Introduction

Stepping into the realm of options trading can be both alluring and daunting, as it offers the potential for significant profits but also carries substantial risks. Understanding the inner workings of options trading is paramount to maximizing your chances of success while safeguarding your capital.

Image: www.youtube.com

This comprehensive guide will delve into the potential risks associated with options trading, exploring common pitfalls and strategies to help you navigate the turbulent waters of financial markets. By equipping yourself with the necessary knowledge and adopting prudent practices, you can significantly reduce the odds of losing money while harnessing the advantages that options trading has to offer.

Understanding Options Trading

Options contracts, as the name suggests, grant you the option, not the obligation, to buy or sell an underlying asset, such as a stock, index, or commodity, at a predetermined price on or before a specific expiration date. You have the right but not the compulsion to exercise this option, depending on whether it’s advantageous based on market conditions.

In essence, options trading involves speculating on the future price movements of the underlying asset. If your predictions align with the market’s trajectory, you could potentially reap significant profits. However, if the market moves against you, your losses can be substantial, potentially exceeding your initial investment.

The Pitfalls of Options Trading

There are inherent risks involved in options trading that novice traders must be cognizant of to mitigate potential losses. Some of the most prevalent pitfalls to watch out for include:

-

Time Decay: The value of an option decays over time irrespective of the underlying asset’s price movement. This is because options have a limited lifespan, and the closer they get to their expiration date, the less time they have to potentially gain value. As time passes, the option premium, which is the price you pay to acquire the option, diminishes, potentially resulting in losses.

-

Implied Volatility: Options pricing takes into account implied volatility, which gauges market expectations of an underlying asset’s future price fluctuations. If the market experiences lower-than-anticipated volatility, option premiums suffer, potentially leading to losses. Conversely, if volatility spikes, option premiums escalate, potentially amplifying profits.

-

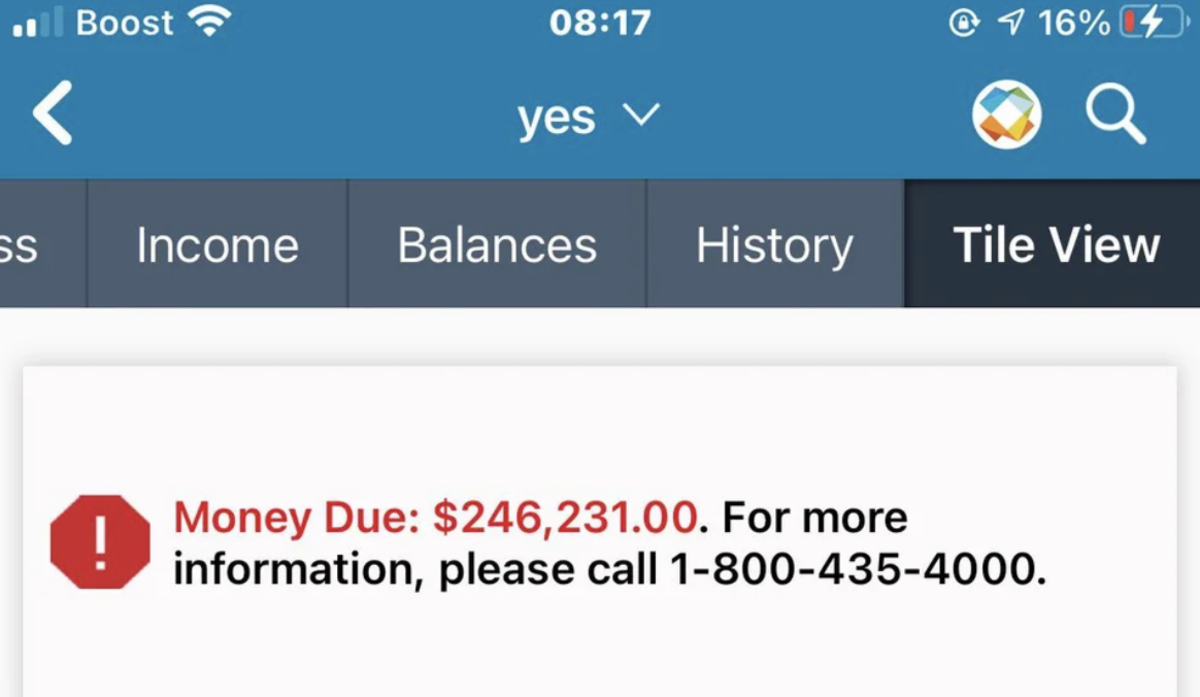

Unlimited Loss Potential: Unlike buying a stock, where your losses are limited to the initial investment, options trading exposes you to potentially unlimited losses. This is because an option buyer has the obligation to fulfill the contract if it’s exercised, even if the underlying asset’s price plummets.

-

Margin Trading: Options trading often involves margin trading, where you borrow funds from a broker to increase your buying power. While margin can magnify potential profits, it also amplifies potential losses, making it crucial for traders to manage their risk exposure prudently.

-

Complex Strategies: Options trading encompasses a multitude of sophisticated strategies that may seem alluring but can be highly complex. Inexperienced traders venturing into these strategies without a thorough understanding of the risks involved can face severe financial setbacks.

Strategies to Mitigate Risks

To minimize potential losses in options trading, here are some prudent strategies to consider:

-

Education and Knowledge: Before venturing into options trading, it’s imperative to equip yourself with a comprehensive understanding of options and their intricacies. Attend workshops, read books, and consult with experienced traders to bolster your knowledge and decision-making abilities.

-

Start Small: Begin with small trades to gauge your risk tolerance and refine your trading strategies. Avoid committing substantial capital upfront until you’ve gained proficiency and confidence.

-

Realistic Expectations: Resist the allure of quick riches and set realistic expectations for your trading endeavors. Recognize that consistent profitability in options trading requires skill, patience, and a well-defined strategy.

-

Risk Management: Develop a robust risk management plan that outlines your entry and exit points, as well as your stop-loss orders, to help limit potential losses. Strictly adhere to your trading plan to avoid emotional decision-making.

-

Diversification: Spread your risk across multiple options trades, underlying assets, and expiration dates to mitigate the impact of any single trade’s performance.

-

Sell Options: Instead of buying options, consider selling them to generate income. While selling options involves different risks, it can provide a more consistent income stream.

Image: topgunoptions.com

Can You Lose Money In Options Trading

Image: www.thestreet.com

Conclusion

While options trading offers the potential for significant profits, it’s crucial to recognize that it’s not a risk-free endeavor. With its inherent complexities and potential for substantial losses, it’s imperative to approach options trading with a well-informed and cautious mindset.

By arming yourself with knowledge, adopting sound risk management practices, and employing appropriate strategies, you can significantly enhance your chances of navigating the challenges of options trading while maximizing your potential for success. Remember, the path to financial success is paved with calculated decisions and prudent risk management.