Embarking on the Trading Journey

In the realm of options trading, navigating the intricate landscape of tiers can be daunting to both seasoned veterans and aspiring traders alike. Embarking on this journey requires a deep understanding of the various levels and their impact on your trading prospects. This comprehensive exploration will illuminate the nuances of option trading tiers, empowering you with the knowledge and insights to confidently navigate this dynamic trading arena.

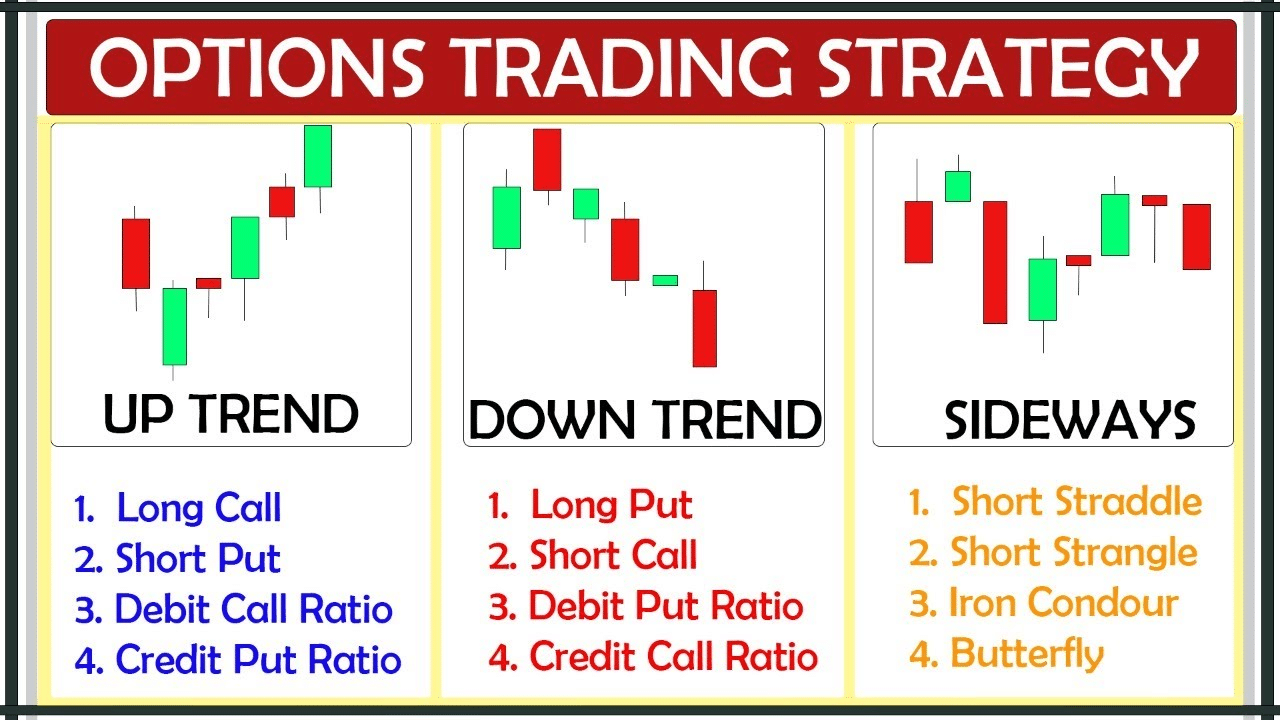

Image: www.youtube.com

Defining Tiers in Options Trading

Option trading tiers categorize traders based on their trading experience, activity, and sophistication. This tiered system serves as a regulatory framework to ensure market stability and protect investors from potential financial risks. Each tier offers distinct privileges, varying levels of trading restrictions, and access to exclusive trading privileges.

Tier 1: The Foundation

This entry-level tier is designed for novice traders with limited experience. Traders in Tier 1 are subject to stricter trading restrictions, lower margin requirements, and limited access to advanced trading strategies. These measures aim to provide a sheltered environment for traders to gain foundational knowledge and develop their trading skills.

Tier 2: Advancing to Intermediacy

As traders progress in their journey, they can ascend to Tier 2. Traders in this tier have demonstrated a higher level of experience and may participate in a broader range of trading strategies. They enjoy increased margin levels, allowing for enhanced trading flexibility. However, Tier 2 traders still operate within certain limitations, ensuring responsible trading practices.

Image: investgrail.com

Tier 3: Unleashing Experience

Experienced traders who have consistently met the regulatory criteria ascend to Tier 3. This elite tier grants traders access to the full spectrum of trading strategies, including advanced options strategies. Traders in Tier 3 benefit from significantly higher margin levels and reduced trading restrictions. As a result, they possess greater flexibility and increased potential to optimize their trading outcomes.

Evolving Trading Landscape: Latest Trends and Innovations

The world of option trading is constantly evolving, fueled by technological advancements and regulatory changes. One notable trend is the emergence of online trading platforms that offer real-time data, sophisticated trading tools, and streamlined order execution. These platforms empower traders with greater control and enhance trading efficiency.

In addition, social media and online forums have become valuable platforms for traders to connect, share knowledge, and exchange insights. The collective wisdom of experienced traders can provide valuable guidance to traders of all levels.

Expert Advice: Navigating the Tiered Journey

In this highly competitive trading landscape, seeking expert advice can provide a strategic advantage. Here are some valuable tips to enhance your trading acumen:

- Understand Your Risk Tolerance: Before embarking on any trading venture, assess your risk tolerance and invest accordingly. Identify the level of risk you are comfortable with and tailor your trading strategies within those boundaries.

- Seek Knowledge and Continuous Education: Education is the cornerstone of successful trading. Engage in ongoing learning initiatives, attend webinars, and immerse yourself in industry publications to stay abreast of market trends, regulatory changes, and trading strategies.

Frequently Asked Questions (FAQs): Demystifying Tiered Option Trading

- What is the basis for determining tier placement? Tier placement is primarily based on a trader’s experience, activity level, and compliance with regulatory requirements.

- Can I advance to a higher tier before meeting the requirements? Progression through tiers occurs gradually after meeting the stipulated criteria. Traders cannot skip tiers without fulfilling the necessary experience and qualifications.

- How can I transition to a higher tier? To ascend to a higher tier, traders must demonstrate a consistent record of responsible trading practices, meet the required trading volume and experience, and fulfill any additional regulatory criteria.

- What are the advantages of reaching higher tiers? As traders progress through tiers, they gain access to a wider range of trading strategies, increased margin levels, and reduced trading restrictions.

- Is it possible to be demoted to a lower tier? Yes, traders may be subject to demotion to a lower tier if they fail to maintain the trading requirements or violate regulatory guidelines.

Option Trading Tiers

Image: www.projectfinance.com

Conclusion: Embracing the Journey, Unlocking Opportunities

Navigating the tiered landscape of option trading presents both challenges and opportunities. By comprehending the intricacies of each tier and applying expert advice, traders can confidently ascend the tiers, expanding their trading horizons and maximizing their potential. The key lies in embracing the journey, continuously honing your skills, and staying abreast of the evolving trading landscape. Embark on your tiered trading adventure today and unlock the possibilities that await.

Are you ready to delve deeper into the intriguing world of option trading tiers? Share your thoughts and questions in the comments section below.