As an options trader, I’ve often found myself longing for extra time to execute trades after the regular market closes. To my delight, extended-hours trading provides the perfect solution, allowing me to capture additional market opportunities.

Image: streetfins.com

Extended Hours Trading: A Game-Changer

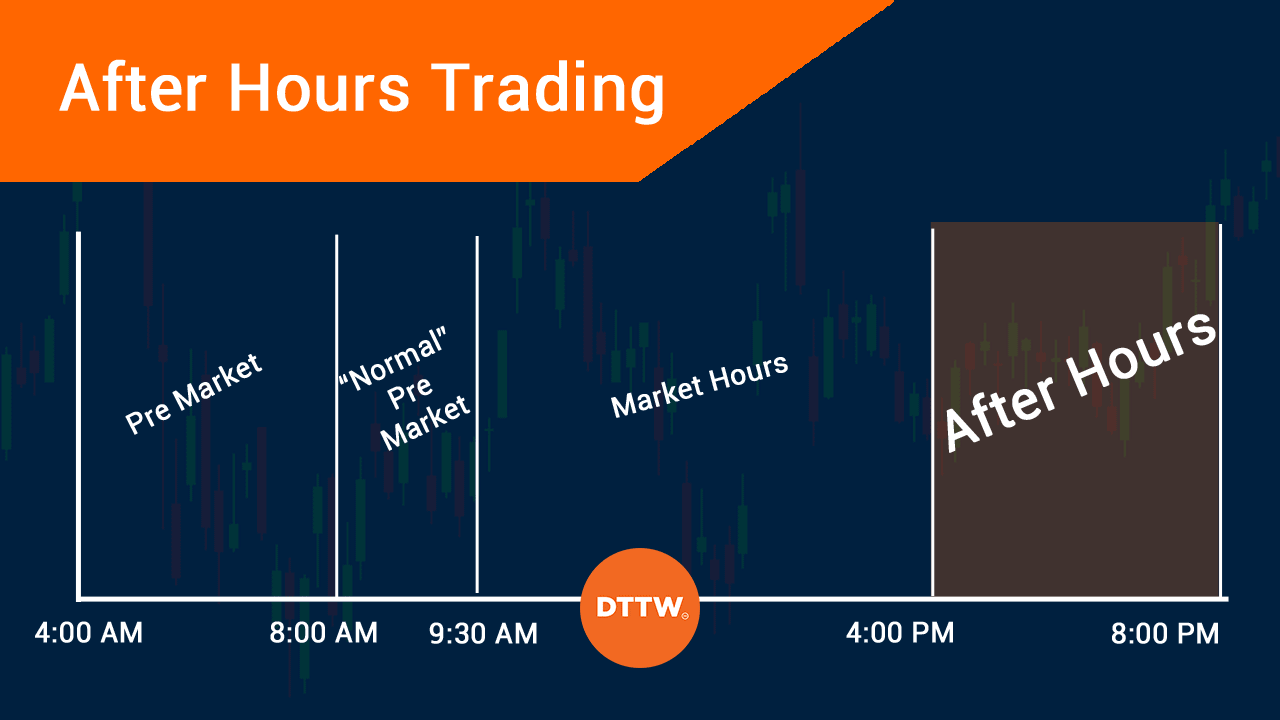

Extended hours trading, also known as pre-market and after-hours trading, extends the trading window beyond the regular market hours. This unique feature enables traders like me to adjust positions, enter new trades, or exit positions after the traditional market hours have ended.

Pre-market trading runs from 8:00 AM to 9:30 AM ET, providing an opportunity to make early trades before the opening bell. On the other hand, after-hours trading takes place from 4:00 PM to 8:00 PM ET, extending the trading window after the regular market closes at 4:00 PM ET.

Benefits of Extended Hours Options Trading

There are several compelling benefits to consider when engaging in options trading during extended hours:

- Enhanced Flexibility: Extended hours trading offers greater flexibility, allowing you to trade when it’s most convenient for you, whether before work, after dinner, or during the weekends.

- Increased Liquidity: While trading volume may be lower during extended hours, the liquidity can still be sufficient for most types of options trades, providing greater flexibility and efficiency.

- Gap Filling and Risk Mitigation: Extended hours trading provides an opportunity to fill gaps in trading, reduce overnight risk, and adjust open positions in response to breaking news or earnings reports.

Tips for Successful Extended Hours Options Trading

To maximize your success when trading options during extended hours, consider implementing the following strategies:

- Research and Understand the Market: Stay informed about market news, upcoming events, and economic indicators that may impact stock prices and options premiums.

- Set Clear Trading Parameters: Define entry and exit points, stop-loss levels, and profit targets before placing any trades during extended hours.

- Manage Risk Wisely: Trade with smaller positions and limit your overall risk exposure during extended hours, as market conditions may be more volatile.

Image: www.daytradetheworld.com

Common FAQs on Extended Hours Options Trading

Q: Is there a difference in the type of options available for trade during extended hours?

A: Most equity options, including call and puts, are tradable during extended hours, but certain options with specific strike prices and expiration dates may not be available.

Q: Are the spreads for options wider during extended hours?

A: Spreads may generally be wider after regular market hours due to lower liquidity. However, spreads may vary depending on the underlying stock, option type, and demand for each specific contract.

Options Trading Extended Hours

Conclusion

Options trading extended hours presents a unique opportunity to capture additional market opportunities and adjust your trading strategies after the regular market closes. By understanding the market conditions, following risk management guidelines, and leveraging extended hours trading, you can increase your chances of success and maximize your potential for profit.

Are you interested in learning more about options trading extended hours? We would love to hear your questions, comments, and experiences in the comment section below.