Introduction

Image: tradebrains.in

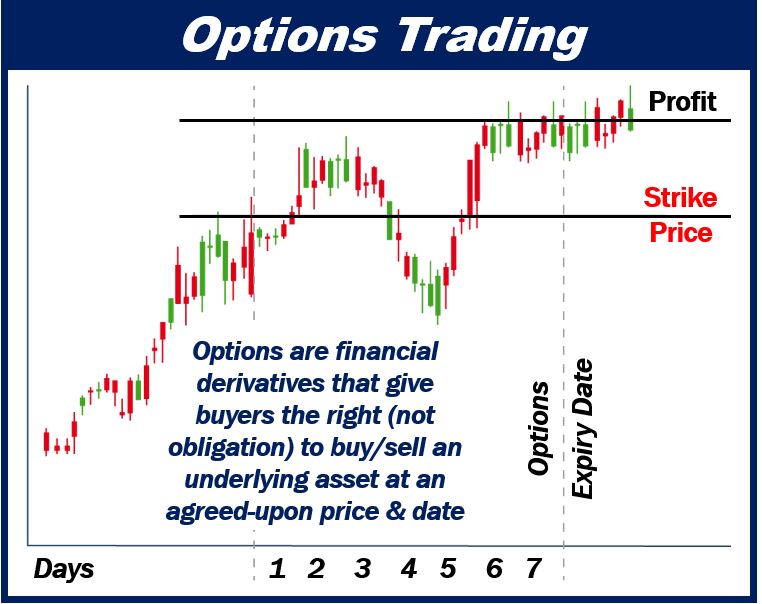

Options trading, with its tantalizing potential for high returns, has captivated investors for decades. These versatile financial instruments bestow upon traders the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price, known as the strike price, before a set deadline, known as the expiration date. Delving into the realm of options trading necessitates a comprehensive understanding of the various types of options and their distinct characteristics.

A Plethora of Options: Classifying Option Types

The options market presents investors with a diverse array of options types, each tailored to specific trading strategies and risk tolerance levels. Broadly categorized into two primary types, call options and put options, options further bifurcate into numerous subcategories:

Call Options: The Right to Buy

Call options grant the holder the right to purchase an underlying asset at a predetermined strike price on or before the expiration date. The inherent value of a call option emanates from the expectation that the underlying asset’s price will rise above the strike price, generating a profit for the option holder.

Put Options: The Right to Sell

In contrast, put options confer upon the holder the right to sell an underlying asset at a predetermined strike price on or before the expiration date. This type of option is particularly advantageous when the investor anticipates a decline in the underlying asset’s price below the strike price.

Advanced Option Types: Unlocking Market Nuances

Beyond the fundamental call and put options, the options market encompasses an array of advanced option types catering to the needs of seasoned traders:

- American Options: American options offer maximum flexibility, empowering holders to exercise their right to buy or sell the underlying asset at any time up until the expiration date.

- European Options: Unlike their American counterparts, European options can only be exercised on their designated expiration date.

- Spread Options: Involving the simultaneous purchase of options with different strike prices and expiration dates, spread options are employed by traders to capitalize on market volatility.

- Butterfly Spreads: Consisting of the purchase of an at-the-money option and the sale of two out-of-the-money options with different strike prices, butterfly spreads offer limited but potentially lucrative profit potential.

- Condor Spreads: Comprising the purchase of two in-the-money options and the sale of two out-of-the-money options with different strike prices, condor spreads aim to profit from a more contained range of price movement.

Image: marketbusinessnews.com

Types Of Options And It’S Trading

Image: finance.yahoo.com

Trading Options: A Strategic Approach

Understanding the nuances of each option type is paramount to developing an effective trading strategy that aligns with your financial objectives and risk tolerance. Consider the following tips to enhance your options trading expertise:

- Define Your Trading Goals: Clearly establish your investment objectives and risk appetite before venturing into options trading.

- Research and Analysis: Conduct thorough research and analysis on the underlying asset and its market dynamics before making any trading decisions.

- Option Pricing: Familiarize yourself with the factors that influence option pricing, such as the underlying asset’s volatility, the risk-free rate, and the time to expiration.

- Risk Management: Employ sound risk management practices, such as setting stop-loss orders and position sizing appropriately, to mitigate potential losses.

- Monitoring and Adjustment: Regularly monitor your open positions and adjust as necessary based on changes in market conditions.

Conclusion

Navigating the options market requires traders to possess a comprehensive understanding of the diverse types of options available, their inherent characteristics, and the associated trading strategies. By mastering this knowledge and meticulously executing your trades, you can unlock the full potential of options trading while effectively managing your risk exposure.