Understanding the Dynamics of Option Market Liquidity

In the realm of options trading, understanding the interplay between volume and open interest is crucial for informed decision-making. These two key metrics provide valuable insights into the liquidity and market sentiment surrounding a particular option contract.

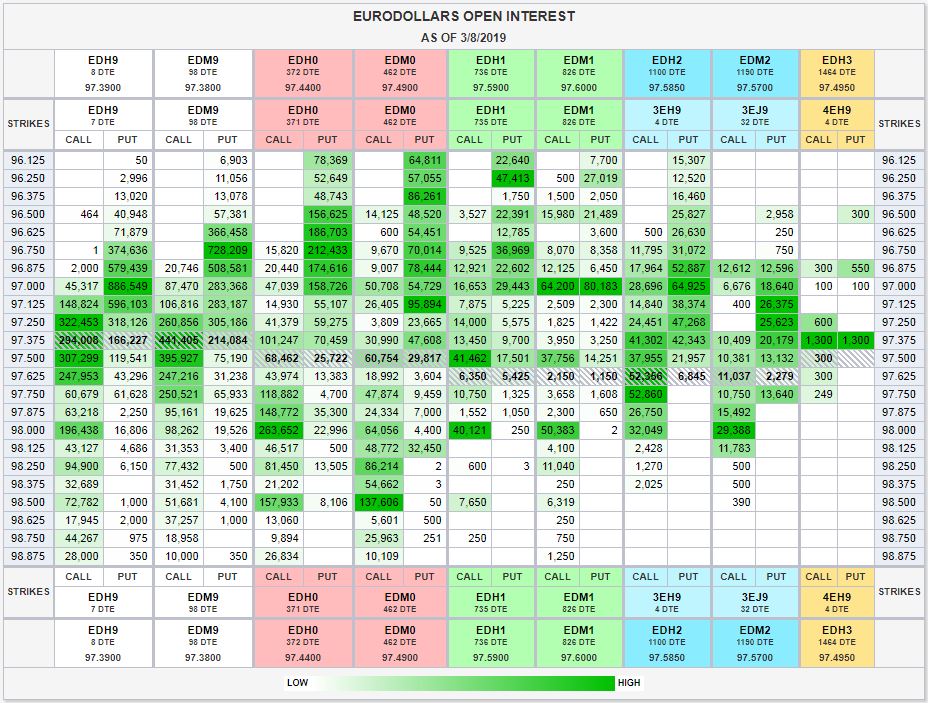

Image: www.cmegroup.com

Volume: A Measure of Activity

Option volume represents the total number of contracts traded over a specific period, typically a day or week. It reflects the level of trading activity and provides an indication of the liquidity in the market. High volume indicates active trading and increased liquidity, while low volume suggests a less liquid market.

Open Interest: A Snapshot of Outstanding Contracts

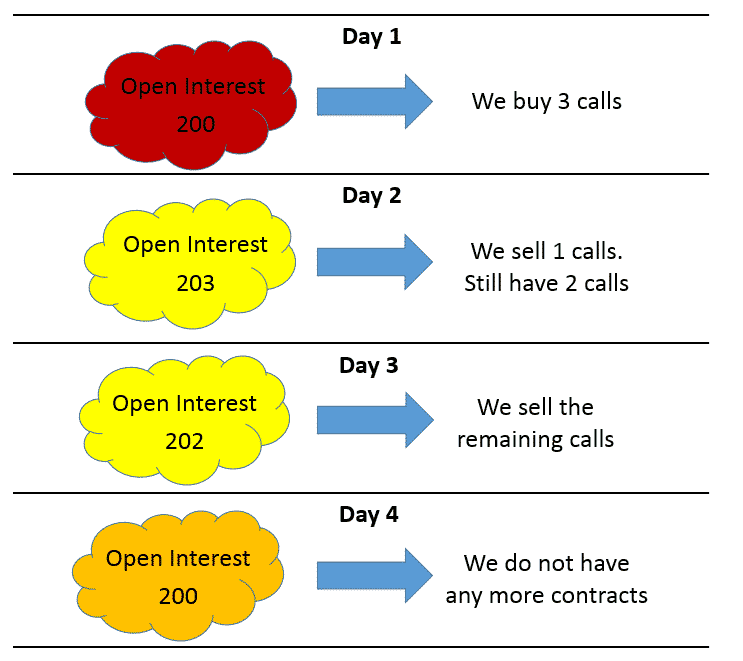

Open interest refers to the number of option contracts that have been purchased or sold but have not yet been settled or closed out. It represents the total number of active contracts in the market at a given point in time. Higher open interest indicates a greater number of outstanding contracts, suggesting increased market interest and potential for future trading.

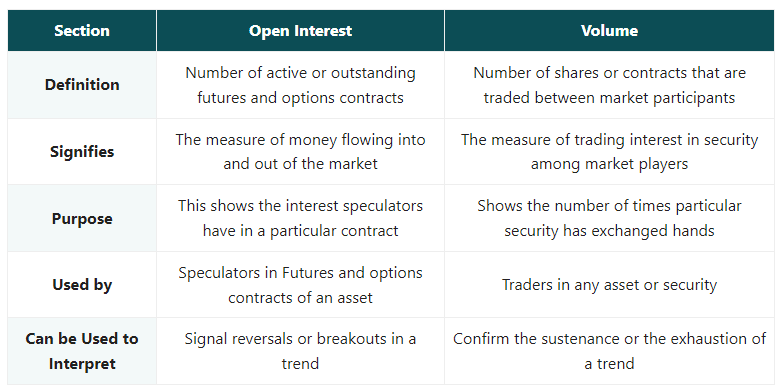

Distinguishing Volume from Open Interest

While both volume and open interest measure liquidity, they differ in their specific implications. Volume captures the short-term flow of activity, indicating the current level of trading. Open interest, on the other hand, provides a snapshot of the overall market position and the potential for future trading.

Image: warsoption.com

The Relationship Between Volume and Open Interest

Volume and open interest are often correlated, but not always. In general, higher volume is likely to lead to increased open interest as more contracts are traded and remain outstanding. However, fluctuations in open interest may not always align with volume. For instance, traders may enter and exit contracts without significantly affecting volume, resulting in a change in open interest.

Significance of Volume and Open Interest

Understanding volume and open interest is essential for traders to assess market liquidity and gauge the potential for future price movements. High volume and open interest can indicate strong market interest and increased volatility, while low volume and open interest may suggest a less liquid market with limited trading opportunities.

Tips for Using Volume and Open Interest in Trading

- Monitor both volume and open interest simultaneously to gain a comprehensive view of market liquidity.

- Consider the relationship between the two metrics. High volume and rising open interest can signal potential market momentum.

- Analyze volume and open interest in combination with other technical indicators to enhance your analysis.

Frequently Asked Questions

Q: Which metric is more important, volume or open interest?

Both metrics are important, but the significance depends on the trading strategy.

Q: How can I use open interest to predict market direction?

Changes in open interest, particularly when coupled with volume analysis, can provide insights into potential future price movements.

Q: Do high volume and open interest always indicate a strong market?

Not necessarily. While they often reflect market strength, it’s important to consider other factors, such as price trends and economic news.

Difference Between Volume And Open Interest In Option Trading

Image: www.cheddarflow.com

Conclusion

Understanding the difference between volume and open interest in option trading is essential for traders to navigate the complexities of the market. Monitoring both metrics provides valuable insights into liquidity and sentiment, aiding in informed decision-making. By leveraging these metrics effectively, traders can enhance their analysis and potentially improve their trading outcomes.

Are you interested in learning more about volume and open interest in option trading? If so, we encourage you to explore our resources and reach out to our team of experts for additional guidance.