Introduction

In the world of finance, options trading often conjures images of high-stakes gambles and complex jargon that can leave even the most seasoned investors scratching their heads. However, at its core, options trading is simply a tool that allows investors to manage risk and potentially enhance returns in a variety of market environments. Whether you’re a novice or an experienced trader, understanding the basics of options trading can empower you to navigate the financial landscape with greater confidence.

Image: www.entrepreneurshipsecret.com

Options contracts are derivative instruments that derive their value from an underlying asset, such as a stock, bond, or commodity. Unlike stocks, which give the owner direct ownership in a company, options provide the buyer (also known as the holder) with the right, but not the obligation, to buy or sell the underlying asset at a specified price on or before a set date. This uniquely flexible feature of options positions them as powerful instruments for risk management, speculation, and income generation.

Types of Options

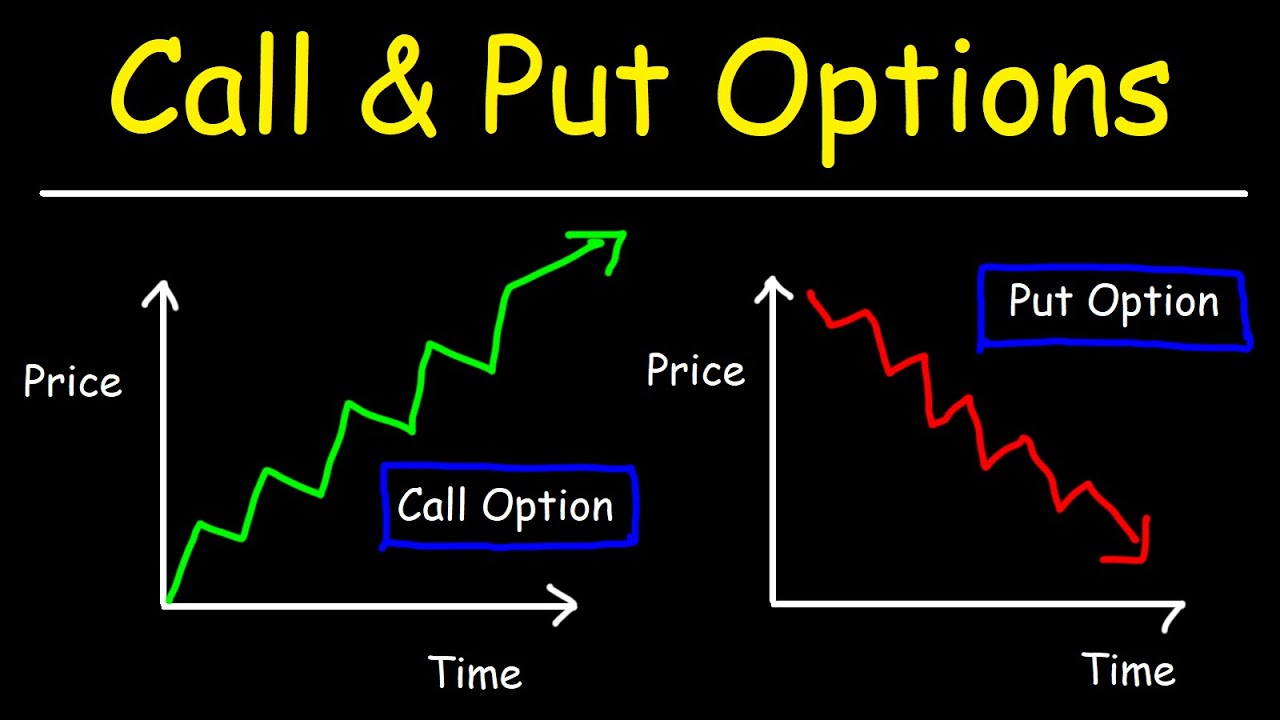

Options trading encompasses two primary types of contracts: calls and puts. These contracts differ in their directionality and the rights they grant to the holder:

a. Call Options: A call option gives the holder the right to purchase the underlying asset at the specified price, known as the strike price, on or before the contract’s expiration date. Call options are typically employed when investors expect the value of the underlying asset to rise above the strike price.

b. Put Options: Put options, on the other hand, grant the holder the right to sell the underlying asset at the strike price on or before the expiration date. Put options are typically used when investors expect the value of the underlying asset to fall below the strike price.

Understanding Premiums

When trading options, it’s crucial to understand the concept of a premium. An option premium is the price paid by the buyer to acquire the contract. The premium takes into account various factors, including the current price of the underlying asset, the strike price, the time remaining until expiration, and the prevailing market volatility. Premiums fluctuate as these factors change, affecting the value of the option contract.

Expiration Date

Each option contract has a predetermined expiration date, by which time the holder must exercise their right to buy or sell the underlying asset or let it expire worthless. Options can have various expiration dates, ranging from one month to several years, giving traders flexibility in managing their positions.

Image: www.youtube.com

Settlement

When an option is exercised before its expiration date, the holder is obligated to either buy or sell the underlying asset at the agreed-upon strike price. This process, known as settlement, results in the exchange of cash or the transfer of ownership in the underlying asset, depending on the type of option held.

Bullish and Bearish Strategies

Options trading strategies can be broadly categorized as bullish or bearish, reflecting the trader’s outlook on the underlying asset.

a. Bullish Strategies: Bullish traders expect the price of the underlying asset to rise and typically employ call options or combinations of options designed to benefit from a positive price movement.

b. Bearish Strategies: Bearish traders believe the price of the underlying asset will fall and opt for put options or other option strategies designed to profit from a decline in the asset’s value.

Risk and Reward

As with any financial instrument, options trading involves both risks and rewards. The potential returns on options can be substantial, but so can the potential losses. It’s essential for traders to carefully evaluate their risk tolerance and investment goals before engaging in options trading.

Basics To Options Trading

Conclusion

Options trading offers a versatile and dynamic set of tools for market participants, allowing them to manage risk, speculate on price movements, and enhance their portfolio returns. By understanding the basics of options, including the types of options, premiums, expiration dates, settlement terms, trading strategies, and associated risks, investors can leverage this powerful financial instrument effectively. Whether you’re a seasoned pro or a budding enthusiast, this fundamental knowledge will equip you to navigate the world of options trading with increased confidence and potentially reap its many benefits.