Unlocking Investment Opportunities with Robinhood’s Revolutionary Move

Image: www.youtube.com

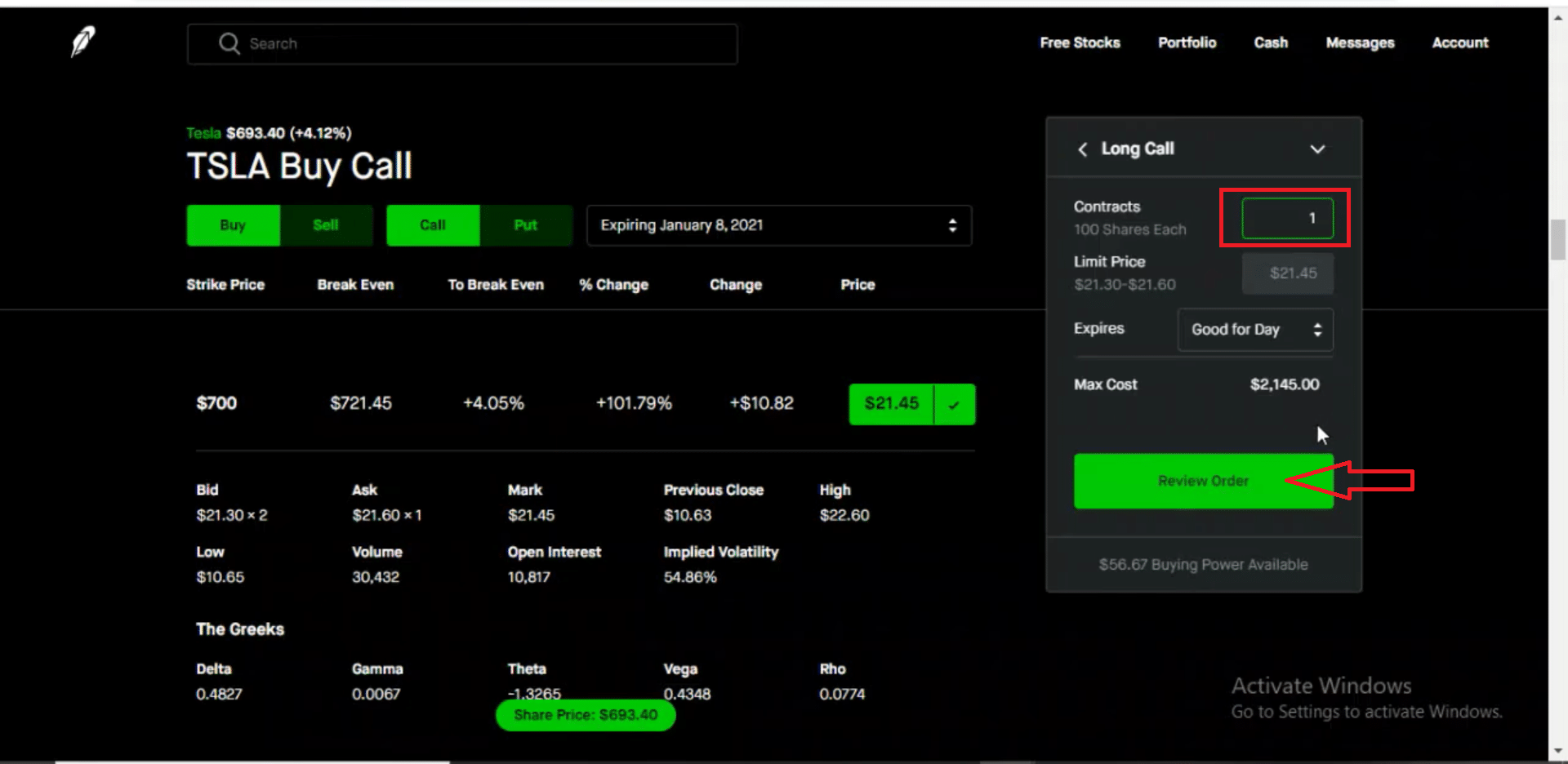

In a monumental shift for retail investors, Robinhood has recently announced the enabling of options trading on its platform. This move marks a significant breakthrough, democratizing access to a powerful financial tool that was previously reserved for experienced traders. The advent of robinhood option trading enable has opened up a world of possibilities for retail investors, empowering them to enhance their financial strategies and potentially generate significant returns.

The Allure of Options Trading

Options, a type of derivative contract, offer investors a potent mechanism to leverage specific market outcomes. Through options, traders can speculate on future price movements or hedge against potential losses without having to commit to actual asset purchases. This flexibility makes options particularly alluring, allowing investors to tailor strategies to their risk appetite and investment goals.

Robinhood’s Disruptive Role

Robinhood has consistently played a disruptive role in the financial industry, challenging conventional norms and empowering retail investors. Its mission to “democratize finance” has manifested in a user-friendly trading platform, affordable fees, and accessible financial education. With the launch of options trading, Robinhood has extended its mission, making a sophisticated investment tool available to a broader audience.

Benefits of Options Trading on Robinhood

The integration of options trading on Robinhood offers compelling advantages to retail investors:

- Accessibility: Robinhood’s intuitive platform and simple pricing structure lower the entry barrier for options beginners.

- Education: Robinhood provides comprehensive educational resources, empowering investors to navigate the complexities of options trading.

- Flexibility: Investors can explore various options strategies, ranging from basic call/put options to advanced multi-leg spreads.

- Potential Returns: Options carry the potential for significant returns, as investors can benefit from both bullish (increasing) and bearish (decreasing) market movements.

Risks of Options Trading

While options offer enticing opportunities, it’s crucial to acknowledge their inherent risks. Options can be complex instruments that carry the potential for significant losses. Some key risks associated with options trading include:

- Volatility: Options prices are highly sensitive to underlying asset price movements, which can lead to rapid fluctuations in value.

- Time Decay: Options contracts have a finite lifespan, and their value deteriorates as expiration approaches, increasing the likelihood of loss.

- Margin Accounts: Options trading often involves the use of margin accounts, which can magnify both potential gains and losses.

- Suitability: Options trading may not be suitable for all investors, particularly those with limited experience or risk tolerance.

Getting Started with Robinhood Options Trading

Robinhood offers a structured approach to help investors get started with options trading. Before embarking on this journey, it’s essential to:

- Educate Yourself: Familiarize yourself with the basics of options trading, options strategies, and associated risks.

- Apply for Options Trading: Submit an application to Robinhood requesting approval for options trading.

- Get Approved: Robinhood will assess your trading experience, knowledge, and risk tolerance before granting approval.

- Start Trading: Once approved, you can begin exploring and executing options strategies on Robinhood’s user-friendly platform.

Conclusion

Robinhood’s enabling of options trading represents a pivotal moment in the democratization of finance. By providing retail investors with access to this powerful tool, Robinhood empowers them to enhance their

Image: bethanblakely.blogspot.com

Robinhood Option Trading Enable

https://youtube.com/watch?v=rvmQGX_WL40