Understanding Volume in the Option Market

In the world of option trading, volume plays a pivotal role in determining the health and liquidity of a given contract. Volume refers to the number of contracts that have been traded over a specific period, typically a single trading day. A high volume indicates a significant amount of activity, while a low volume suggests a lack of interest or participation.

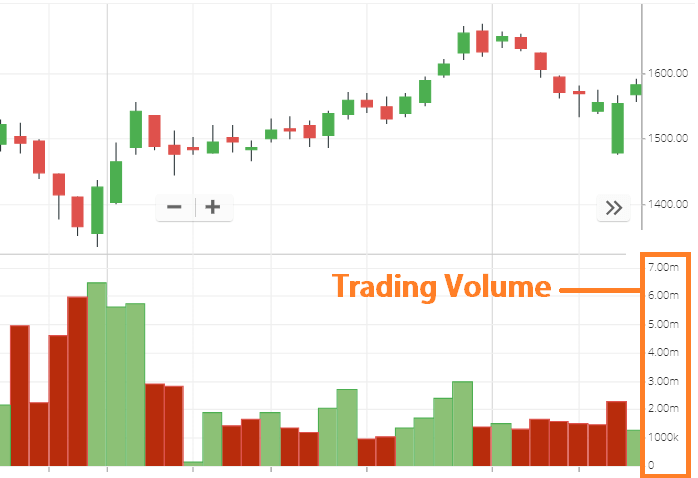

Image: earnfo.com

Significance of Volume

Volume provides valuable insights into the market sentiment and the underlying dynamics of an option contract. A high volume usually signifies that there is ample liquidity, which makes it easier for traders to enter or exit positions quickly and efficiently. This increased liquidity also contributes to tighter spreads, reducing trading costs. Conversely, low volume can result in wider spreads and difficulty in executing trades.

Tracking Volume

Tracking volume over time can help traders identify trends and patterns in the option market. Increasing volume often suggests growing interest in a particular contract, which can be a sign of potential price momentum. On the other hand, a sudden decline in volume may indicate waning interest or a lack of liquidity, which could lead to increased volatility.

Impact on Option Pricing

Volume also has a significant impact on option pricing. High volume can contribute to greater price stability by providing a more robust market for the contract. This stability makes it less likely for extreme price fluctuations to occur, as there are more buyers and sellers willing to participate in the market. Conversely, low volume can lead to increased volatility, as the actions of a few large traders can have a disproportionate impact on the price.

Image: www.youtube.com

Interpreting Volume

When interpreting volume, it’s important to consider the context of the trade. For example, a high volume in a low-liquidity contract may not carry the same significance as a high volume in a heavily traded contract. Additionally, volume should be viewed in conjunction with other indicators, such as open interest, implied volatility, and strike price.

Conclusion

Volume is a crucial metric in option trading that provides valuable insights into market sentiment, liquidity, and price dynamics. By understanding the significance of volume, traders can make more informed decisions and adapt their trading strategies accordingly. Whether you’re a seasoned option trader or just starting out, incorporating volume into your analysis will give you a competitive edge in the ever-evolving market.

What Does Volume Mean In Option Trading

Image: www.thestreet.com

FAQ

Q: What is the difference between volume and open interest?

A: Volume measures the number of contracts traded over a specific period, while open interest represents the number of contracts that are currently outstanding.

Q: How can I track historical volume data?

A: Many online trading platforms and financial websites provide historical volume data for various option contracts.

Q: What is the impact of large volume on option prices?

A: Large volume can lead to tighter spreads and reduced volatility, as it signifies a more liquid market with ample participation.

Q: Is volume more significant for short-term or long-term option trades?

A: Volume can be important for both short-term and long-term option trades, as it provides insights into market liquidity and sentiment.

Q: How should I incorporate volume into my option trading strategy?

A: Volume should be considered alongside other indicators, such as implied volatility and strike price, to make informed trading decisions and identify potential trading opportunities.