Introduction

In the ever-evolving financial landscape, options trading has emerged as a powerful tool for investors seeking to mitigate risk, enhance returns, and navigate market volatility. Among the leading platforms for options trading, TD Ameritrade stands out, offering a robust suite of services and educational resources. However, understanding the options trading fees at TD Ameritrade is crucial for making informed decisions and optimizing your trading strategies.

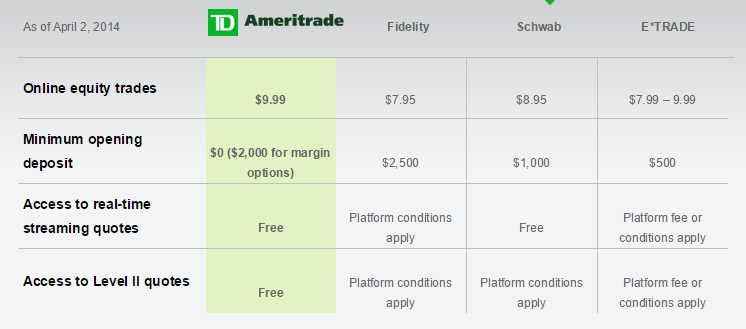

Image: www.gobankingrates.com

Decoding TD Ameritrade’s Options Trading Fees

Options trading involves the purchase or sale of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. At TD Ameritrade, the fees associated with options trading primarily encompass:

1. Contract Fees:

Each options contract carries a fee, also known as a contract premium, which represents the cost of acquiring the option. The premium is determined by factors such as the strike price, the time to expiration, and the volatility of the underlying asset.

2. Transaction Fees:

When you place an options trade, you incur a transaction fee. At TD Ameritrade, this fee is typically $0.65 per contract, regardless of the number of contracts traded in a single order.

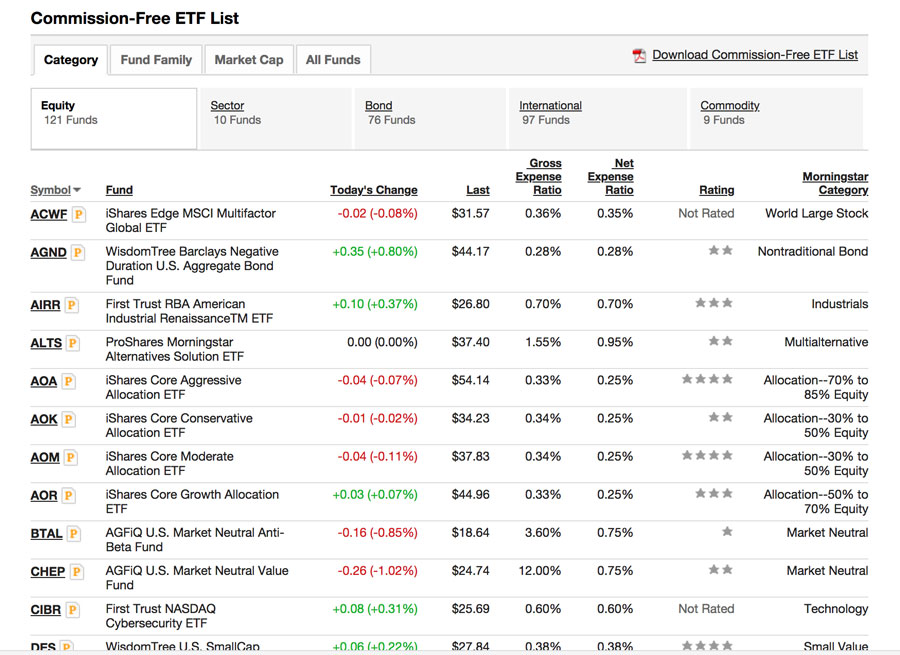

Image: s3.amazonaws.com

3. Market Data Fees:

To access real-time market data, including quotes, charts, and news, you may incur a fee. These fees vary depending on the level of data access you require.

4. Assignment Fees:

If you hold an options contract until its expiration and it is assigned, you may be responsible for an assignment fee. This fee covers the administrative costs associated with the exercise or assignment of the contract.

Factors Influencing Options Trading Fees

The fees you incur for options trading at TD Ameritrade are influenced by several factors, including:

1. Complexity of Trade:

More complex trades, such as those involving multiple legs or advanced strategies, may attract higher fees.

2. Account Tier:

TD Ameritrade offers tiered account levels, each with its own fee structure. Higher-tier accounts typically benefit from lower trading fees.

3. Market Conditions:

Market volatility and trading volume can impact the pricing of options contracts and transaction costs.

Tips for Minimizing Options Trading Fees

While options trading fees are an inherent cost of participating in the market, there are strategies you can employ to minimize their impact:

1. Negotiate Volume Discounts:

If you trade high volumes of options regularly, consider negotiating discounted rates with TD Ameritrade.

2. Use Limit Orders:

Instead of market orders, use limit orders to buy or sell options at your desired price or better. This can reduce the potential for higher transaction fees.

3. Focus on High-Probability Trades:

Concentrate your efforts on trades with a high probability of success. Avoid excessive speculative trading, which can lead to frequent fees and diminished returns.

4. Consider Commissions-Free Platforms:

Some platforms, such as Robinhood, offer commission-free options trading. However, these platforms may have higher contract premiums or limited access to market data.

Expert Insights on Options Trading Fees

Industry experts recommend the following strategies for navigating options trading fees:

-

“Understanding the fee structure and associated costs is imperative for making informed trading decisions,” says renowned options strategist Mark Sebastian.

-

“By leveraging tiered account structures and negotiating discounts, traders can potentially lower their overall trading expenses,” advises veteran financial advisor Lisa Shalett.

-

“Focus on developing a comprehensive trading plan that outlines your risk tolerance and financial objectives,” emphasizes professional trader Dan Sheridan.

Options Trading Fees Td Ameritrade

Image: broker-reviews.org

Conclusion

Options trading fees are an integral part of the options trading landscape. By understanding the fee structure at TD Ameritrade and employing effective trading strategies, you can optimize your financial performance. Remember, options trading involves inherent risks, and it’s crucial to conduct thorough research, consult with reputable brokers, and seek professional guidance as needed. With knowledge and a well-informed approach, you can confidently navigate the world of options trading, maximizing your potential while minimizing your trading costs.