In the dynamic realm of finance, options trading stands as a powerful tool that can transform your investment strategies. Whether you’re a seasoned trader or a curious novice, this comprehensive guide will provide you with an unparalleled understanding of options trading, its strategies, and the potential to enhance your financial prowess.

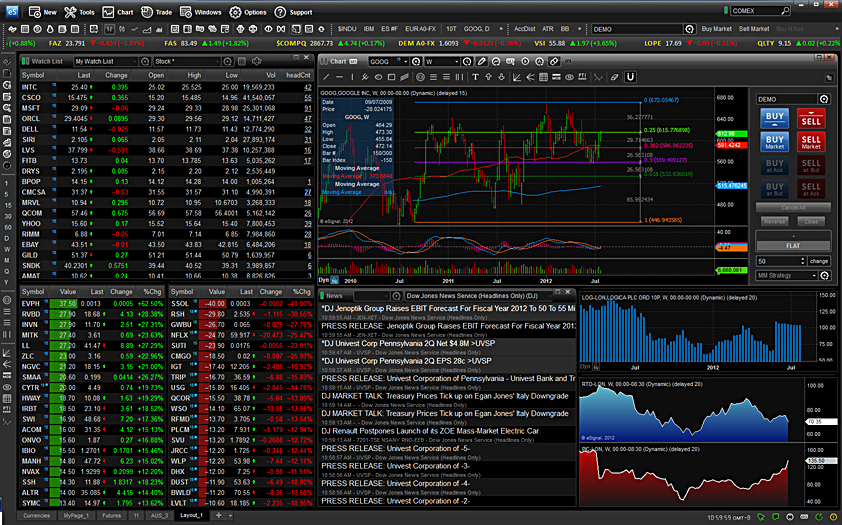

![Stock Options Trading 101 [The ULTIMATE Beginner's Guide] ⋆ ...](https://tradingforexguide.com/wp-content/uploads/_stock-options-trading-101-the-ultimate-beginners-guide.jpg)

Image: tradingforexguide.com

What is Options Trading?

Options are financial contracts that grant the buyer (you) the right, but not the obligation, to buy or sell a specific asset (stock, bond, or commodity) at a predetermined price (strike price) and on a specific date (expiration date). These versatile instruments provide flexibility and leverage in managing your investment portfolio, allowing you to explore various strategies and mitigate risks.

Types of Options Contracts

Options trading encompasses two primary types of contracts: calls and puts. Call options give you the right to buy an asset, while put options enable you to sell an asset at the strike price. Each type of option comes with its own set of strategies and application scenarios, catering to diverse trading objectives.

Essential Concepts in Options Trading

To navigate the world of options trading effectively, it’s crucial to grasp fundamental concepts such as:

-

Time Value: The premium (price) of an option decays over time, diminishing as the expiration date approaches.

-

Intrinsic Value: The intrinsic value represents the inherent value of the option based on the difference between the strike price and the current market price of the underlying asset.

-

Volatility: Volatility measures the market’s price fluctuations. Higher volatility increases option premiums.

Image: www.trading-impossible.com

Strategies for Options Trading

The versatility of options trading lies in the multitude of strategies that traders can employ to capitalize on market opportunities. Some common strategies include:

-

Covered Calls: Selling a call option against shares of the underlying asset you own. This strategy aims to generate income while limiting potential downside risk.

-

Protective Puts: Buying a put option to hedge against potential losses in the underlying asset. This strategy helps protect your portfolio in volatile markets.

-

Bullish Butterfly Spread: A combination of purchasing and selling options at different strike prices with the goal of profiting from a moderate increase in the underlying asset’s price.

Expert Insights into Options Trading

“Options trading can empower investors to assume calculated risks and potentially amplify their returns,” explains renowned financial expert Emily Caldwell. “However, it’s not a silver bullet and requires a deep understanding of the underlying concepts and strategies.”

“Remember, options trading involves potential risks and should be approached with caution,” cautions investment strategist James Carter. “Conduct thorough research, seek advice from experienced professionals, and always trade within your risk tolerance.”

Actionable Tips to Enhance Your Options Trading

-

Start Small: Begin with small trades to minimize risk while gaining practical experience.

-

Study Market Trends: Monitor economic data, news, and historical price patterns to make informed trading decisions.

-

Manage Risk: Use proper position sizing and consider implementing risk management techniques like stop-loss orders.

-

Seek Professional Guidance: Consult with a qualified financial advisor or broker for personalized advice and support tailored to your investment goals.

Trading Options Stock Market

Conclusion: Unlocking the Power of Options Trading

Options trading offers a powerful toolset for ambitious investors seeking to enhance their financial portfolios. By gaining a deep understanding of the concepts, strategies, and risks involved, you can navigate this exciting market with confidence. Remember that options trading is not without risks and should be approached with a prudent mindset and a well-informed strategy. Embrace the potential of options trading and chart a path toward financial empowerment.