In the ever-evolving world of options trading, eric vertical spread options strategies stand out as a powerful tool with the potential to enhance returns while managing risk. Whether you’re a seasoned investor or just starting to dip your toes into the options market, understanding eric vertical spreads is crucial for maximizing your trading potential.

Image: www.mohitjakhotiablogspot.com

Deciphering Eric Vertical Spread Options

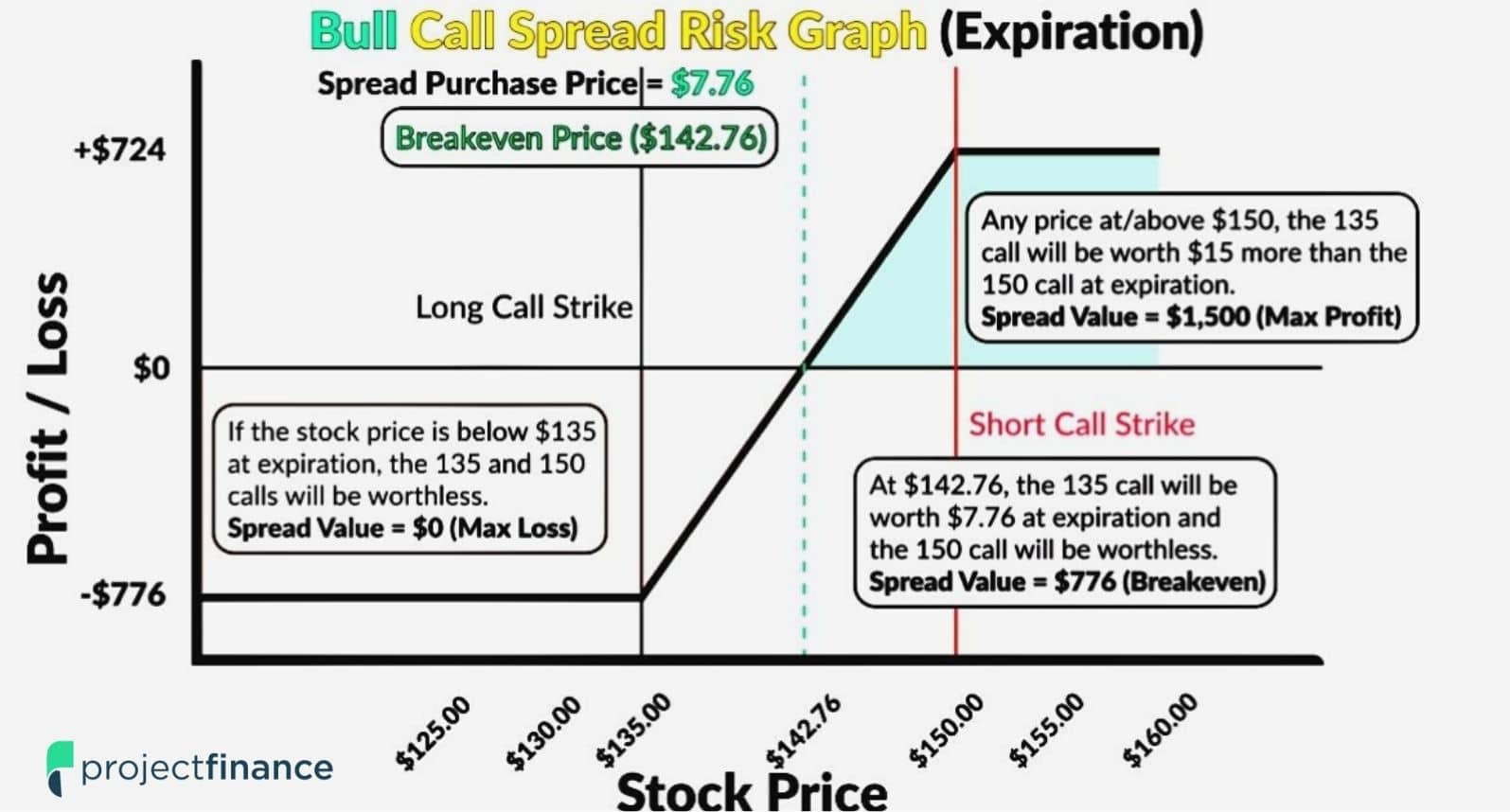

At its core, an eric vertical spread is an options strategy that involves simultaneously buying and selling multiple options contracts with the same underlying asset but different strike prices and expiration dates. These contracts are strategically designed to create a profit window that maximizes potential gains and limits losses.

The Basic Mechanism

The most common form of eric vertical spread options trading involves buying one at-the-money (ATM) call option and selling one out-of-the-money (OTM) call option with a higher strike price and the same expiration date. This creates a bullish position that profits if the underlying asset’s price rises above the strike price of the ATM call. Conversely, if the price falls, the spread loses value due to the decline in both the call options.

Uncovering the Unique Benefits

Eric vertical spread options strategies offer several significant advantages to traders:

-

Limited Risk: By simultaneously buying and selling options, traders can cap their potential losses to the net premium paid for the spread. This risk management aspect makes eric spreads attractive for investors seeking to mitigate downside risk.

-

Tailored Profit Potential: The profit range for an eric vertical spread is defined by the difference in strike prices between the two options. Traders can customize their spreads to target specific profit targets based on their market expectations.

-

Adaptability: Eric spreads are versatile strategies that can be employed in both bull and bear markets. By adjusting strike prices and expirations, traders can tailor their spreads to capitalize on various market conditions.

Image: www.youtube.com

Embracing Expert Guidance

To enhance your eric vertical spread options trading journey, it’s essential to seek insights from established experts in the field. Here are a few tips from industry veterans:

-

Understand the underlying: Thoroughly analyze the historical performance, industry trends, and financial health of the underlying asset before implementing any options strategy.

-

Manage your risk: Set predetermined risk limits and stick to them. Don’t overextend your portfolio by trading with more capital than you’re willing to lose.

-

Monitor market movements: Stay informed about economic conditions, company news, and industry developments that may impact the underlying asset’s price.

Eric Vertical Spread Options Trading

Image: fabalabse.com

Conclusion

Eric vertical spread options trading presents a strategic approach to options trading, offering a unique blend of limited risk, customizable profit potential, and market adaptability. By grasping the fundamentals, embracing expert guidance, and implementing sound trading principles, you can effectively harness the power of eric spreads to enhance your investment returns while managing the inherent risks associated with options trading.