Investing in stocks can be a daunting task for many, especially with the market’s inherent volatility. However, there’s an alternative strategy that provides flexibility and potentially amplifies returns – options trading. While the world of options may seem complex at first, there are accessible ways to navigate this market. Here’s a comprehensive guide to simple option trading strategies that can help you capitalize on market moves.

Image: optionstradingiq.com

Understanding the Basics of Options Trading

Options are financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Options come in two main types: calls and puts. Call options grant you the right to buy, while put options give you the right to sell an asset. Traders use options to hedge their investments, speculate on price movements, and generate income.

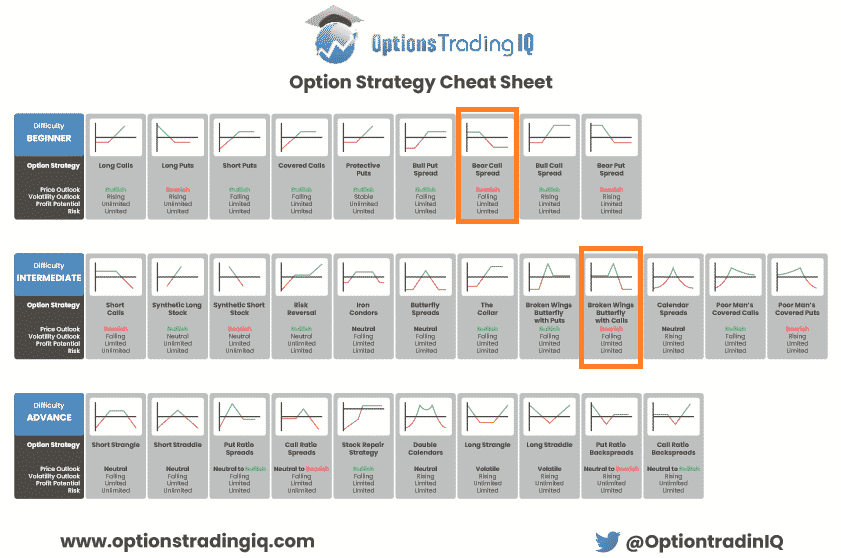

Simple Option Trading Strategies

1. Buying a Call Option

Buying a call option allows you to profit if the underlying asset’s price rises above the strike price (predetermined price) before the option expires. This strategy is suitable for bullish traders who anticipate a stock’s price to increase.

2. Buying a Put Option

Buying a put option is a good strategy for traders anticipating a decline in the underlying asset’s price. If the asset’s price falls below the strike price, the put option holder profits.

3. Selling a Covered Call

Selling a covered call involves selling a call option against an existing stock position. This strategy generates income from the option premium but limits your potential upside on the stock if the price rises significantly. It’s suitable for traders who own the underlying asset and believe its price will remain within a certain range.

4. Selling a Cash-Secured Put

Selling a cash-secured put means selling a put option while holding sufficient cash to exercise the contract if the option is assigned. This strategy is similar to selling a covered call but requires cash instead of existing stock ownership. It can generate income and potentially acquire the underlying asset at a discount if the price falls.

5. Bull Call Spread

A bull call spread involves buying a call option with a lower strike price and selling a call option with a higher strike price on the same underlying asset. This strategy is designed to profit from a moderate rise in the asset’s price and has limited risk compared to buying a single call option.

6. Bear Put Spread

A bear put spread consists of selling a put option with a higher strike price and buying a put option with a lower strike price on the same underlying asset. This strategy benefits from a decline in the asset’s price and has limited profit potential compared to buying a single put option.

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/option-strategies-cheat-sheet.png)

Image: howtotrade.com

Simple Option Trading Strategies

Image: www.pinterest.com

Conclusion

Simple option trading strategies provide an accessible way to harness the power of the options market. By understanding the basics, applying these strategies, and managing risk effectively, traders can potentially enhance their returns and navigate market fluctuations. Remember, options trading carries inherent risks and thorough research and knowledge are crucial for success. Engage in due diligence, consult with financial advisors if needed, and stay informed about market trends to make informed decisions that align with your financial goals.