A Revolutionary Approach to Uncovering Hidden Patterns

In the labyrinthine world of financial markets, finding order amidst chaos has been an elusive pursuit. Fractal options trading, with its unique ability to unravel intricate patterns, is emerging as a beacon of hope for investors seeking to navigate the complexities of the markets. By harnessing the power of fractal geometry, options traders can unlock hidden insights, uncover profitable opportunities, and gain a competitive edge in the trading arena.

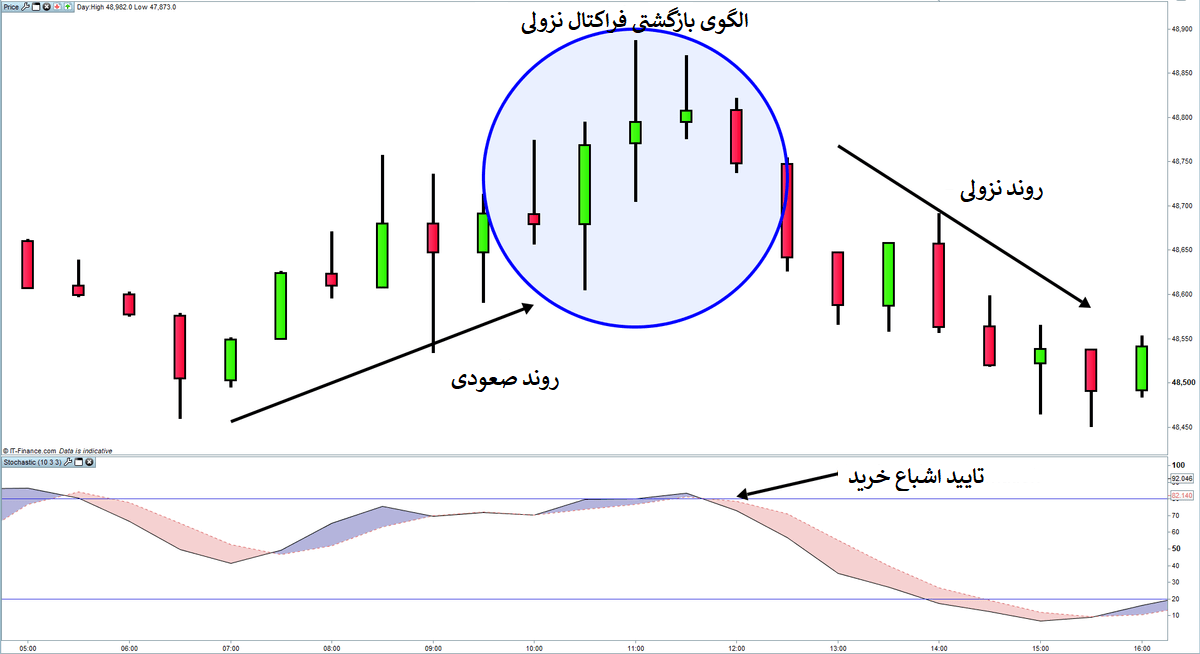

Image: boursetime.com

Understanding Fractal Options Trading

Fractal options trading is a specialized technique that utilizes fractal patterns, self-similar geometric shapes that repeat themselves at various scales, to identify potential trading opportunities. Fractals are ubiquitous in nature, from the branching patterns of trees to the intricate coastlines of islands. By applying fractal analysis to historical market data, traders can uncover hidden patterns that are invisible to traditional technical indicators.

The History of Fractal Options Trading

The concept of fractals was first introduced by mathematician Benoit Mandelbrot in the 1970s. However, it wasn’t until the 1990s, with the advent of powerful computing resources, that fractal analysis began to gain traction in the financial industry. Fractal options trading emerged as a distinct trading strategy in the early 2000s, gaining popularity among a select group of professional traders.

The Power of Fractal Patterns

Fractal patterns possess unique properties that make them invaluable for options traders. First, they are self-similar, meaning that the same basic shape appears at different magnifications. This self-similarity allows traders to identify repeatable patterns that can be exploited for trading opportunities. Secondly, fractal patterns are non-linear, which means that they are not predictable using traditional linear analysis techniques. This non-linearity makes fractal options trading particularly valuable in volatile markets, where traditional indicators often fail to provide reliable signals.

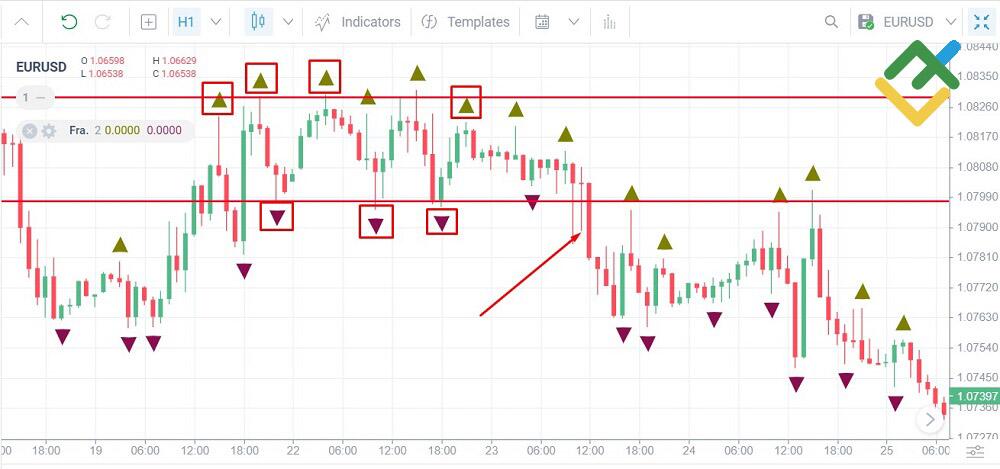

Image: www.litefinance.org

Recent Trends and Developments

In recent years, fractal options trading has gained significant momentum. Advances in computing power have enabled the development of sophisticated fractal analysis software, making it more accessible to individual traders. Additionally, the growing popularity of options trading has created a fertile environment for the growth of fractal options trading techniques.

Expert Tips and Advice

To harness the full potential of fractal options trading, it is essential to adopt a disciplined and structured approach. Here are some expert tips and advice to help you get started:

1. Identify fractals in market data: Use specialized charting software to identify fractal patterns in price data. Look for repetitive shapes and patterns that appear at different time scales.

2. Correlate fractals to price movements: Analyze how fractal patterns align with price movements. This will help you determine the potential trading opportunities associated with each fractal pattern.

3. Choose appropriate options strategies: Fractal options trading is compatible with a variety of options strategies. Select strategies that align with your trading style and risk tolerance.

4. Manage risk effectively: As with any options trading strategy, risk management is paramount. Determine the appropriate position size and use stop-loss orders to mitigate potential losses.

5. Seek professional guidance: Consider seeking professional training or mentorship to further enhance your understanding and execution of fractal options trading techniques.

FAQ on Fractal Options Trading

- **Q:** What are the advantages of fractal options trading? **A:** Fractal options trading offers several advantages, including: uncovering hidden patterns, identifying profitable trading opportunities, outperforming traditional technical indicators in volatile markets, and providing a framework for systematic and disciplined trading.

- **Q:** What are the challenges of fractal options trading? **A:** Fractal options trading requires a deep understanding of fractal analysis and a disciplined trading approach. It also involves the use of specialized software, which can be complex and time-consuming to master.

- **Q:** Is fractal options trading suitable for all traders? **A:** Fractal options trading is not suitable for all traders. It requires a good understanding of options trading, risk management, and technical analysis.

Fractal Options Trading

Image: optionstradingiq.com

Conclusion

Fractal options trading, with its unique ability to uncover intricate patterns and identify hidden opportunities, is revolutionizing the way options traders approach the markets. By harnessing the power of fractals, traders can gain a competitive edge, make informed decisions, and potentially generate superior returns. As the markets become increasingly complex and unpredictable, fractal options trading is poised to play an increasingly important role in the arsenals of successful investors.

Are you intrigued by the potential of fractal options trading? Share your thoughts and questions in the comments section below, and let’s explore the remarkable world of fractal patterns together.