Uncovering the Costs Associated with Options Trading on TD Ameritrade

Options trading offers a unique blend of rewards and risks, but it’s essential to understand the associated costs to make informed decisions. TD Ameritrade, a prominent brokerage firm, provides a comprehensive platform for options trading, but their fee structure can be complex. This article delves into a comprehensive analysis of TD Ameritrade options trading fees, empowering traders to navigate the financial landscape with confidence.

Image: dollarsprout.com

Introductory Fees

Embarking on the options trading journey with TD Ameritrade comes with an initial fee of $6.95 per contract upon opening a contract. This fee applies to both opening and closing trades. The minimum fee per order is $10, regardless of the number of contracts traded.

Commission Fees

The heart of TD Ameritrade’s options trading fees lies in commissions. When you buy or sell an options contract, you pay a commission based on the number of contracts traded. The commission structure is as follows:

- 1-49 contracts: $0.65 per contract

- 50-99 contracts: $0.60 per contract

- 100-499 contracts: $0.55 per contract

- 500+ contracts: Negotiable

Exercise and Assignment Fees

If you decide to exercise or assign an option contract, TD Ameritrade charges a $1.50 fee per contract. This fee applies whether you exercise the right to buy or sell the underlying asset or assign the contract to another party.

Other Fees

Beyond the core fees, TD Ameritrade may impose additional charges under specific circumstances. These include:

- Contract Fee: $0.25 per contract for contracts that last longer than one year.

- Regulatory Fee: $0.02 per contract to cover regulatory costs.

- SEC Fee: $0.31 per contract traded, a fee imposed by the Securities and Exchange Commission (SEC).

Example of Options Trading Fees

To illustrate the fee structure, consider a trade of 100 ABC options contracts. Assuming the commission rate of $0.55 per contract, you would pay $55 in commission (100 x $0.55). Adding the opening fee ($6.95), exercise fee ($1.50), and regulatory fee ($2), the total cost for this trade would be $64.45.

Conclusion

TD Ameritrade’s options trading fees are a crucial aspect of understanding the overall cost of trading. While the fees can be reasonable for active traders, it’s essential to factor them into your trading strategy to avoid surprises. By embracing a comprehensive understanding of these fees, traders can make informed decisions, optimize their profitability, and navigate the complexities of options trading with confidence.

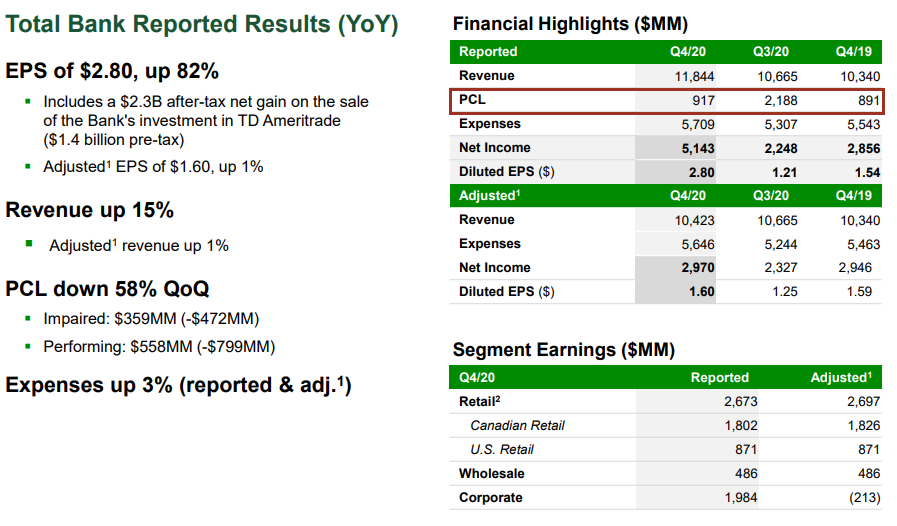

Image: www.thedividendguyblog.com

Td Options Trading Fees

https://youtube.com/watch?v=FQ1D6sCLxwQ