Trading Options with Robinhood: A Simplified Guide to Financial Empowerment

Image: www.youtube.com

Embrace the Future of Finance: Unlock the Power of Options Trading with Robinhood

In the ever-evolving world of finance, options trading stands out as a powerful tool that can amplify your investment potential. Among the pioneers in this realm, Robinhood has emerged as a game-changer, offering an accessible and user-friendly platform that empowers individuals to engage with options. Through this comprehensive guide, we delve into the intricacies of trading options with Robinhood, guiding you towards financial independence.

Understanding the Basics of Options Trading

Options are financial instruments that provide investors with the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price on or before a predefined date. They offer traders the flexibility to hedge against risk, enhance returns, and potentially generate income even in volatile markets.

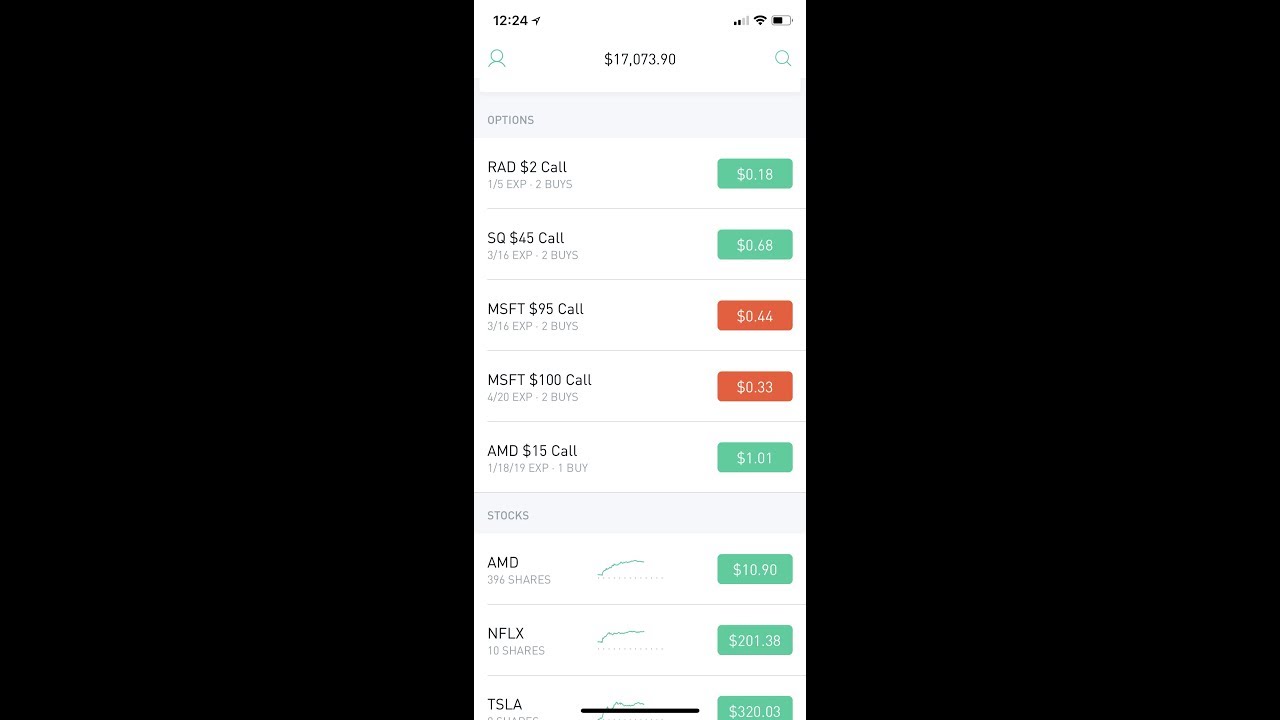

When trading options with Robinhood, you can choose between two main types:

Call Options: Grant you the right to purchase the underlying asset at a strike price within a predetermined time frame.

Put Options: Provide you with the right to sell the underlying asset at a strike price within a predefined period.

Benefits of Trading Options with Robinhood

Robinhood’s user-friendly platform and accessibility have made options trading available to a wider audience. Here are some of the key benefits:

-

Zero Commission Fees: Unlike traditional brokerages, Robinhood charges no commission fees on options trades, making it cost-effective for both beginners and experienced traders.

-

Intuitive Interface: Robinhood’s mobile and web platforms are designed with simplicity in mind, allowing even novice traders to navigate the complexities of options trading with ease.

-

Educational Resources: Robinhood provides comprehensive educational materials, including webinars, articles, and videos, to help you understand the basics of options and build trading strategies.

Getting Started with Options Trading on Robinhood

-

Open an Account: Create a Robinhood account and ensure it’s approved for options trading by completing the required verification process.

-

Fund Your Account: Deposit funds into your Robinhood account to begin trading.

-

Choose an Option: Identify the underlying asset and strike price that align with your trading goals.

-

Place Your Trade: Enter the desired quantity of contracts, expiration date, and premium you’re willing to pay.

-

Monitor Your Position: Regularly track the performance of your options and make adjustments as necessary.

Expert Insights and Actionable Tips

-

Start Small: Begin with small trade sizes until you’re comfortable with the nuances of options trading.

-

Manage Risk: Options trading carries inherent risk, so it’s crucial to implement risk management strategies such as stop-loss orders and position sizing.

-

Seek Professional Advice: Consult with a financial advisor or professional trader to gain personalized guidance and develop a trading plan tailored to your individual circumstances.

Conclusion

Options trading with Robinhood empowers individuals to unlock financial opportunities. Through its zero commission fees, user-friendly interface, and extensive educational resources, Robinhood makes options accessible to everyone. Remember to approach options trading with due diligence and a clear understanding of the risks involved. By leveraging the insights and actionable tips provided in this guide, you can confidently step into the world of options trading and harness its potential to enhance your financial future.

Image: www.makeuseof.com

Trading Options Robinhod

Image: www.youtube.com