In the realm of financial investing, options trading holds a captivating allure, offering a unique blend of risk and reward. Within this dynamic sphere, futures options emerge as a multifaceted instrument that empowers traders to speculate on the future value of an underlying asset. While navigating the intricacies of options trading demands a discerning understanding, the rewards for astute investors can be substantial.

Image: www.ampfutures.com

Futures options, in essence, confer the right, rather than the obligation, to buy or sell an underlying asset at a predefined price on a predetermined date. This flexibility allows traders to capitalize on market movements, both favorable and adverse, as they unfold over time. Unlike traditional options, futures options are standardized contracts traded on a futures exchange, providing greater transparency and liquidity.

Unlocking the Potential of Time

Harnessing the Power of Expiration

The defining characteristic of futures options lies in their expiration date. This pivotal element establishes a finite timeline for the exercise of the option contract. Traders must meticulously consider the expiration date in conjunction with their market outlook to maximize their potential returns.

Understanding the Impact of Time Premium

Time premium represents an intrinsic value attributed to options contracts, reflecting the remaining time until their expiration. This premium compensates the option buyer for the uncertainty and potential price fluctuations that may occur during the life of the contract. Understanding time premium dynamics is crucial for traders seeking to optimize their strategies.

Image: www.youtube.com

Evolving Landscape of Futures Options Trading

Technological Advancements Revolutionizing the Market

The advent of electronic trading platforms has profoundly transformed the futures options landscape. Online brokerages have democratized access to these sophisticated instruments, enabling retail traders to participate alongside institutional investors. Advanced trading tools, real-time data feeds, and sophisticated risk management systems have further enhanced the accessibility and efficiency of options trading.

Navigating Regulatory Developments

As the futures options market continues to evolve, regulatory bodies play an active role in ensuring market integrity and investor protection. Recent regulatory initiatives have focused on measures to mitigate systemic risks, enhance transparency, and safeguard against market manipulation. Traders must remain abreast of these evolving regulations to ensure compliance and protect their investments.

Expert Strategies for Futures Options Trading

Mastering Risk Mitigation Techniques

Effective options trading hinges upon a disciplined approach to risk management. Understanding potential profit and loss scenarios is paramount, and traders must establish clear entry and exit strategies. Employing stop-loss orders and position sizing helps control risk exposure, while diversification across multiple contracts can mitigate portfolio volatility.

Leveraging Technical and Fundamental Analysis

Successful options traders combine technical and fundamental analysis to inform their trading decisions. Technical analysis involves studying historical price patterns, indicators, and trading volume to identify potential trading opportunities. Fundamental analysis delves into the underlying economic and business factors that influence the value of the underlying asset. By merging these two approaches, traders can gain a comprehensive understanding of market dynamics.

Frequently Asked Questions on Futures Options Trading

Q: What are the key advantages of futures options compared to traditional options?

A: Futures options provide greater standardization, liquidity, and margin flexibility. They are traded on regulated exchanges, ensuring market transparency and mitigating counterparty risk.

Q: How do I determine the appropriate expiration date for my futures options strategy?

A: The appropriate expiration date depends on the trader’s market outlook and investment horizon. Longer-term contracts offer more time for potential price appreciation but come with a higher time premium cost. Conversely, shorter-term contracts may limit potential gains but reduce the impact of time decay.

Q: What are some of the common mistakes to avoid in futures options trading?

A: Avoid overleveraging, failing to understand risk parameters, and trading emotionally. It is crucial to adhere to a disciplined trading plan, manage risk effectively, and seek guidance from experienced professionals when necessary.

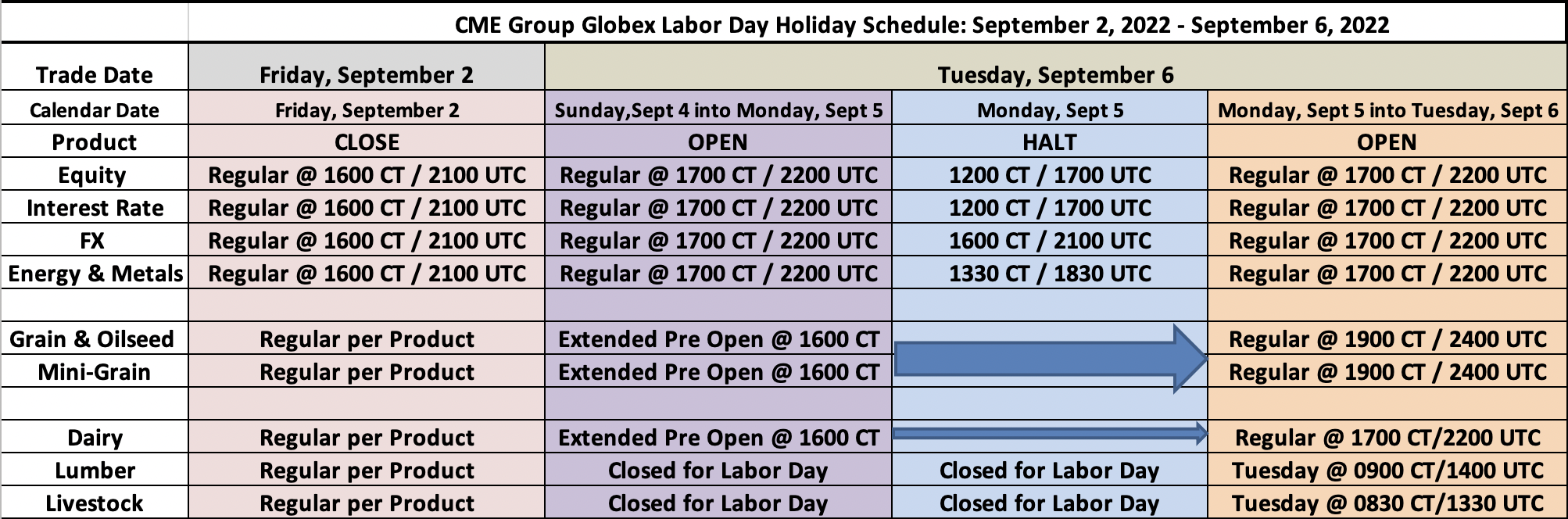

Future Options Trading Time

Image: www.indiratrade.com

Conclusion

The world of futures options trading presents a captivating opportunity for investors to navigate the ever-changing financial landscape. Time becomes a pivotal factor in this dynamic realm, where understanding expiration dates and time premium is essential for success. Technological advancements and regulatory developments continue to shape the market, while expert strategies centered around risk management and analytical techniques empower traders to harness the potential of these sophisticated instruments.

We invite you to delve deeper into the intricacies of futures options trading, exploring the wealth of resources available online, seeking guidance from industry experts, and practicing sound risk management principles. The journey ahead may present both challenges and rewards, and we encourage you to embrace this opportunity for financial growth and discovery.