the stock price falls.

Image: forextraders.guide

Recent Developments in News Options Trading

The advent of real-time news feeds and sophisticated trading platforms has revolutionized news options trading. Today’s traders have access to instant market data and advanced tools that enable rapid analysis and execution of trades. Additionally, the rise of mobile trading has made it possible for investors to capitalize on news-driven opportunities from anywhere at any time.

Benefits of News Options Trading

News options trading offers several advantages for investors, including:

- Asymmetric Payoff: Options provide the possibility of limited risk (premium paid) with the potential for unlimited return (profit) if the trade goes in the trader’s favor.

- Volatility Exploitation: News events can induce market volatility, which options traders can harness to generate profits.

- Hedging: Options can be used to protect existing positions against potential adverse price movements due to news announcements.

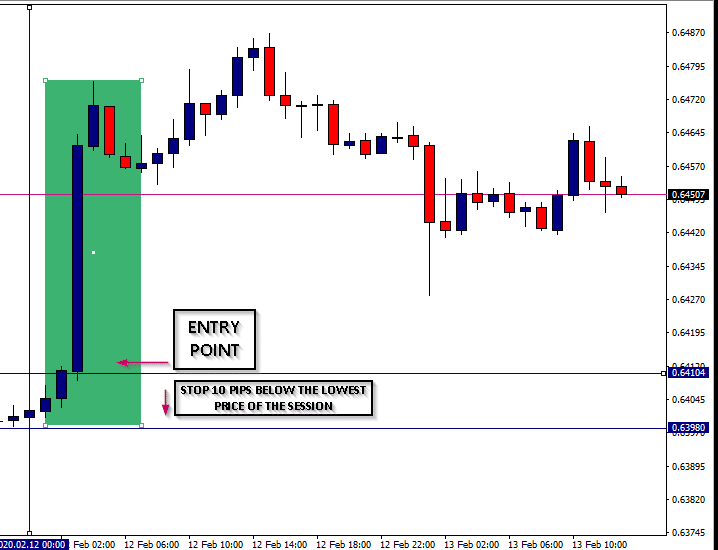

News Options Trading

Image: forextraders.guide

Conclusion

News options trading presents a dynamic and potentially lucrative opportunity for investors who seek to capitalize on market-moving events. By understanding the fundamentals, analyzing market dynamics, and employing appropriate strategies, traders can enhance their returns and mitigate risk. However, it’s essential to approach news options trading with a thorough understanding of the markets and prudent risk management practices to maximize potential benefits.