Trading options can be a complex yet rewarding endeavor, and staying informed about the latest news and developments is crucial for success. This article delves into the world of trading option news, providing insights into its importance, how to find it, and utilizing it to make well-informed decisions.

Image: stockoc.blogspot.com

Why Trading Option News Matters

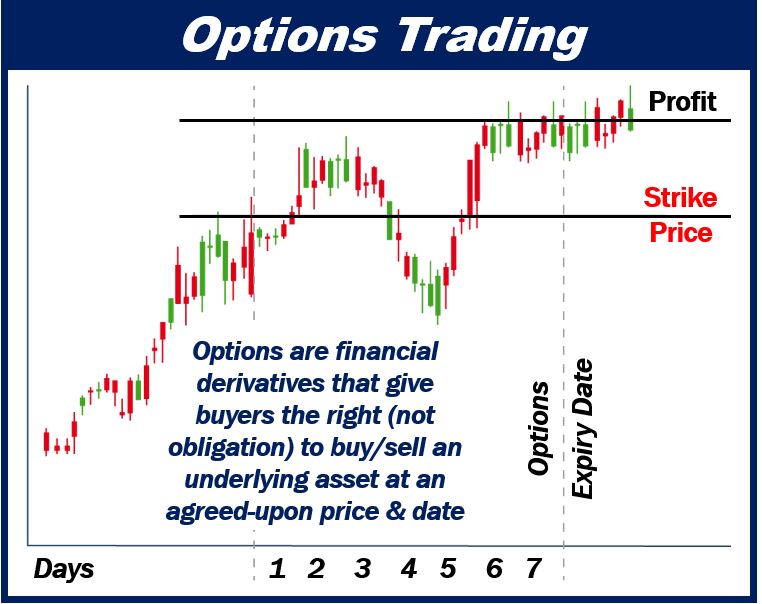

Option trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. These contracts derive their value from various factors, including the underlying asset’s price, the strike price, the time to expiration, and market volatility.

By keeping abreast of trading option news, traders can gain valuable insights into these factors, enabling them to assess market conditions, predict price movements, and make informed decisions. Option news covers a wide range of topics, including upcoming stock splits, mergers and acquisitions, earnings announcements, and economic data releases, all of which can significantly impact option prices.

Sources of Trading Option News

There are numerous sources where traders can find reliable trading option news. Financial news websites, such as Bloomberg, Reuters, and The Wall Street Journal, provide extensive coverage of market news, including option-related events. Specialized news outlets, such as CNBC, Barron’s, and Benzinga, offer in-depth analysis and commentary on option trading.

Social media platforms like Twitter and LinkedIn have become popular channels for disseminating trading option news, with many traders, analysts, and experts sharing their views and insights. However, it is important to be discerning when consuming information from social media, as not all sources are credible.

Analyzing and Utilizing Trading Option News

Once traders have gathered information from various sources, they need to analyze and assess it carefully. Identifying the key points and their potential impact on option prices is crucial. For instance, if a company announces a stock split, the option prices will likely adjust to reflect the reduced share price. Similarly, positive earnings surprises or upbeat economic data can lead to an increase in option premiums.

Traders should consider the timing and relevance of the news when making decisions. News that is released close to the expiration date of an option will have a more immediate impact on its price than news that is several weeks away. Additionally, news that pertains to the underlying asset’s industry or sector is more likely to affect the option’s value than news from unrelated markets.

Image: marketbusinessnews.com

Expert Opinion and Market Sentiment

In addition to analyzing trading option news, traders can also consider expert opinions and market sentiment. Leading analysts and market commentators often provide their insights on option trading strategies and potential market developments. Their views can offer valuable perspectives and help traders make informed choices.

Gauging market sentiment through tools like social media sentiment analysis or volume-weighted average price (VWAP) can also provide insights into the overall market outlook. Positive sentiment and high trading volume typically indicate bullishness, while negative sentiment and low volume often point to bearishness. This information can be used to assess the demand for a particular option and make strategic decisions.

Trading Option News

Image: www.goodbuyreport.com

Conclusion

Trading option news is essential for anyone looking to succeed in the financial market. By staying informed about the latest developments and understanding their impact on option prices, traders can make