Investing in the stock market can be a daunting task, especially for those new to the world of finance. However, there are ways to navigate this complex terrain while maximizing potential returns and minimizing risk. One such strategy is known as matador options trading, a powerful technique that allows investors to capitalize on the often-volatile nature of the market.

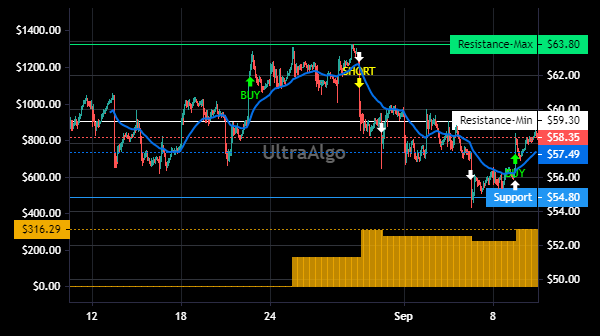

Image: www.ultraalgo.com

In essence, matador options trading involves selling a put option while simultaneously buying a call option with the same strike price and expiration date. This creates a neutral position, allowing the trader to profit from stock price movements in either direction within a defined range.

Delving into the Matador Options Strategy

The beauty of the matador options strategy lies in its ability to generate income irrespective of market direction. When the stock price rises, the trader benefits from the call option, which appreciates in value. Conversely, if the stock price falls, the trader profits from the exercise of the put option. The strike price acts as the pivot point, determining the range within which the trader can potentially profit.

However, it’s important to note that matador options trading is not without its risks. The trader must carefully select the underlying stock and options contracts while meticulously managing the risk-reward ratio. Emotional trading can lead to substantial losses, which is why a disciplined approach is paramount.

Matador Options Trading: A Historical Perspective

The origins of matador options trading can be traced back to the Mexican Revolution, where bullfighters faced off against formidable bulls. Just as matadors use a combination of skill and bravery to overcome the challenge, options traders employ strategies like the matador to navigate market volatility.

The strategy gained wider recognition in the 1990s when volatility in the market surged, providing fertile ground for matador options trading. Since then, it has become a popular approach for traders seeking income generation and risk mitigation.

Mastering the Essentials of Matador Options Trading

To execute a successful matador options trade, traders must adhere to the following principles:

-

Selecting the Underlying Stock: The underlying stock should exhibit significant volatility, as this heightens the potential for price fluctuations within the defined range.

-

Determining the Strike Price: The strike price should be carefully selected based on the trader’s risk tolerance and market expectations.

-

Choosing the Expiration Date: Matador options trades typically have shorter expiration periods, ranging from a few weeks to several months.

-

Managing Risk: Risk management is crucial, and traders should carefully monitor the position and adjust it accordingly as market conditions change.

Image: www.marketbeat.com

Current Trends and Developments in Matador Options Trading

In recent years, matador options trading has evolved, with traders incorporating advanced techniques and technology into their strategies. Machine learning algorithms, for instance, are increasingly used to analyze market data and identify potential trading opportunities.

Matador Options Trading

Image: www.megabolsa.com

Conclusion: Unleashing the Potential of Matador Options Trading

Matador options trading provides investors with a powerful tool to enhance their investment performance. By combining calculated risk-taking with a deep understanding of market dynamics, traders can leverage the strategy to navigate volatile markets and generate consistent returns. However, it’s crucial to exercise caution, manage risk judiciously, and continually adapt to the ever-changing financial landscape.