In the realm of financial investments, the advent of Robinhood has revolutionized the way individuals engage with the stock market, particularly in the world of options trading. This brokerage platform has made option trading more accessible to a wider audience, opening up doors for both experienced and novice investors alike.

Image: www.youtube.com

In this comprehensive guide, we will delve into the intricacies of Robinhood option trading, shedding light on its key features, strategies, and the potential benefits and risks involved. Whether you’re a seasoned pro or just starting your trading journey, this article equips you with the knowledge to navigate the world of Robinhood options successfully.

Understanding Robinhood Options Trading

Options trading involves the exchange of financial contracts that grant the buyer (or holder) the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price within a specific timeframe. Robinhood offers access to a variety of options contracts, enabling investors to speculate on the future value of underlying assets or hedge against potential price fluctuations.

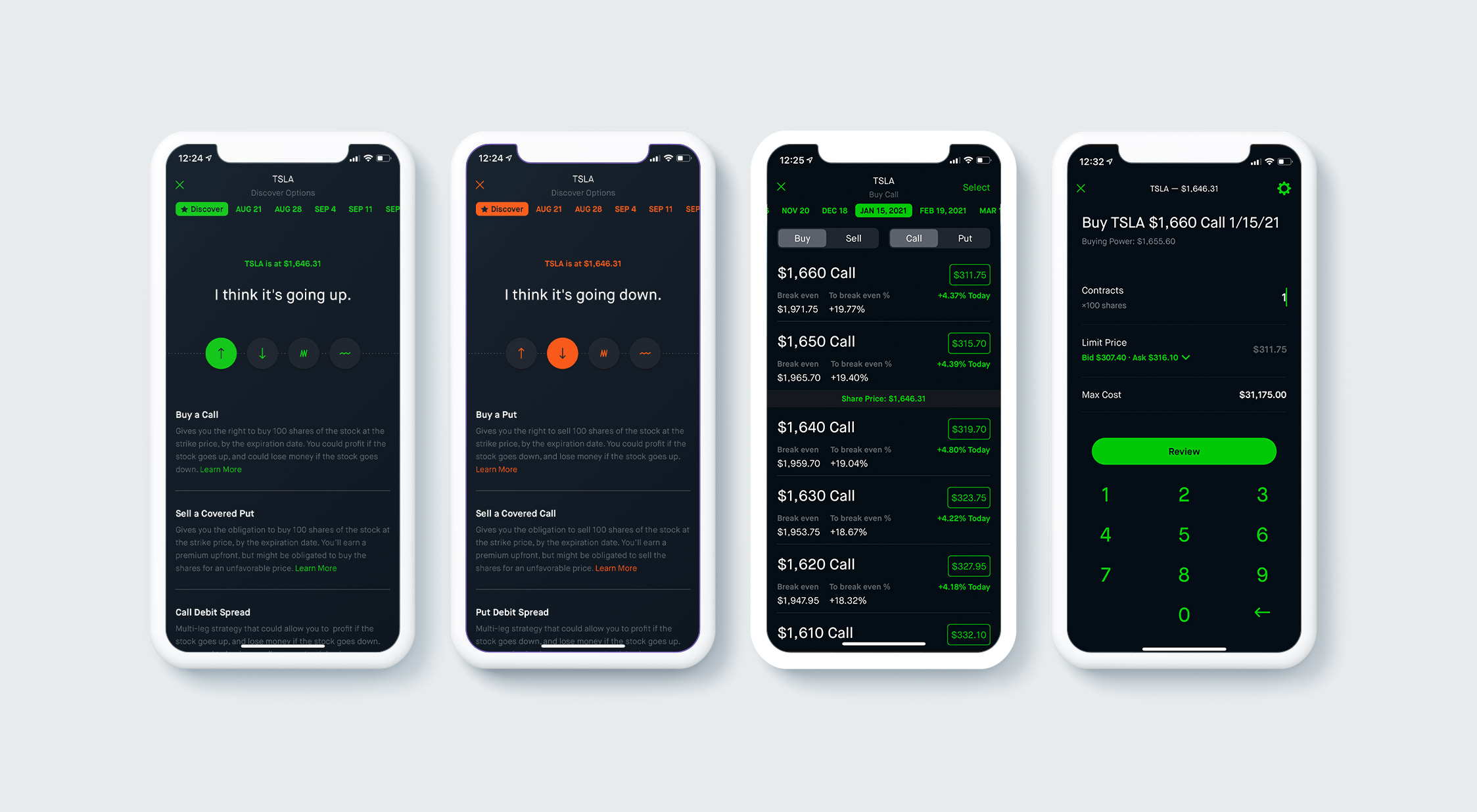

One of the key advantages of Robinhood options trading is its user-friendly interface, which streamlines the trading process for both beginners and experienced investors. The platform provides clear explanations of options concepts, making it easier to understand the mechanics of this complex financial instrument.

Types of Options Strategies on Robinhood

Robinhood offers a range of options strategies, each tailored to different risk appetites and investment goals. Some of the most common strategies include:

1. Buying Call Options:

This strategy involves purchasing a call option, which gives the holder the right to buy a specified number of shares of an underlying stock at a specific price on or before a certain date. Buying call options is appropriate when investors expect the stock price to rise, as it allows them to profit from such an upswing.

Image: www.youtube.com

2. Selling Call Options:

This strategy involves selling a call option, which obligates the seller to sell a specified number of shares of an underlying stock at a specified price on or before a certain date. Selling call options is typically employed when investors expect the stock price to stay the same or decline, as they collect a premium for taking on this obligation.

3. Buying Put Options:

This strategy involves purchasing a put option, which gives the holder the right to sell a specified number of shares of an underlying stock at a specific price on or before a certain date. Buying put options is appropriate when investors expect the stock price to decline, as it allows them to profit from such a downswing.

4. Selling Put Options:

This strategy involves selling a put option, which obligates the seller to buy a specified number of shares of an underlying stock at a specified price on or before a certain date. Selling put options is typically employed when investors expect the stock price to stay the same or increase, as they collect a premium for taking on this obligation.

Evaluating the Risks and Benefits of Robinhood Options Trading

As with any form of investment, options trading on Robinhood carries both potential benefits and risks. It’s crucial to weigh these factors carefully before making any trading decisions.

Benefits:

1. Increased Leverage: Options trading allows investors to gain exposure to underlying assets with a relatively small amount of capital, providing the potential for amplified returns.

2. Flexibility: Options contracts offer various strategies that can be customized to suit different investment goals and risk tolerances, providing investors with a high degree of flexibility.

3. Potential for Income Generation: Selling options premiums can generate income, even if the underlying asset’s price doesn’t move significantly.

Risks:

1. Unlimited Loss Potential: Buying options carries the risk of unlimited losses, as the value of an option can decline to zero.

2. Time Decay: Options contracts have a limited lifespan, and their value decays over time, regardless of the underlying asset’s price movement.

3. Complexity: Options trading can be complex, and it’s important to fully understand the risks involved before engaging in this type of investment.

How Is Robinhood Option Tradeing

Image: imranrazaq.com

Conclusion

Robinhood options trading has undoubtedly transformed the investment landscape, providing a powerful tool for both experienced and novice investors seeking to diversify their portfolios and potentially enhance their returns. However, it’s essential to approach options trading with caution and a thorough understanding of the risks involved. By carefully evaluating the benefits and risks, and by implementing sound investment strategies, individuals can harness the potential of Robinhood options trading while mitigating the associated risks.

As always, it’s prudent to conduct thorough research, consult with financial professionals, and continuously educate oneself before making any investment decisions.