Introduction

Options trading, a financial practice that involves the buying and selling of contracts conveying specific rights and obligations, can be both lucrative and complex. Two crucial metrics that hold immense significance in options trading are open interest and volume. By gaining a thorough understanding of these concepts, traders can enhance their profit-maximizing strategies and mitigate risks efficiently.

Image: www.youtube.com

This comprehensive article delves into the intricacies of open interest and volume in options trading, providing a clear definition of each, explaining their significance, and offering insights into how they can be utilized to make more informed trading decisions.

Open Interest: Delving Deeper

Definition

Open interest, in the realm of options trading, signifies the total number of contracts for a particular option series that remain outstanding and have not been either exercised or closed out. This metric offers a snapshot of the market’s overall interest in a specific option contract at a given time.

Significance

Open interest plays a crucial role in determining an option contract’s liquidity, which, in turn, impacts its pricing. Higher open interest generally indicates greater liquidity, making it easier for traders to enter and exit positions without facing significant price fluctuations.

Moreover, by monitoring open interest levels over time, traders can gauge changes in market sentiment towards a particular stock or underlying asset. For instance, an abrupt increase in open interest may suggest that traders are becoming more bullish on the underlying asset, while a decline could indicate a shift towards a more bearish sentiment.

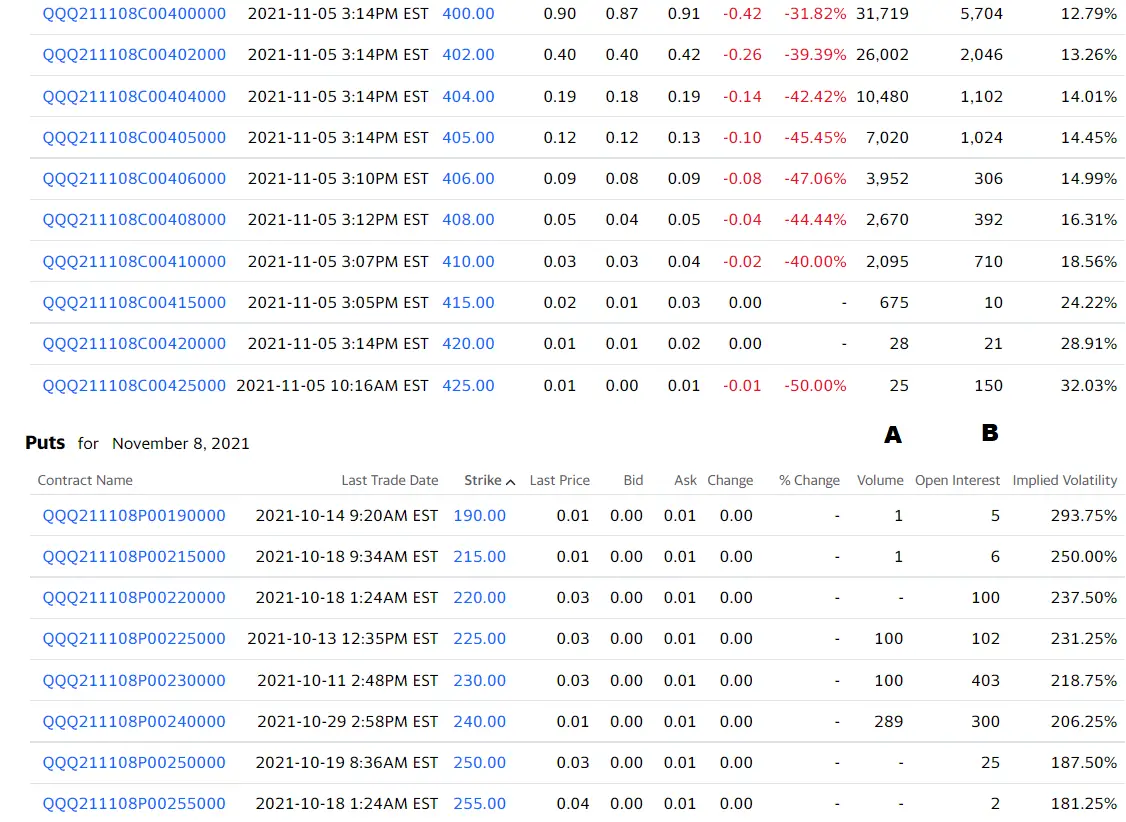

Image: bookmap.com

Volume: Assessing Market Activity

Definition

Volume, within the options market, refers to the total number of contracts traded during a specific period. This metric provides an indication of the level of activity associated with a particular option contract and the underlying asset it represents.

Significance

Volume is a key barometer of market participation and can provide valuable insights into the supply and demand dynamics of an option contract. High volume typically suggests that there is substantial interest in the underlying asset and that the option contract is actively being traded.

Traders can analyze volume trends to identify potential trading opportunities. For example, a surge in volume may precede a significant price movement, allowing traders to anticipate market shifts and position themselves accordingly.

Combining Open Interest and Volume for Enhanced Analysis

While open interest and volume are valuable metrics on their own, combining them provides even more comprehensive insights for traders.

When open interest and volume are both high, it indicates a strong and liquid market with a considerable number of participants. This scenario typically suggests that the market has a clear direction and that traders have confidence in the underlying asset’s performance.

Conversely, low open interest and volume may indicate a market with limited liquidity and participation. This can make it more challenging to execute trades at favorable prices and may suggest that the market lacks a clear consensus on the underlying asset’s direction.

Open Interest And Volume Options Trading

Image: www.newtraderu.com

Conclusion

Open interest and volume are indispensable metrics for options traders, providing invaluable information about market sentiment, liquidity, and activity. By understanding and skillfully using these metrics, traders can make more informed decisions, identify potential trading opportunities, and navigate the complexities of the options market with greater precision. Remember, mastering these concepts requires continuous learning, practice, and a commitment to staying abreast of market developments.

We encourage you to explore additional resources, consult with experienced traders, and practice applying these concepts to your own trading strategies. By diligently honing your knowledge, you can unlock the full potential of open interest and volume analysis and achieve greater success in your options trading endeavors.