Can algorithms predict the direction of financial markets? This captivating question underpins the rise of binary options trading algorithms, promising transformative profits for traders navigating the volatile world of finance. In this comprehensive article, we delve into the enigmatic realm of these trading tools, empowering you with the knowledge to make informed decisions and potentially elevate your trading success.

Image: www.youtube.com

Understanding Binary Options Trading Algorithms

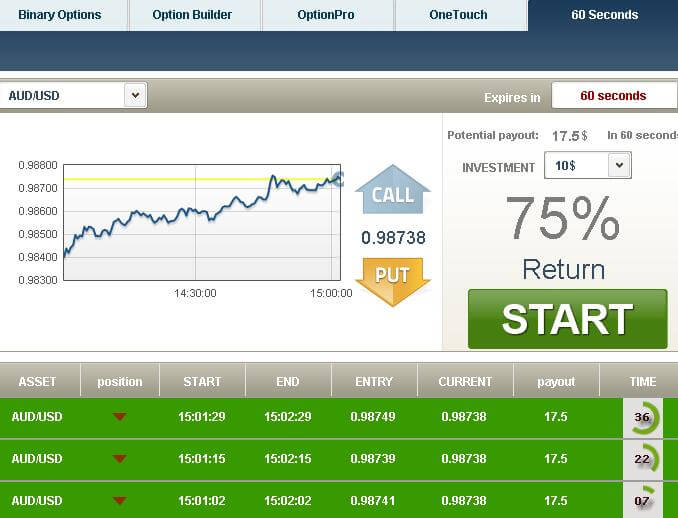

Binary options are a type of derivative instrument that allow traders to speculate on the future price movement of an underlying asset, such as stocks, commodities, or currencies, over a predefined time frame. Unlike traditional options trading, binary options offer a simplified setup where traders predict only whether the underlying asset’s value will rise or fall. This inherent simplicity and potential for high returns make binary options both alluring and challenging.

Enter binary options trading algorithms. These computerized programs use a predetermined set of rules and historical market data to analyze financial markets and forecast future price fluctuations. By leveraging these complex algorithms, traders aim to increase their chances of predicting the correct direction of the underlying asset, ultimately maximizing their profit potential.

The Advent of Sophisticated Trading Algorithms

The genesis of algorithmic binary options trading can be traced back to the advent of high-frequency trading (HFT). These ultra-fast trading strategies, executed by lightning-fast computers, rely on complex mathematical models and statistical analysis to make countless trades within milliseconds. While initially reserved for hedge funds and institutional investors, the advancement of technology has democratized access to sophisticated trading algorithms, empowering retail traders with tools once exclusive to the financial elite.

Untangling the Jargon: Types of Binary Options Trading Algorithms

The world of binary options trading algorithms is a multifaceted tapestry, with each approach tailored to distinct trading styles and risk appetites. Here are some commonly employed algorithm types:

-

Trend Following Algorithms: As their name suggests, these algorithms identify and capitalize on existing trends in the financial markets. They analyze historical price movements and use technical indicators to predict the continuation or reversal of these trends.

-

Breakout Algorithms: These algorithms exploit market volatility by triggering trades when the underlying asset’s price breaks through a predefined resistance or support level. Breakout algorithms attempt to capture sharp price movements and short-term gains.

-

Range-Bound Algorithms: Designed for periods of market consolidation, these algorithms identify trading opportunities within a defined price range. They seek to profit from the fluctuations within this range, aiming for steady returns with reduced risk.

-

Fundamental Analysis Algorithms: These algorithms incorporate fundamental data, such as economic indicators and company earnings reports, into their analysis to determine the intrinsic value of the underlying asset. Fundamental analysis algorithms aim to uncover long-term market trends.

Image: yourincomeadvisor.com

Choosing the Right Algorithm for You

The vast array of binary options trading algorithms can be overwhelming, but understanding your trading style and risk tolerance is crucial for selecting the most suitable option. Consider the following factors:

-

Trading Style: Are you a short-term or long-term trader? Do you prefer trending markets or range-bound conditions? Matching your algorithm to your trading style enhances performance potential.

-

Risk Appetite: Algorithms come with varying levels of risk. Understand your tolerance for risk and select an algorithm that aligns with your financial goals and comfort level.

-

Market Volatility: Not all algorithms perform well in all market conditions. Research how algorithms respond to different levels of volatility before making a choice.

A Note on Reliability and Trustworthiness

While binary options trading algorithms offer alluring profit opportunities, it’s essential to approach their use with caution. The reliability and trustworthiness of an algorithm stem from its underlying data sources, analytical rigor, and backtesting performance. Always scrutinize these factors before employing an algorithm for real-money trading.

Binary Options Trading Algorithms

Image: education.howthemarketworks.com

Journey into Profitable Algorithm-Based Trading

The advent of binary options trading algorithms has introduced a transformative force into the financial arena, empowering traders with sophisticated tools to navigate market complexities. Understanding the concept of binary options and the various types of trading algorithms is paramount to informed decision-making and unlocking profit potential. By aligning your choice of algorithm with your trading style and risk tolerance, you embark on a path toward success in the ever-evolving world of binary options trading.