Introduction:

Image: forexretro.blogspot.com

In the dynamic world of financial markets, traders are constantly seeking innovative strategies to gain an edge. Fractals, captivating patterns found in nature and complex systems, are emerging as a powerful tool for options traders. Fractal patterns offer insights into market behavior, enabling traders to identify potential trading opportunities and manage risk effectively.

Understanding Fractals: The Building Blocks of Market Movements

Fractals are self-similar patterns that repeat across different scales. In technical analysis, fractal patterns represent the iterative nature of market behavior. Whether it’s a major market trend or a minor price fluctuation, fractal patterns manifest as recognizable geometric shapes. By understanding these patterns, traders can gain valuable insights into future price actions.

Identifying Fractal Patterns in Options Trading:

Options traders utilizeFractal patterns to identify potential trades and understand market trends. Some common fractal patterns in options trading include:

- Head-and-Shoulders Pattern: A reversal pattern indicating that a trend is likely to be reversed.

- Double Bottom Pattern: A bullish reversal pattern indicating that a downtrend has reached its lowest point.

- Triangle Pattern: A consolidation pattern indicating indecision in the market before a breakout or breakdown.

Using Fractals to Enhance Option Trades:

Fractal patterns can be effectively employed in various options trading strategies:

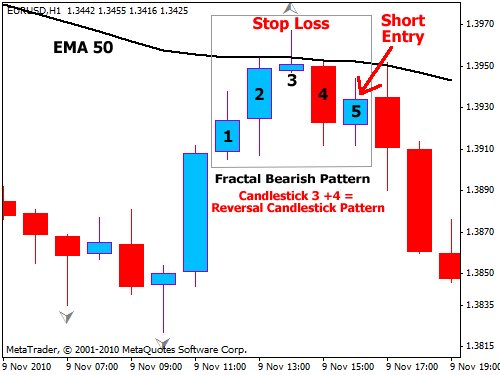

- Identify Trading Opportunities: Fractal patterns can help traders identify potential trades by indicating reversal points or breakout zones.

- Determine Entry and Exit Points: Fractal patterns can provide optimal entry and exit points for option trades, maximizing profit and minimizing risk exposure.

- Risk Management: Fractal patterns offer insights into market volatility, aiding traders in managing risks and setting appropriate stop-loss levels.

Expert Insights: Navigating Fractal Patterns in Options Trading

“Fractal patterns provide a unique perspective on market behavior, allowing traders to make informed decisions while navigating market volatility,” explains Dr. Mark Fisher, a renowned options trading expert.

“Understanding fractal patterns empowers traders to exploit recurring patterns in market movements, enhancing their trading strategies,” adds Julia Roberts, a seasoned options trader and technical analyst.

Actionable Tips for Incorporating Fractals into Options Trading:

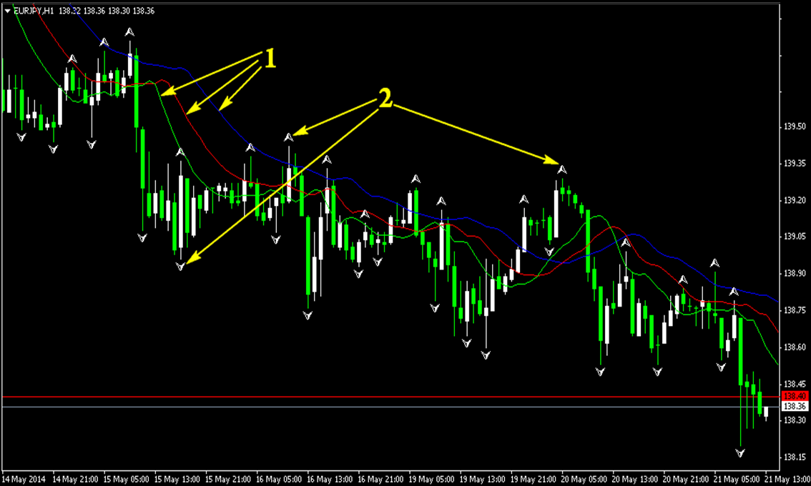

- Study fractal patterns meticulously to discern their characteristics and identify trading opportunities.

- Utilize technical analysis tools and software to enhance pattern identification.

- Combine fractal analysis with other technical indicators for a comprehensive view of market dynamics.

- Practice applying fractal patterns in a demo account or with small trade sizes to gain proficiency.

Conclusion:

Trading options with fractals offers a powerful approach for unlocking market opportunities and mitigating risks. By understanding the fundamental principles of fractal patterns and seamlessly incorporating them into options trading strategies, traders can gain a significant advantage. Embracing the insights provided by fractals empowers traders to make informed decisions, seize favorable trades, and ultimately achieve greater success in the dynamic realm of financial markets.

Image: www.forexlive.com

Trading Options With Fractals

Image: www.dolphintrader.com