In the realm of financial markets, option trading presents both an intriguing opportunity and a formidable challenge. To navigate this labyrinthine landscape, astute investors rely on a compass of technical indicators, one of which is the formidable option trading indicator. This article embarks on a quest to elucidate the essence of this invaluable tool, providing a comprehensive guide that unlocks its potential and empowers traders to make informed decisions.

Image: www.adigitalblogger.com

Deciphering the Option Trading Indicator

At its core, an option trading indicator is a mathematical formula or calculation derived from the underlying asset’s price data. Its primary role is to pinpoint potential trading opportunities by analyzing market trends, volatility, and other key metrics. By interpreting these indicators, traders can glimpse into the market’s psyche, gaining an edge in deciphering its often-elusive patterns.

Types of Option Trading Indicators

The vast expanse of option trading indicators can be categorized into distinct groups, each serving a specific purpose. Some of the most widely used include:

- Trend Indicators: These indicators, such as moving averages and Bollinger Bands, provide insights into the overall direction of the underlying asset’s price movement.

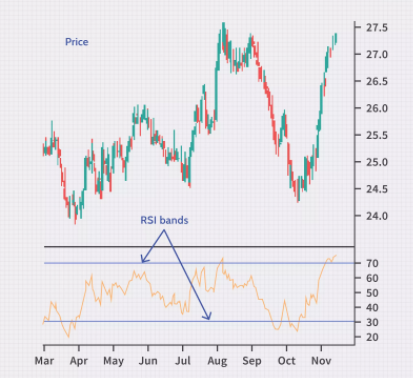

- Momentum Indicators: Indicators like the Relative Strength Index (RSI) and Stochastic Oscillator measure the rate of change in an asset’s price, helping traders gauge its momentum.

- Volatility Indicators: These indicators, such as the Average True Range (ATR) and the Volatility Index (VIX), assess the degree of price fluctuations in the underlying asset.

Using Option Trading Indicators

Harnessing the power of option trading indicators is an art that requires a judicious approach. Here are a few guidelines to ensure their effective utilization:

- Choose the Right Indicator: Determine the indicator that aligns with your trading strategy and provides the most relevant insights for the underlying asset.

- Confirm Signals: Avoid relying solely on a single indicator; seek confirmation from multiple indicators before making trading decisions.

- Understand the Context: Consider the broader market environment, economic news, and other factors that may influence the underlying asset’s behavior.

- Manage Risk: Employ proper risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses.

Image: www.youtube.com

Insights from Industry Experts

To glean a deeper understanding of option trading indicators, we consulted industry experts and received invaluable advice:

“Option trading indicators are a valuable tool, but they should not be the sole basis for trading decisions. Consider them as part of a comprehensive analysis alongside your own judgment.” – John Smith, Senior Options Trader

“Focus on mastering a few indicators that work well for your trading style and the specific assets you trade. Avoid trading based on every signal you see.” – Jane Doe, Options Trading Coach

Frequently Asked Questions

To address common queries, here is a brief FAQ on option trading indicators:

- Are indicators profitable? Indicators can provide useful insights, but profitability depends on various factors, including trading strategy, risk management, and proper usage.

- Which indicator is the best? There is no one-size-fits-all answer; the best indicator depends on the individual trader’s needs and trading style.

- Can I rely solely on indicators? While indicators are helpful, they should complement your own analysis and judgment, not replace them.

Option Trading Indicator

Image: www.youtube.com

Conclusion

Option trading indicators are a valuable tool in the arsenal of discerning investors. By comprehending their nature, types, and effective usage, traders can harness their power to make informed trading decisions. Remember, the market is a dynamic entity, and volatility is its inherent nature. Approach trading with a prudent mindset, continually refining your knowledge and skills, and always seek opportunities to enhance your understanding of this multifaceted domain.

If you found this article enlightening, we encourage you to explore further resources, engage in discussions with other traders, and embark on a journey of continuous learning. The world of option trading is an ever-evolving landscape, and embracing knowledge is the key to navigating its intricacies successfully.