Navigating the Financial Landscape: Your Guide to Option Trading Costs

Are you seeking to delve into the world of options trading but uncertain of the associated costs? Ameritrade, a leading brokerage firm, offers a comprehensive range of option trading services. But what are the intricacies of Ameritrade’s cost structure? This article aims to illuminate the different types of costs you can expect when trading options with Ameritrade, empowering you to make informed decisions that align with your financial goals.

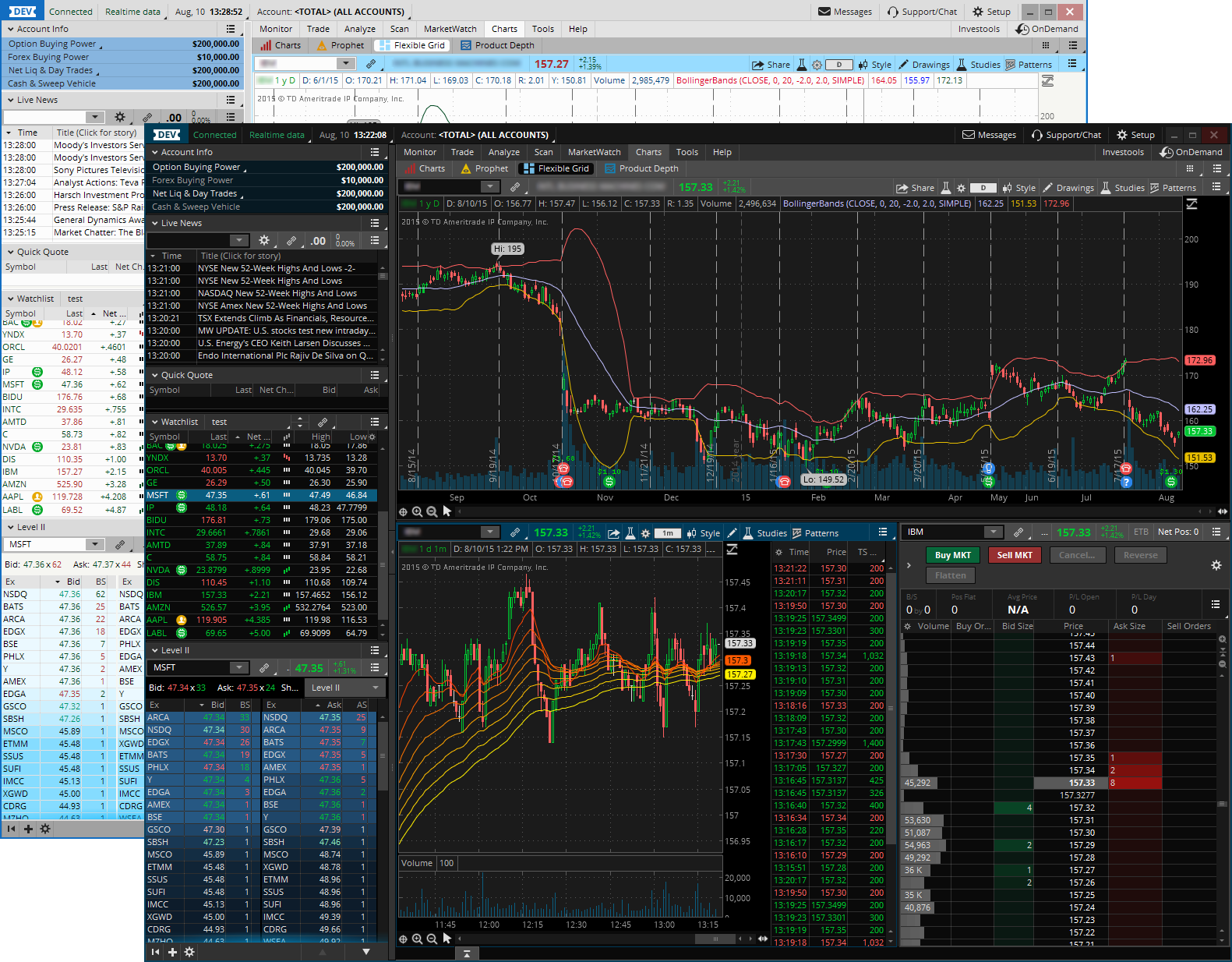

Image: www.fullquick.com

Ameritrade Cost Structure: A Breakdown

Ameritrade’s cost structure for option trading encompasses a combination of fees, including brokerage commissions, exchange fees, and regulatory fees. Here’s a detailed breakdown:

1. Brokerage Commissions

Ameritrade charges a per-contract commission for each option trade executed. This commission varies depending on the type of option and the size of the trade. Currently, the commission structure for equity options is as follows:

- Up to 10 contracts: $0.65 per contract

- 11 to 49 contracts: $0.60 per contract

- 50 to 99 contracts: $0.55 per contract

- 100 or more contracts: $0.50 per contract

2. Exchange Fees

In addition to brokerage commissions, Ameritrade passes on exchange fees to its clients. These fees vary depending on the exchange where the option is traded and the type of option (e.g., call or put). Exchange fees typically range from $0.02 to $0.04 per contract.

Image: www.pinterest.com

3. Regulatory Fees

Regulatory fees, such as the SEC fee and the Options Regulatory Fee (ORF), are also passed on to clients. The SEC fee is a flat $0.014 per contract, while the ORF varies depending on the value of the underlying security.

Factors Influencing Ameritrade Option Trading Costs

Several factors can impact the overall cost of trading options with Ameritrade, including:

- Type of option: Call options and put options have different commission structures.

- Size of the trade: Larger trades typically incur lower per-contract commissions.

- Number of contracts: Trading a multiple of 10 contracts can qualify for lower commissions.

- Exchange where the option is traded: Different exchanges have their own fee structures.

- Volatility of the underlying security: Options on more volatile securities tend to have higher commissions.

Optimizing Your Trading Costs

To minimize your option trading costs, consider the following tips:

- Trade larger blocks of contracts: Executing trades in multiples of 10 contracts can significantly reduce per-contract commissions.

- Consider lower-cost exchanges: Some exchanges offer lower fees than others. Explore your options to identify the exchange that best suits your needs.

- Negotiate with Ameritrade: For large and active traders, it’s possible to negotiate a reduced commission rate with Ameritrade.

FAQs on Ameritrade Option Trading Costs

Q: What are the various types of costs associated with option trading at Ameritrade?

A: The primary costs are brokerage commissions, exchange fees, and regulatory fees.

Q: How can I reduce my option trading costs?

A: Trading larger blocks, choosing lower-cost exchanges, and negotiating with Ameritrade can help reduce costs.

Q: Are Ameritrade’s option trading costs competitive?

A: Ameritrade’s commission structure is comparable to other major brokerage firms.

Ameritrade Cost For Trading Options

Conclusion: Empowering Your Option Trading Decisions

By understanding the intricacies of Ameritrade’s cost structure, you can make informed choices that optimize your option trading strategy. Consider the factors that influence trading costs and implement strategies to mitigate expenses. Whether you are a seasoned trader or embarking on your options trading journey, this guide has equipped you with the knowledge to navigate the financial landscape effectively.

Call to Action:

Embark on your option trading adventure with confidence! Ameritrade offers a comprehensive platform to meet your trading needs. Visit their website to learn more about their services and take the first step towards financial success.