Image: pijigufoqow.web.fc2.com

Shedding Light on Market Dynamics and Trends

The National Stock Exchange of India (NSE) serves as the primary platform for executing options trades in the country. By tracking options trading volume statistics, market participants gain valuable insights into the sentiments prevailing among the trading community. This article delves into the intricacies of NSE options trading volume statistics, providing a comprehensive analysis.

Understanding Options Trading Volume Statistics

Options trading volume refers to the total number of options contracts traded during a specific period. It’s a measure of the activity level in the options market and provides insights into demand and supply dynamics. By analyzing options trading volume statistics, traders and investors can identify key trends, predict future market movements, and make informed trading decisions.

Real-World Applications of Options Trading Volume Statistics

Options trading volume statistics offer a wide range of applications in the financial markets:

- Gauging Market Sentiment: High trading volume typically indicates strong interest and participation in the market. Conversely, low volume may suggest a lack of enthusiasm or liquidity.

- Predicting Market Direction: Rising options trading volume, particularly in long-term options, may indicate that investors anticipate a significant market move.

- Identifying Trading Opportunities: Traders can spot potential trading opportunities by observing changes in options trading volume patterns.

- Risk Management: Monitoring options trading volume can aid in managing risk by providing information about market volatility and liquidity.

Image: 2point2capital.com

Factors Influencing Options Trading Volume

Several factors can influence options trading volume:

- Market Outlook: Positive or negative market sentiment can drive increased trading activity.

- Volatility: Higher market volatility typically leads to higher options trading volume as investors seek to protect or hedge their positions.

- Economic Data: Economic releases and events can significantly impact market sentiment and options trading volume.

- Interest Rates: Changes in interest rates can affect the attractiveness of options strategies.

- Regulation: Regulatory changes or policy shifts can influence options trading volume.

Latest Trends in Options Trading Volume on the NSE

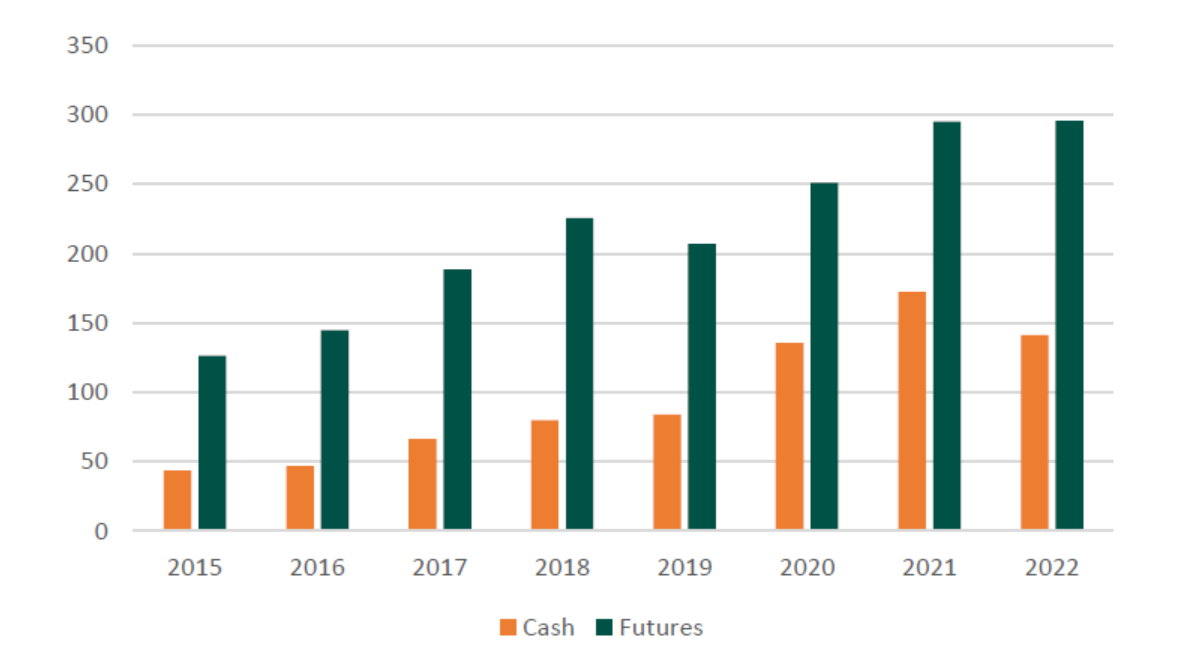

- Growth in Open Interest: Open interest in options contracts on the NSE has witnessed a steady rise in recent years, indicating growing market participation.

- Rise of Index Options: Trading volume in index options, such as Nifty and Bank Nifty, has outpaced that of individual stock options.

- Increased Volatility Trading: Demand for options with shorter expiries (weekly and monthly) has surged, pointing to greater short-term volatility trading.

- Technological Advancements: Advancements in trading platforms and mobile applications have made options trading more accessible, contributing to increased volume.

Options Trading Volume Statistics Nse

Image: www.tradingview.com

Conclusion

Options trading volume statistics on the NSE provide invaluable insights into market activity, sentiment, and trends. By studying these statistics diligently, traders and investors can gain an edge in navigating the complex world of options trading. Whether it’s identifying potential trading opportunities, managing risk, or simply gauging market sentiment, options trading volume statistics empower market participants with actionable information.