Rising from Market Turbulence with Vertical Put Spreads

In the ever-changing landscape of financial markets, navigating downturns can seem daunting. However, strategic options traders have a powerful tool at their disposal: vertical put spread options. This innovative strategy enables traders to capitalize on falling stock prices, turning market volatility to their advantage.

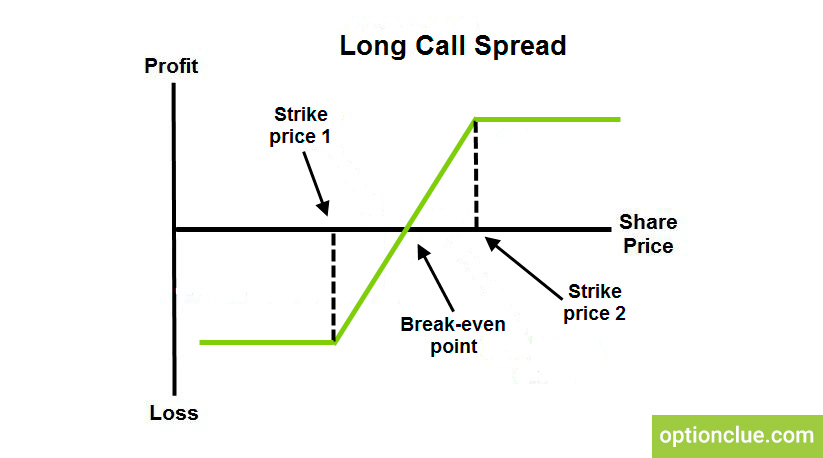

Image: optionclue.com

What are Vertical Put Spread Options?

A vertical put spread is an options trading strategy that involves selling a higher-priced put option while simultaneously buying a lower-priced put option with the same expiration date but on the same underlying asset. The difference between the strike prices of the two options, known as the spread width, determines the maximum profit potential.

How do Vertical Put Spreads Work?

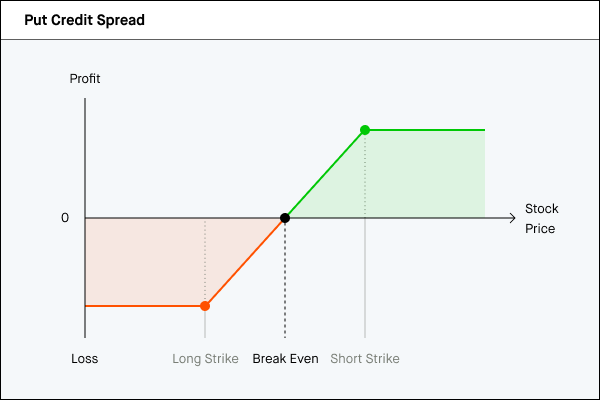

When implemented effectively, vertical put spreads can safeguard traders against significant losses. By selling the higher-priced put option, traders effectively sell the right to another party to sell (put) a specific amount of the underlying asset at the specified strike price. Conversely, by purchasing the lower-priced put option, they acquire the right to sell the same asset at a lower strike price.

Maximizing Returns with Vertical Put Spreads

The profit from a successful vertical put spread is realized when the price of the underlying asset declines. As the asset price falls below the lower strike price, the trader has the right to sell the asset at that lower price, realizing a profit. The maximum profit potential is capped at the spread width, ensuring the trader’s downside risk is limited.

Image: www.schwab.com

Tips and Expert Advice for Successful Vertical Put Spread Trading

To enhance your vertical put spread trading strategies, consider these invaluable tips:

-

Carefully Select Underlying Assets: Choose assets with significant bearish momentum or anticipated price declines.

-

Choose the Right Strike Prices: Set strike prices that align with your market outlook and risk tolerance.

-

Manage Your Risk: Monitor market movements diligently and adjust your positions accordingly to mitigate potential losses.

Vertical Put Spread Options Trading

Image: learn.robinhood.com

Conclusion

Vertical put spread options are a powerful tool for traders who seek to profit from falling asset prices. By combining strategic analysis with calculated risk management, you can navigate bearish market conditions with confidence.

Are you ready to harness the power of vertical put spread options?